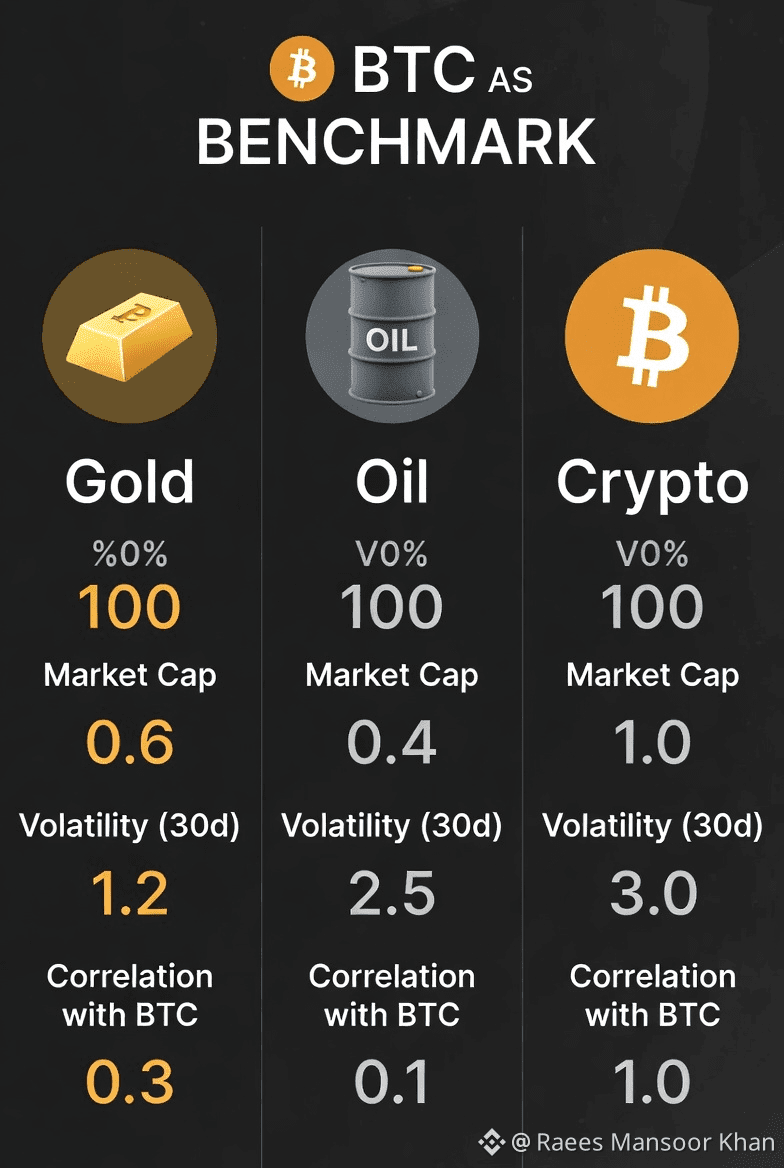

Crypto (Bitcoin):

Highest potential upside — most analysts predict explosive growth (potentially 5x–20x or more by 2030–2040) due to scarcity, adoption, and institutional inflows. However, it's the most volatile and risky.

Gold:

Strong, steady appreciation — expected to rise significantly (potentially 2x–3x by 2030) as a safe-haven amid inflation and geopolitical risks. More stable than crypto.

Oil:

Lowest upside — prices are likely to stabilize or decline long-term (around $50–$80/barrel range) due to energy transition and peak demand scenarios.

Forecasts

Gold (per ounce)

Current price (early 2026): Around $4,000–$4,700.

By 2030: Most forecasts range from $5,000–$10,000+ (conservative: $5,000–$7,000; optimistic: $10,000–$14,000 or higher in extreme scenarios).

Beyond 2030: Could reach $10,000–$24,000 in very bullish cases.

Drivers: Inflation hedge, central bank buying, geopolitical uncertainty.

Oil (Brent or WTI per barrel)

Current price (early 2026): Around $60–$80.

By 2030: Forecasts mostly $50–$80 (some see slight increases, but many predict declines due to oversupply and renewables).

By 2040+: Could stabilize at $50–$100 or lower in energy-transition scenarios; some see peaks around 110 million barrels/day demand before gradual decline.

Drivers: Supply glut, energy transition, electric vehicles, and economic growth in emerging markets.

Crypto (Bitcoin as proxy)

Current price (early 2026): Around $90,000–$100,000.

By 2030: Wide range — conservative: $300,000–$500,000; base: $500,000–$1 million; bullish: $1–$2 million+ (some extreme views up to $10 million if it captures gold's market cap).

By 2040+: Potentially $1–$14 million or higher in adoption scenarios.

Drivers: Halving cycles, institutional adoption (ETFs, corporate treasuries), scarcity (21 million cap), and "digital gold" narrative.

Which Will Be "More Expensive" in the Future?

Crypto has the highest growth potential and risk. It could become dramatically more expensive relative to today due to its scarcity and adoption curve.

Gold offers solid, reliable appreciation with lower volatility.

Oil is the least likely to see major long-term price gains (more likely to fluctuate or trend sideways/down).