@Dusk Network surfaced during one of those end-of-day conversations after the charts were shut, when people stop performing certainty. Someone wondered aloud why so much on-chain capital still moves as if it’s anxious. Not unstable anxious. Entering too early, exiting poorly, reacting to faint signals as if they were alarms. The question hung in the air because everyone already knew the usual explanations. Fragmented liquidity. Reflexive leverage. Burnt-out governance. Yet none of those felt like root causes. They sounded more like symptoms wearing the mask of answers.

Dusk exists because a deeper assumption has gone largely unchallenged that exposure in financial systems is neutral, even virtuous. On-chain design has long treated transparency as an unquestioned good rather than a variable with real economic consequences. Over time, that belief pushes participants into behaviors that appear irrational from the outside but make perfect sense once you account for the pressure created by constant visibility.

When every position is traceable, balances are public by default, and strategies leak the moment they’re executed, long-term thinking erodes. Traders exit earlier than fundamentals justify. Institutions either stay away or interact through fragile abstractions. Governance turns performative, because revealing intent too soon is costly. Capital doesn’t just flow it shields itself. And capital that’s always on guard rarely builds anything meant to last.

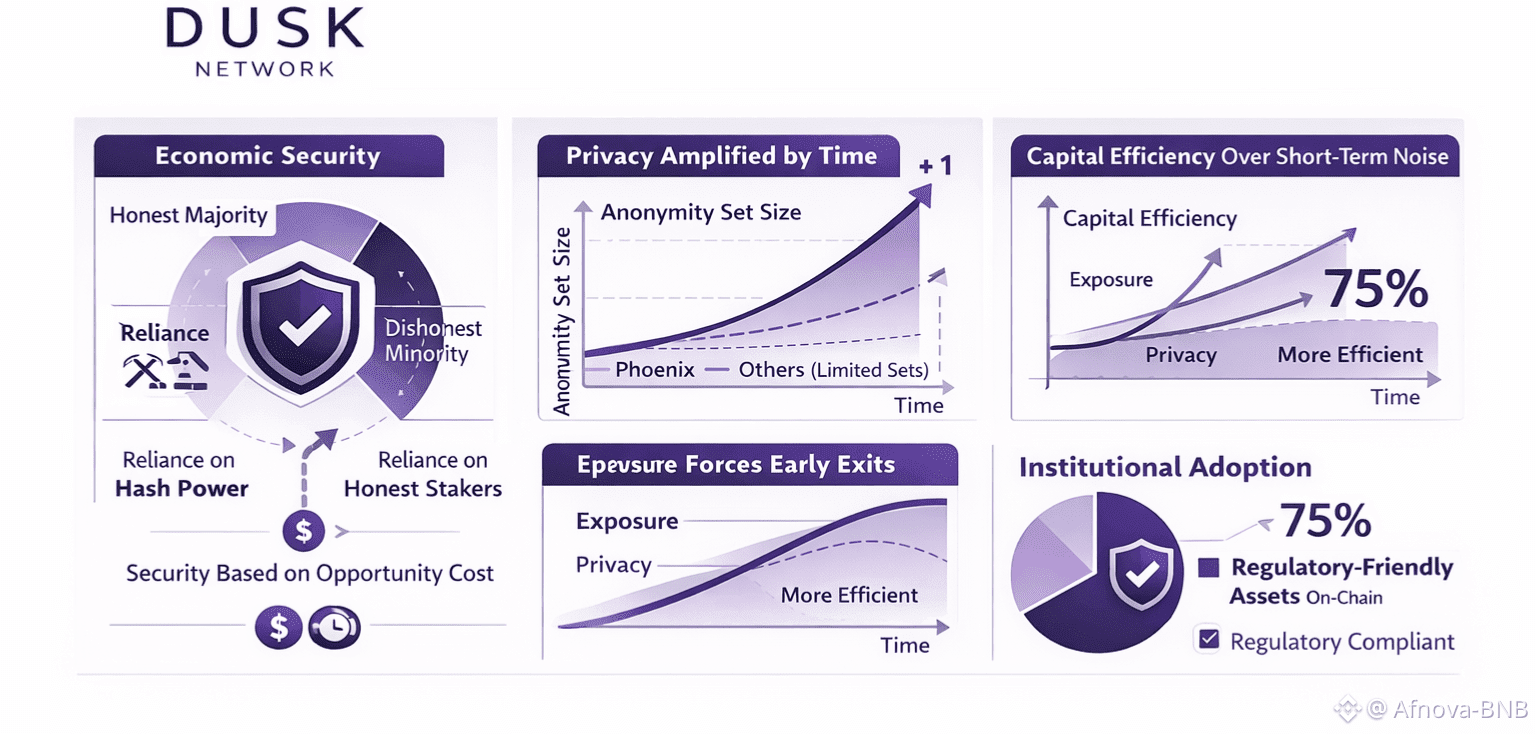

One subtle outcome is capital inefficiency. Positions that could remain deployed are unwound early, not due to changing fundamentals, but because visibility itself becomes a risk. Markets don’t consistently penalize weak ideas they penalize exposed ones. Over repeated cycles, this dynamic quietly favors short-term behavior while preaching long-term alignment. Most participants sense the inconsistency, yet few systems are designed to address it.

