The confidential settlement rails really grabbed my attention when I checked out the Dusk Network. Basically, they're what makes it possible for the network to handle transactions privately and in line with regulations. So, people can move assets safely, keep their info private, and stick to the rules.

Unlike regular blockchains where everyone can see what's going on, Dusk lets you make transfers confidentially, thanks to some fancy cryptography that also keeps things verifiable and compliant.

Unlike regular blockchains where everyone can see what's going on, Dusk lets you make transfers confidentially, thanks to some fancy cryptography that also keeps things verifiable and compliant.

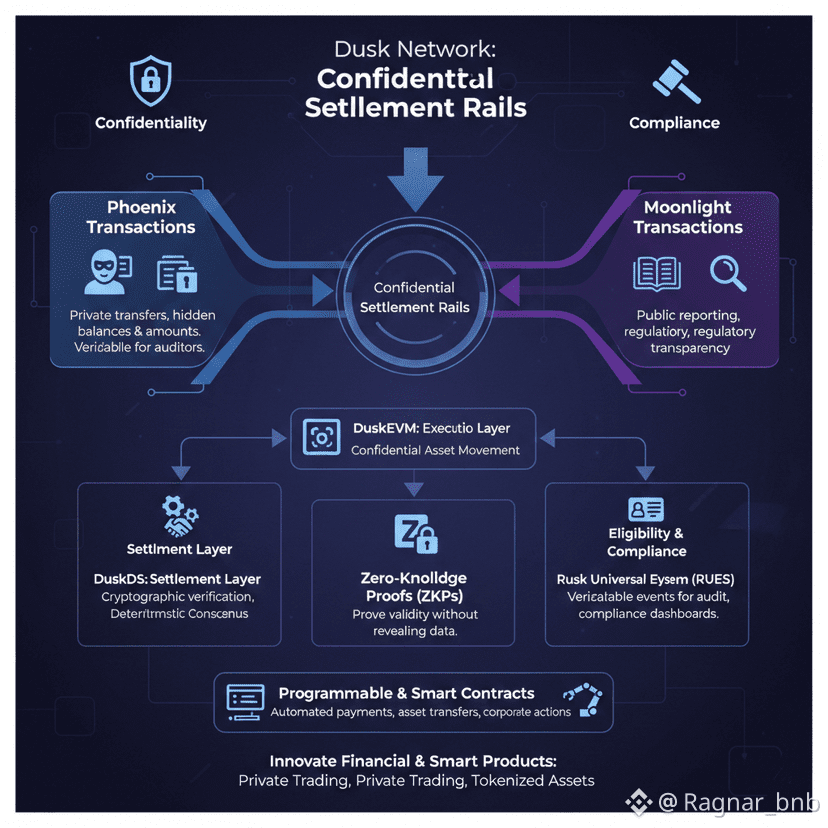

The docs say these rails use a two-way system: Phoenix for keeping things private, and Moonlight when you need to show your work. I think Phoenix transactions are super useful. I can hide stuff like balances and amounts while still proving to auditors that everything's legit. Then, Moonlight transactions let you be open when you have to be, making sure the network can meet legal needs without messing with privacy where it's not needed.

Also, DuskDS is there. It takes care of settling transactions, reaching agreement, and making sure data is available. With DuskDS, all asset transfers are checked out cryptographically and finalized with something called deterministic consensus. Once a transaction is confirmed. I can create apps that need to be really reliable, like those for big money transfers or dealing with tokenized assets.

Zero-knowledge proofs (ZKPs) are necessary. They let the network prove transactions are good without giving away any secret information. I can check if an account has enough money to make a transfer or that a transaction follows the rules without showing the amount or who's involved. It's all about keeping things private while still making sure everything's trustworthy.

The rails make sure only eligible people can use them. So, you need to verify for KYC, AML, and if they are allowed to do it. By checking identities right in the settlement process, Dusk skips having to do separate compliance checks, which cuts down on extra work while keeping everything auditable.

From a developer’s side, the rails are programmable and work with smart contracts,. I can make contracts that automatically settle payments, transfer assets, or start corporate actions, all while using confidential Phoenix transactions. Moonlight transactions? Use them when you have to report something.

You can also move assets between the DuskDS settlement layer and DuskEVM execution layer while keeping things confidential. This makes sure that smart contract stuff on DuskEVM lines up with the settlement on DuskDS.

Finally, the Rusk Universal Event System (RUES) makes things better. Every transaction makes verifiable events that can be used for checking things, showing compliance, or creating dashboards. Big institutions can keep an eye on things, meet requirements, and track asset movement safely without giving away private data.

You can design cool financial products. Privacy-focused trading or tokenized asset marketplaces. This could get institutions interested, because they can work on the network without showing their financial info to rivals.

Confidential settlement rails are a key part of the Dusk Network. They mix privacy, compliance, stability, and the ability to be programmed. They let developers and institutions make transactions that are secure, checkable, and keep things private, which bridges the gap between real-world financial needs and blockchain tech. If you're building regulated financial apps, these rails are what you need to handle assets safely.