Hey fam, I want to share something with you that I’ve been tracking closely and feel is one of the most fascinating developments in crypto right now. You’ve heard me talk before about projects chasing narratives, tech trends, and hype cycles. But DUSK isn’t like most of those. This is the kind of technology narrative that evolves slowly, builds under the surface, and only reveals its full impact once you’ve really taken the time to look at what’s shipping and what’s being used.

That’s why today I want to take you on a deep look into DUSK and what’s actually happening in this ecosystem as we move through 2025 and into 2026. We’re going to talk about where it started, what it has become, and why it feels like more than just another network in the crowded Layer One space.

The Birth of a Vision

When DUSK was conceived years back, it wasn’t created simply to be a fast chain or a social token playground. The idea was to blend privacy, regulatory compliance, and real‑world financial infrastructure in a way that blockchain had never done before. That concept sounded promising from the start, but the real question was always this: Can a blockchain actually satisfy regulators and financial institutions without sacrificing the privacy features that attract crypto natives?

For years, the answer to that was unknown. DUSK worked quietly, focusing on building the technical foundation that could support confidential smart contracts and compliant financial operations. Quiet work often gets ignored in the crypto world, which loves hype and short‑term gains, but what DUSK was doing was deliberate and deep. It was laying down the plumbing for what could someday be the backbone of regulated finance in Web3.

Getting Mainnet Live Was a Milestone

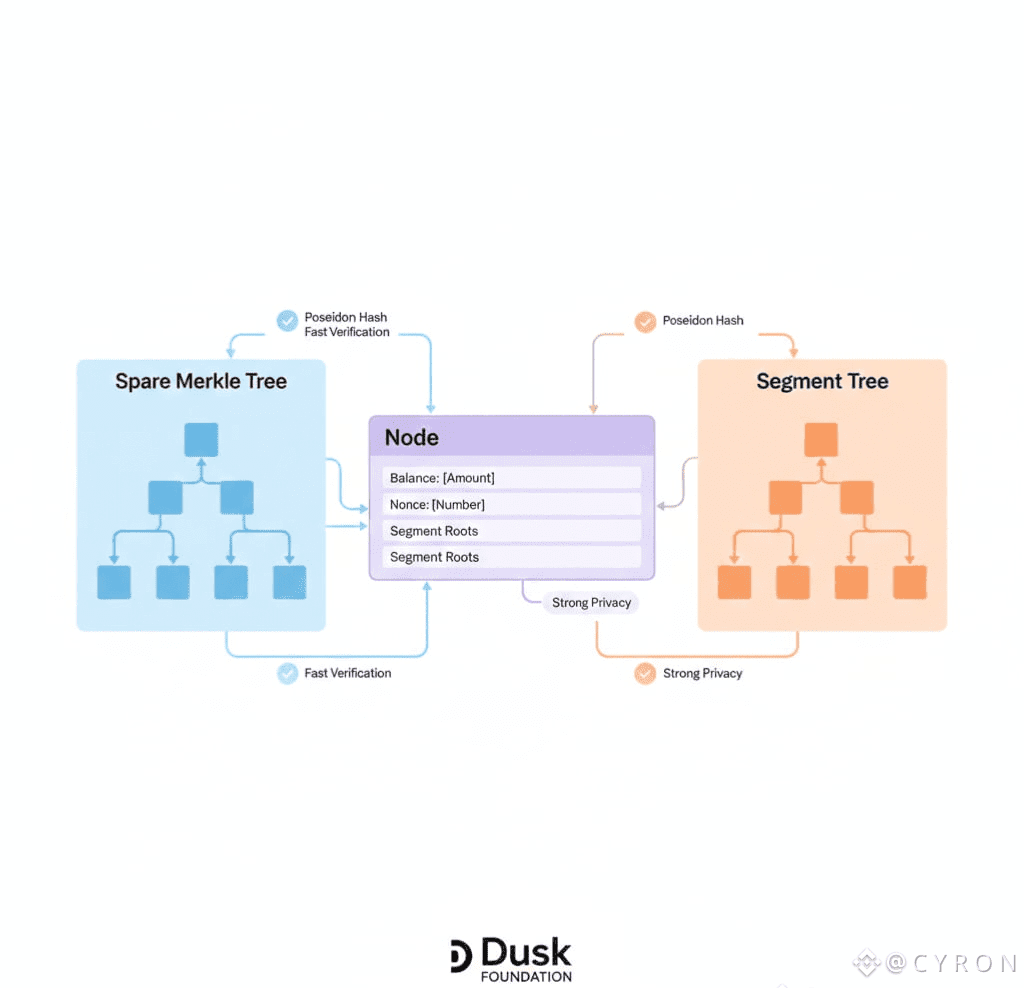

One of the biggest turning points in this project came when the DUSK Mainnet finally went live after years in development and testing. This wasn’t a small testnet launch or a beta experiment. It was the real deal — a fully operational Layer One blockchain that supports private transactions, zero‑knowledge smart contracts, and serves as a base for regulated financial activity.

