Hey fam, I’ve been digging deep into what’s been happening with XPL and the Plasma network over the last several months, and I want to lay it all out for you in a way that feels real and honest. There’s been a lot of chatter, a lot of excitement, some confusion, and even negative sentiment, so let’s unpack what’s actually going on on the ground, on chain, and in the ecosystem.

This piece is long, it’s candid, and it’s meant for the people who are genuinely curious about Plasma beyond just price charts. I want you to walk away understanding what the project is, what’s live, what’s still in progress, and why this matters if you care about the infrastructure side of crypto.

Let’s get into it.

The Vision Behind Plasma

When Plasma first came onto the scene, it came with a bold statement. Unlike many blockchain projects that chase narratives like gaming or NFTs, Plasma was positioning itself as the blockchain for stablecoins and global money movement. It wasn’t just a marketing slogan. The idea was to build a Layer 1 chain optimized for moving digital dollars at scale, with zero fees for stablecoin transfers, deep liquidity, and compatibility with the tools developers already use.

This alone set it apart from a lot of other projects because most blockchains claim utility but don’t actually target a fundamental financial primitive. Plasma went after the stablecoin rails, which have become arguably the most important financial layer in crypto over the past couple of years.

Mainnet Beta Launch Was a Big Deal

One moment most people remember clearly was the mainnet beta launch on September 25, 2025. This wasn’t just a generic launch. Plasma debuted with over $2 billion of stablecoin liquidity already on chain, and more than 100 DeFi protocols integrated from day one. Protocols like Aave, Ethena, Fluid, and Euler were available right at the start, which is unprecedented for a brand new Layer 1.

If you were around in those early days, it felt like something genuinely new was happening. Stablecoins flowed in fast, developers were already deploying contracts, and users could move USDT with low friction in ways that hadn’t been felt on many other networks.

It was positioned as a blockchain built for real money movement, not just for speculative use cases. And to be honest, that moment was electrifying.

Today’s Reality: Adoption Is There… But Not Everywhere

Fast forward a few months and the story has become a little more nuanced.

The Plasma network is live with a good amount of liquidity, and XPL is functioning as the core asset that powers gas, network security, staking, and rewards. That’s foundational stuff. It’s the same role ETH plays on Ethereum or SOL on Solana.

However, post‑launch sentiment cooled down more than many expected. The token saw a huge rally early on, climbing up and earning a multi‑billion dollar market cap in a matter of days but then saw a significant pullback afterward as trading activity subsided and broader market attention shifted.

That doesn’t mean Plasma is dead. Far from it. It just means the narrative shifted from hype to real world usage and infrastructure development, which always takes time.

What’s Under the Hood: Infrastructure That Actually Means Something

So let’s talk about what Plasma really is technically because this is where the long‑term value case lives.