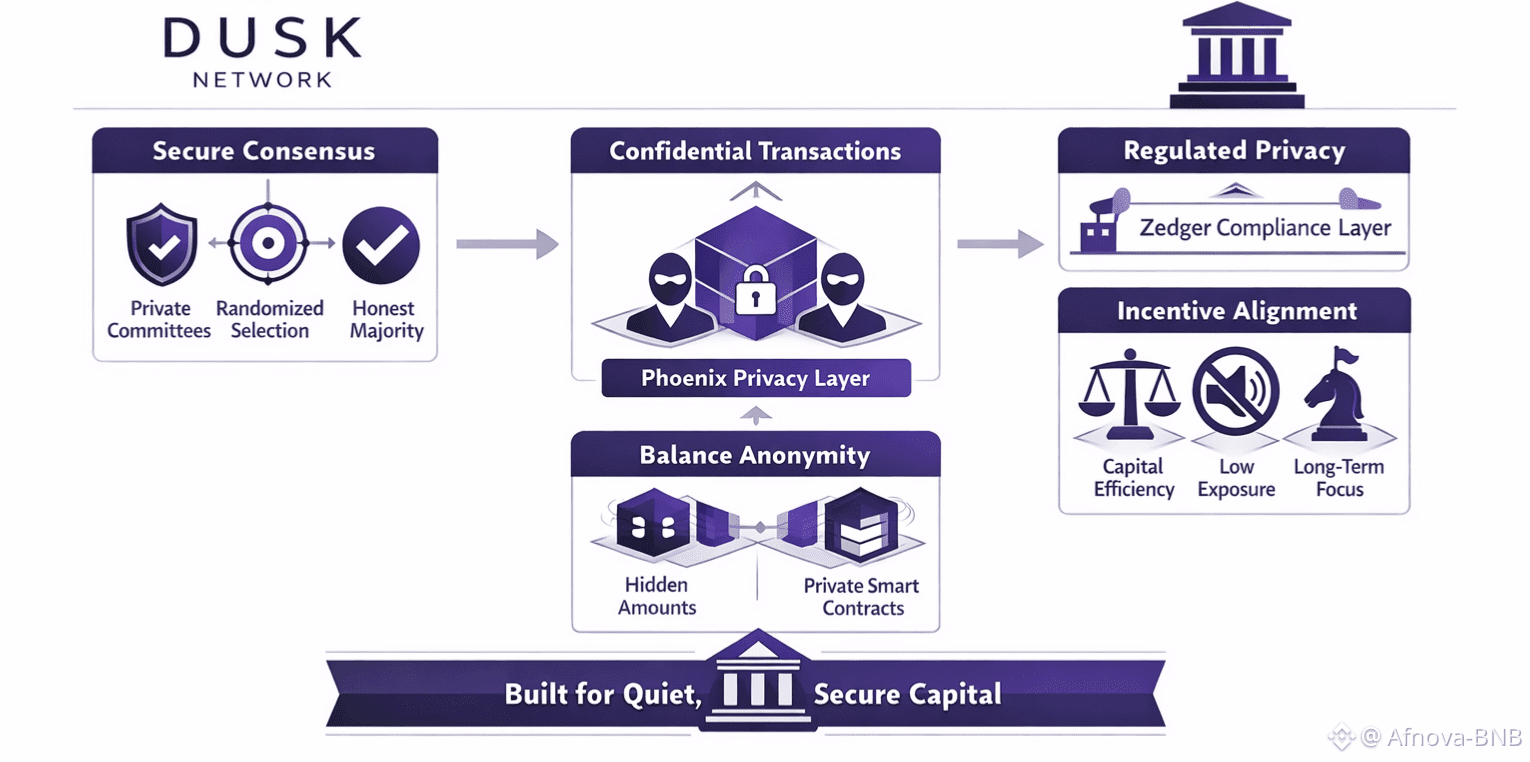

Seen through that lens, Dusk’s architecture feels less like a breakthrough and more like a correction. Its committee-based validation model isn’t chasing headlines or raw throughput. It targets a specific vulnerability: attacks that exploit predictability. Committees are chosen in a deterministic yet private manner. No validator knows the full group in advance. There’s no fixed target. Attacks shift from strategic to probabilistic, from clever to costly. Participation remains open, but coordination risk is sharply reduced.

This flows directly into Dusk’s approach to economic security. Rather than tying safety to hash power contests or assumptions of full visibility, the system relies on an honest majority of active stake. It’s a quieter premise, but arguably a more grounded one. Markets already assess stake honesty through opportunity cost. As long as most participants value system continuity over short-term extraction, liveness and security persist. It’s not idealistic it’s incentive realism under pressure.

Privacy is usually where the discussion turns next, and also where confusion tends to grow. Phoenix, Dusk’s confidential UTxO model, is often described as a privacy feature. That framing misses the point. Phoenix reshapes how history functions. Many privacy mechanisms reset anonymity in batches or limited sets. Phoenix accumulates it. Every transaction ever created expands the anonymity set. Time doesn’t erode privacy it amplifies it. Analysis doesn’t become clearer it becomes increasingly noisy.

That distinction matters. Many systemic risks in DeFi don’t detonate instantly they accumulate. Analytical certainty breeds confidence, confidence invites leverage, and leverage magnifies error. Phoenix breaks that feedback loop by preventing the system from becoming so legible that it can be over-optimized against itself. Even double-spend protection via nullifiers operates without revealing which outputs were consumed. Security is preserved without converting activity into a permanent public ledger of intent.