That mainnet launch was about more than just shipping code. It symbolized the transition from theory to practice. For the first time, all the underlying technology — from zero‑knowledge primitives to staking mechanisms — was live in a production environment. That means developers and institutions could start actually building and transacting on DUSK in a way that could scale beyond experiments or demos.

The Roadmap Becoming Reality

If you go back and read the early post‑mainnet plans, you’ll see they were ambitious. Things like programmable staking models, privacy‑preserving asset issuance protocols, EVM compatible environments, MiCA‑aware payment systems, and tools to tokenize real assets were all on the docket. At the time, it felt like a roadmap that could take years to materialize.

Well, fast forward, and several of those plans are now either live or actively being integrated. Technologies that once lived only in design docs are becoming products. That’s huge.

One thing that stands out strong is not just completing individual features, but the vision of integrating them together. You don’t end up with a powerful ecosystem by having one or two cool pieces. You have it when all the pieces work together. In DUSK’s world those pieces are privacy, compliance, real asset tokenization, and finance‑friendly mechanics.

Real‑World Asset Tokenization Coming to Life

One of the reasons I think DUSK is genuinely interesting is how it’s tackling an area a lot of other blockchains have talked about but haven’t fully delivered on: tokenizing real‑world securities and financial instruments.

DUSK has been moving forward with integrations where regulated trading platforms bring traditional assets like stocks or bonds on chain. And not just in the abstract, but as functioning tradable instruments tied to real licensed exchanges or trading facilities in Europe.

What does this mean? It means DUSK is attracting institutional or near‑institutional use cases that are less about speculation and more about actual financial infrastructure. That’s the kind of adoption that doesn’t get headlines every day because it doesn’t involve memecoins or viral social media posts. But it does matter if you’re thinking about long‑term value and real economic activity flowing through a network.

And the coolest part is that DUSK isn’t just mirroring TradFi on chain. It is building a privacy‑preserving layer for these tokenized assets so that institutions worried about confidentiality don’t have to expose sensitive data publicly. That’s a unique niche, something that few other blockchain projects are realistically positioned to offer.