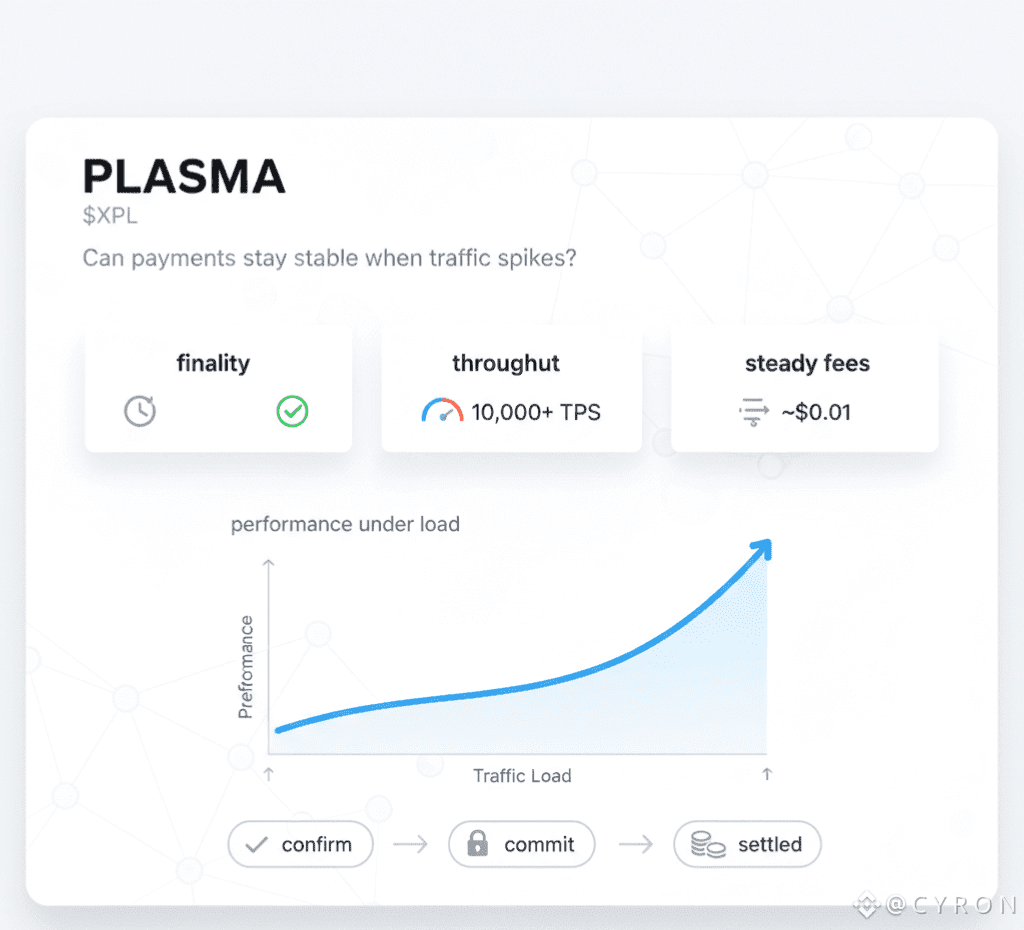

A Blockchain Built for Stablecoins and Speed

The core reason Plasma exists is to make stablecoin transfers fast, reliable, and cheap. On other blockchains, stablecoin transfers are often slowed by congestion or costs. Plasma tackled this head‑on by designing a blockchain that allows zero‑fee stablecoin transactions for users. That’s huge if you think about remittances, payroll, or everyday financial interactions.

This matters because stablecoins like USDT and others have become an important part of how money moves on chain. Plasma didn’t just say it wants to support them, it built a chain around optimizing how they work.

Compatibility With Everything Developers Love

Another smart move was making Plasma fully EVM compatible. For builders, this means you don’t have to learn a new programming language or rewrite your entire stack to deploy on Plasma. Tools like MetaMask, Hardhat, and other Ethereum developer tools just work. That lowers friction for adoption.

This was a big play because developers are the architects of where demand goes. If you make it easy for them to deploy, you remove one of the biggest bottlenecks to ecosystem growth.

Bitcoin Bridge and Multi‑Asset Support

One of the more interesting pieces of the infrastructure puzzle is the trust‑minimized Bitcoin bridge. This lets users bring BTC into the Plasma ecosystem securely and without custodians, turning it into a tokenized version that can participate in DeFi on Plasma.

This feature isn’t just neat tech. It matters because Bitcoin liquidity is massive, and giving that liquidity accessible pathways into a stablecoin‑focused ecosystem opens up real economic utility.

What XPL Actually Does

There’s a big difference between tokens that are “just speculation vehicles” and tokens that actually do foundational work on a blockchain.

$XPL functions as:

Gas for transactions and smart contracts — You need it to interact with the network.

Stake asset for validators — Validators secure the chain and earn rewards in XPL.

Reward token — Especially once staking and delegation launch.

There’s also an inflationary model designed into it. The network begins with about 5 percent annual emissions that decrease over time to a floor around 3 percent. Meanwhile, a fee burning mechanism is in place to help offset dilution as usage grows.

That design shows the team wasn’t just thinking about short term price pumps. They were thinking about alignment and sustained network growth.