A rarely discussed detail is the ability to spend without exposing balances when execution costs can’t be known upfront. It sounds abstract, but it addresses a real constraint: smart contracts are dynamic. Gas usage depends on execution paths. Forcing users to reveal balances simply to interact safely is an unexamined design cost in many systems. Phoenix eliminates that cost. Participation doesn’t require self-disclosure.

Then there’s Zedger, which usually enters the conversation only when institutional players are present. Regulation is often portrayed as inherently hostile to decentralization, but in practice regulators fear opacity more than privacy. Zedger enables regulated assets to exist on-chain while enforcing real constraints whitelists, approvals, balance separation without broadcasting sensitive data. Compliance occurs where necessary, not everywhere by default. It’s a small distinction with large implications for whether markets are functional or merely symbolic.

What ultimately ties these pieces together isn’t a marketing narrative or growth playbook, but restraint. Dusk doesn’t try to manufacture activity with incentives that decay. It doesn’t assume users want visibility only security. It doesn’t confuse governance noise with governance quality. Instead, it builds around a simple observation: serious capital tends to move quietly, and systems that punish quiet behavior eventually empty themselves.

After enough market cycles, certain patterns become obvious patterns that dashboards don’t capture. Protocols fail less from missing features than from forcing participants into unnatural behaviors. They reward signaling over patience, speed over steadiness, exposure over endurance. Dusk stands out because it steps away from those defaults without advertising the fact.

Over time, the protocols that endure are rarely the loudest. They’re the ones that remove frictions you didn’t realize you were compensating for. They give capital room to breathe. They allow strategy without spectacle. Dusk Network feels designed for that slower, deeper layer of reality the one that remains after narratives fade and only structure is left behind.