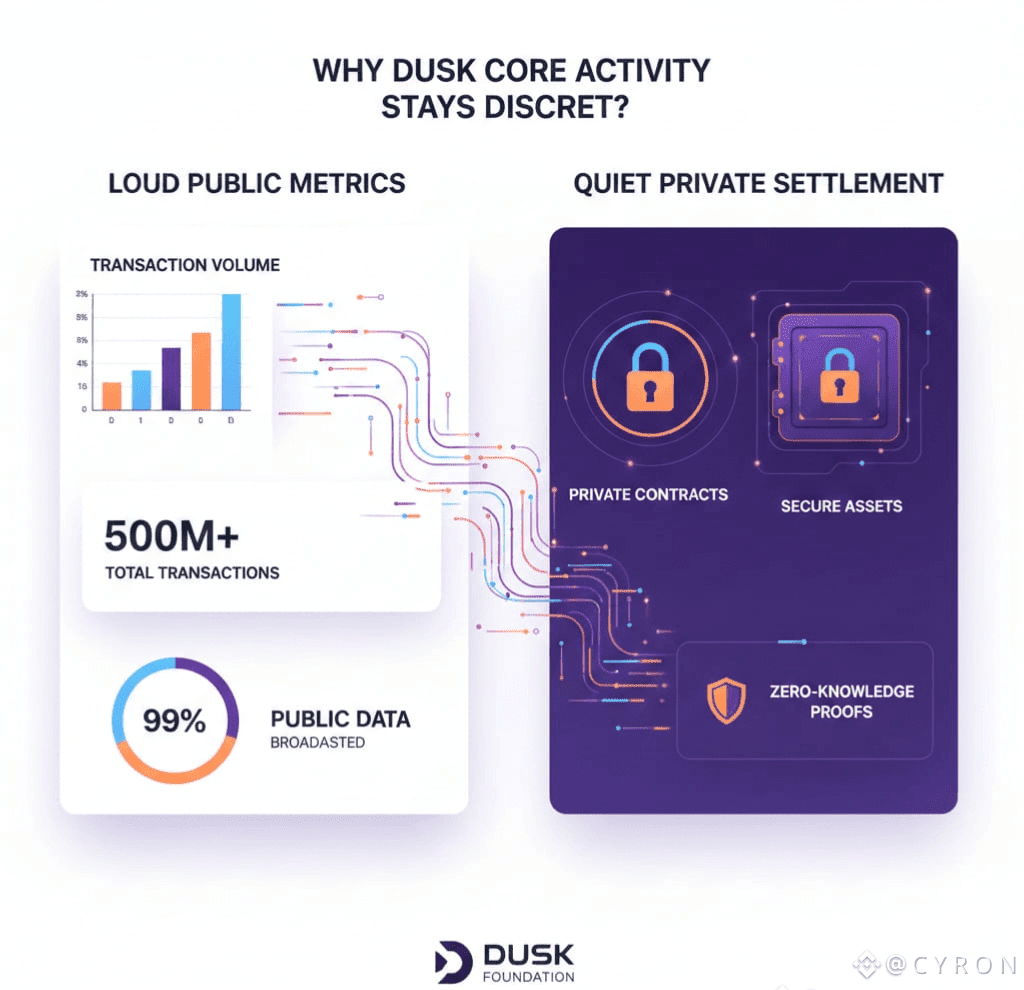

Privacy Done Right and Without Compromise

Let’s talk about privacy because this is where DUSK really tries to bring something meaningful. Privacy coins have historically faced backlash because they make regulators uncomfortable. Full anonymity is fine for some things, but when it’s financial infrastructure that connects to banks, institutions, and regulated entities, you need a way to balance confidentiality with legal auditability.

DUSK does this by weaving zero‑knowledge proofs into the protocol in a way that protects transactional information for users while still allowing authorized parties to audit when required. That’s not easy to do. It’s a balancing act that few projects even attempt because it’s both technically hard and legally complex.

The result is a blockchain that offers privacy, but not at the cost of regulatory acceptance. That might not sound exciting on the surface unless you really stop and think about what it could enable: private transactions between parties that still comply with regulations when identity disclosure is legally necessary. That kind of nuance is rare in crypto.

EVM Compatibility and Developer Tools

One of the criticisms some projects face is that they build something interesting but no one knows how to build on it. That’s not the case here. DUSK has been steadily improving its developer tooling and making parts of the ecosystem more compatible with widely used standards like EVM.

This was a deliberate choice that opens the door for developers coming from Ethereum and other smart contract ecosystems to start building with familiar tools. That makes it easier to grow the network’s dApp ecosystem because builders don’t have to learn everything from scratch.

It’s not that DUSK abandoned its own innovations — far from it. What they did was extend accessibility so others can adopt without barriers. That’s the kind of mature thinking that keeps an ecosystem alive long term.

Bridging and Interoperability

Another piece that often doesn’t get enough appreciation is how DUSK is approaching interoperability. Developing bridges to other networks, especially in a secure and compliant fashion, means assets and liquidity aren’t stuck in one isolated silo. Instead, they can flow between other chains and into DUSK’s ecosystem.

This matters because no blockchain is an island. Users want assets to move freely between ecosystems. DUSK is adding this kind of cross‑chain communication while preserving the privacy features and compliance checks that make it distinct.

When you combine interoperability with privacy and financial compliance, you get something that’s not just useful for crypto natives, but also for developers and institutions who might have otherwise dismissed blockchain as too risky or too unregulated for real business use cases.