Staking and Delegation Still on the Way

A big milestone many people are watching for is the staking and delegation launch planned for early 2026. When this goes live fully, XPL holders will not only be able to secure the network directly, but also delegate to validators and earn passive rewards without running infrastructure themselves.

That’s important because it kicks open the door for broader participation in network security and decentralization. It’s not a small feature. It’s one of the core mechanisms that turns a blockchain from “run by a few” into “owned by many”.

Where Things Stand With Adoption

Here’s where things get interesting when we zoom out and look at real usage versus market sentiment.

At launch, Plasma saw billions of dollars in stablecoin liquidity parked on chain, placing it among the largest blockchains by that metric right out of the gate. That’s a serious technical achievement and big picture proof that the narrative resonated with capital flowing into the chain.

But as time passed, the token price action didn’t match that early excitement. Part of that came from broader market rotation, and part of that came from questions around actual usage versus parked liquidity. Some metrics showed transaction throughput below early expectations, and that tempered hype.

The reality is this: Liquidity isn’t the same thing as usage. It shows interest and capital commitment, but long term success will come from real economic flows and consistent activity.

Integrations and Wallet Support

On the ecosystem side, Plasma hasn’t been standing still.

Support for wallets like Backpack and others means users can actually interact with XPL and stablecoins without needing a million different tools. That’s a detail many newcomers overlook, but it’s critical. If it’s hard to use, adoption stalls. Every step toward seamless wallet support helps bring ordinary users into the network’s fold.

There’s also been broader exchange listing activity. XPL went live on major platforms, giving people more ways to trade, earn, or interact with the token. Those listings are important for liquidity and access, especially for newcomers who aren’t deep into DeFi yet.

Market Sentiment and Community Noise

Let’s be honest for a minute. No project exists without drama. XPL’s launch brought excitement, but also brought volatility and rumors. At times the token hit big peaks and then pulled back hard, sparking debates about insider selling or market maker behavior. Leadership responded by clarifying lockup schedules and vesting terms, but the noise stuck around.

This is honestly par for the course in crypto. People project narratives onto assets and then get disappointed when markets correct. The key takeaway here is not whether the token has perfect price action, it’s whether the underlying infrastructure continues to develop.

Why Plasma’s Story Still Matters

Looking at Plasma today, I think the story is deeper than most realize.

Yes, the token price has cooled. Yes, segments of the community have been frustrated with volatility. But at the same time we have:

A live blockchain with real liquidity on chain

EVM compatibility and developer‑friendly tooling

A stablecoin‑focused vision that actually aligns with how money moves on chain today

Upcoming staking and delegation to drive participation and security

Integration paths for both BTC liquidity and mainstream wallets

Partnerships with major players in the DeFi space

That’s not hype. That’s infrastructure.

What’s Next for Plasma and XPL

If I had to summarize where we are headed, here’s the roadmap to watch:

1. Staking and Delegation Launch across the network.

2. Expansion of real usage beyond parked stablecoins into everyday payments, remittances, and finance products.

3. Broader wallet and tooling support so interacting with Plasma feels as intuitive as any other blockchain.

4. Deeper integrations with cross‑chain liquidity and bridges.

5. Incremental growth in layer activity that slowly bridges the gap between capital parked and actual transaction volume.

This isn’t a sprint. It’s a story that unfolds over months and years.

So What Should You Think?

If you’re in the community or watching from the sidelines, here’s how I’d frame it:

Plasma isn’t some vapor project. It’s a technically real chain with real capital committed to it, real integrations, and a real roadmap that goes beyond price alone. The token price is one indicator, sure, but it is not the whole story.

What matters more is whether the network continues to build, whether usage grows, and whether the ecosystem around stablecoin payments, remittances, and financial rails continues to mature.

And on that front, there’s a lot happening, even if it doesn’t make a headline every day.

Stay tuned, keep watching what’s live on chain, and don’t mistake noise for reality. The real story of Plasma and $XPL is still being written.