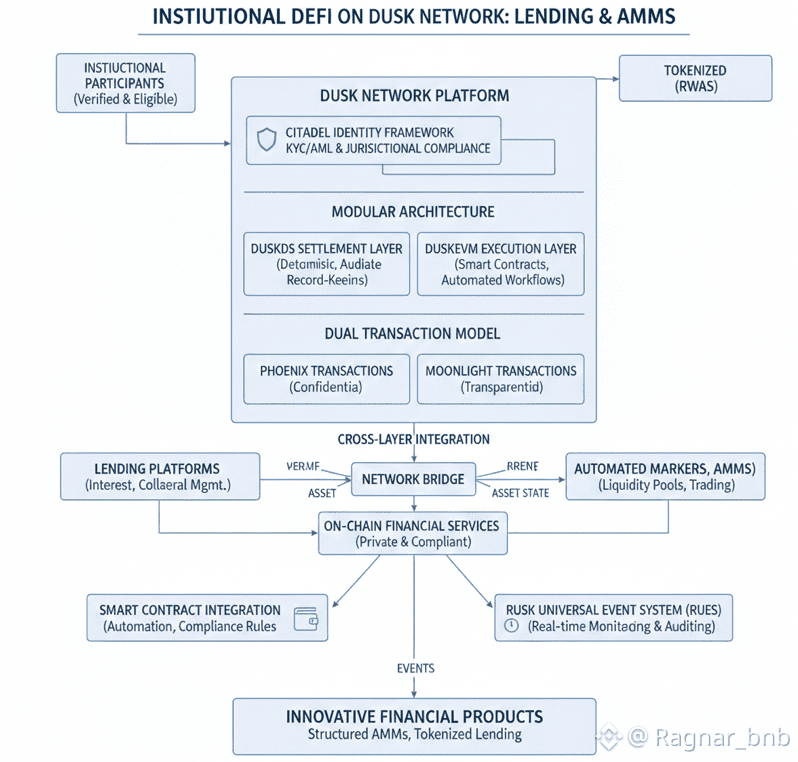

When I checked out the Dusk Network, what got me going was that it supports DeFi tools for big players, like lending platforms and automated market makers (AMMs). I see this as really cool since it lets banks and legit investors tap into decentralized finance without breaking any rules or losing their privacy. Unlike regular DeFi platforms, Dusk puts privacy, staying legal, and reliable transactions together in one spot.

The paperwork says that borrowing and lending on Dusk needs Citadel ID checks. I think this is key because only approved folks can jump into lending, making sure everything follows KYC, AML, and local laws. Lending contracts can handle keeping track of security, interest, and when payments are due. They also make sure everyone's good to go before moving any cash.

From what I know, Dusk’s dual transaction setup is super handy for DeFi apps. Phoenix transactions allow some secret lending deals, where how much is borrowed, the interest, and security don't get out. Only the people who need to know (or the auditors) can see. Moonlight transactions make things clear when they need to be, like for reporting to the government or for the company to keep an eye on things. This keeps sensitive info safe while still following the law.

Automated Market Makers (AMMs) on Dusk make use of smart contracts and a modular design. The DuskEVM or WASM-based part lets me add AMM stuff for trading tokenized assets, while DuskDS handles settling and double-checking. Every transaction is locked down with crypto, reliable, and able to be checked. AMMs can deal with pools of tokenized real stuff, letting institutions add to the pool without showing off their whole portfolio.

Another thing I like is the cross-layer stuff. Lending and AMM contracts need to talk between DuskDS and DuskEVM a lot. The bridge makes sure balances, security, and transactions stay the same across the board while keeping privacy and staying legal. This lets people put together fancy DeFi setups, like security swaps or lending on margin, without screwing things up or getting in trouble with regulators.

Keeping track of things with Rusk Universal Event System (RUES) is also important. Every lending move, security change, or AMM swap makes events that can be checked for audits, reports, or keeping an eye on things. This way, institutions can keep control and make sure everything's recorded while keeping things confidential.

The SDKs and wallet APIs make things even easier. I can manage lending contracts, watch interest grow, and run AMM swaps using wallets or company dashboards. This cuts down on how hard it is to operate things while keeping everything reliable and able to be checked, which is a must for institutions to buy in.

Lastly, institutional DeFi on Dusk lets people cook up creative financial products. Developers and institutions can make regulated pools, tokenized lending stuff, or structured AMMs that bake in privacy and legal compliance. The network's setup makes sure these products are safe and legal, so more banks might be willing to give them a shot rather than dodging public DeFi platforms.

In general, DeFi tools on the Dusk Network bridge the gap between old-school finance and new decentralized finance, putting privacy, compliance, reliable transactions, and automation into the mix. Lending, AMMs, and related stuff run safely under the rules while flexing blockchain's efficiency and crypto's protection. For any developer or institution chasing privacy and compliant DeFi stuff, Dusk has the tools and blueprint to roll out trustworthy, auditable, and modern financial services.