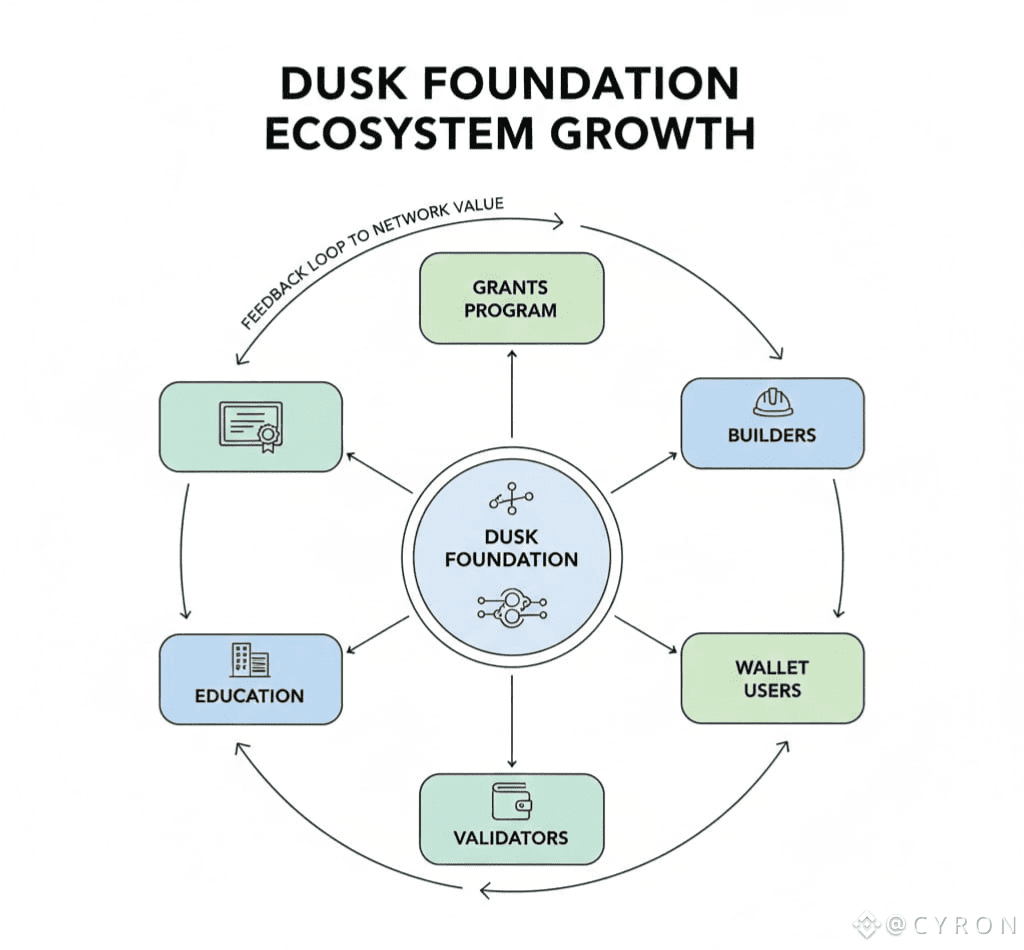

Community and Evolution

Something I genuinely appreciate about DUSK is the way its community has participated in governance and even in shaping the roadmap. There have been governance proposals that the community has weighed in on — from mobile wallet development to onboarding procedures and allocation of treasury resources. That’s real decentralized community engagement.

This matters because a blockchain with strong community involvement tends to be more resilient. People don’t just hold tokens; they contribute knowledge, feedback, and momentum.

There have also been waves of developer engagement reflected in proposals and GitHub activity showing improvements across privacy layers, staking mechanics, wallet enhancements, and more. You don’t see stagnant development here — you see motion.

What The Market Is Seeing Now

Over the course of late 2025 and early 2026, DUSK has had some noticeable price and trading momentum swings. Some of that comes from broader market movements, but a big part is tied to real developments like enhanced interoperability, regulatory oriented partnerships, and the visibility of tokenized assets settling on chain.

Those events feed into the narrative that DUSK isn’t just another altcoin. It’s positioning itself as the bridge between Web3 privacy and regulated finance.

And honestly, that’s a narrative worth watching.

What’s Next in the Pipeline

If you dive into the roadmap and the announcements the team has shared publicly, there’s still a lot to look forward to. From further scalability improvements to expanded institutional integration, and even broader availability of DeFi applications built directly on or alongside DUSK, the ecosystem is far from done.

If anything, I think what we’re seeing now is the transition from “infrastructure build out” to “real adoption and usage.” That’s a big shift in mindset.

Once networks reach the point where real economic activity, real financial tooling, and real regulated interaction happen on them — then we are talking about something that goes beyond hype cycles and into meaningful utility.

Closing Thoughts

So let me be clear about what excites me most about DUSK. It’s not that it ticks boxes on every trendy list. It’s that it is patiently building technology that answers real problems, not just theory or speculation.

There is a growing space in blockchain that demands privacy with accountability, compliance with autonomy, and open finance with regulatory integrity. DUSK is one of the rare projects that is actually delivering on that promise rather than just talking about it.

In a crowded and chaotic landscape, that kind of focused innovation, backed by actual infrastructure, real deployments, institutional interest, and community engagement is something worth watching closely.

We are still in the early chapters of this story, but the direction, traction, and gradual unfolding of utility make DUSK feel different than most. That’s why I believe investors, builders, and the community should be paying attention to this for the long haul.

The real question now isn’t whether DUSK exists. It’s whether it will become the backbone for a new generation of regulated, private financial infrastructure on chain. And that is a narrative I am excited to track with all of you.