Plasma’s native token, XPL, is designed as the economic backbone of a Layer-1 blockchain built specifically for stablecoin payments. Rather than centering on speculative mechanics, XPL is structured to secure the network, fund long-term ecosystem growth, and align incentives between users, validators, builders, and investors. Its tokenomics reflect this focus, combining a large ecosystem allocation, long-term vesting for insiders, and an inflation model balanced by fee burning.

The role of XPL in the Plasma network

XPL serves three core functions within Plasma. First, it is the token used to pay network fees, even though many stablecoin transactions are optimized to remain extremely low cost. Second, it secures the network through staking, rewarding validators who operate nodes and maintain consensus. Third, it acts as the coordination and growth asset for the ecosystem, funding liquidity, partnerships, developer programs, and integrations that bring real payment flows onto the chain.

Unlike general-purpose smart-contract platforms, Plasma positions XPL as a reserve and security asset for a blockchain optimized around stablecoins. This purpose strongly influences how supply, emissions, and burns are structured.

Total supply and initial distribution

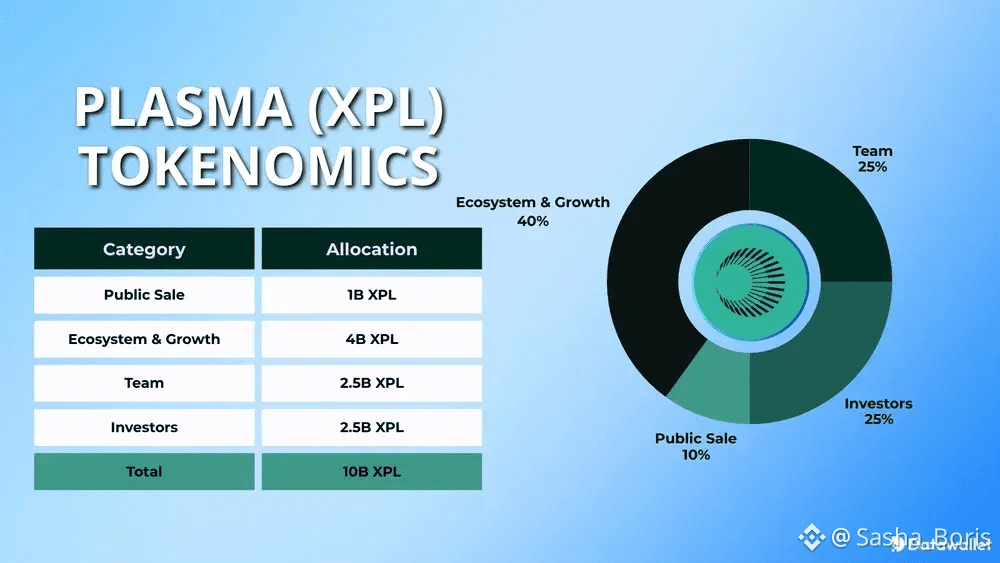

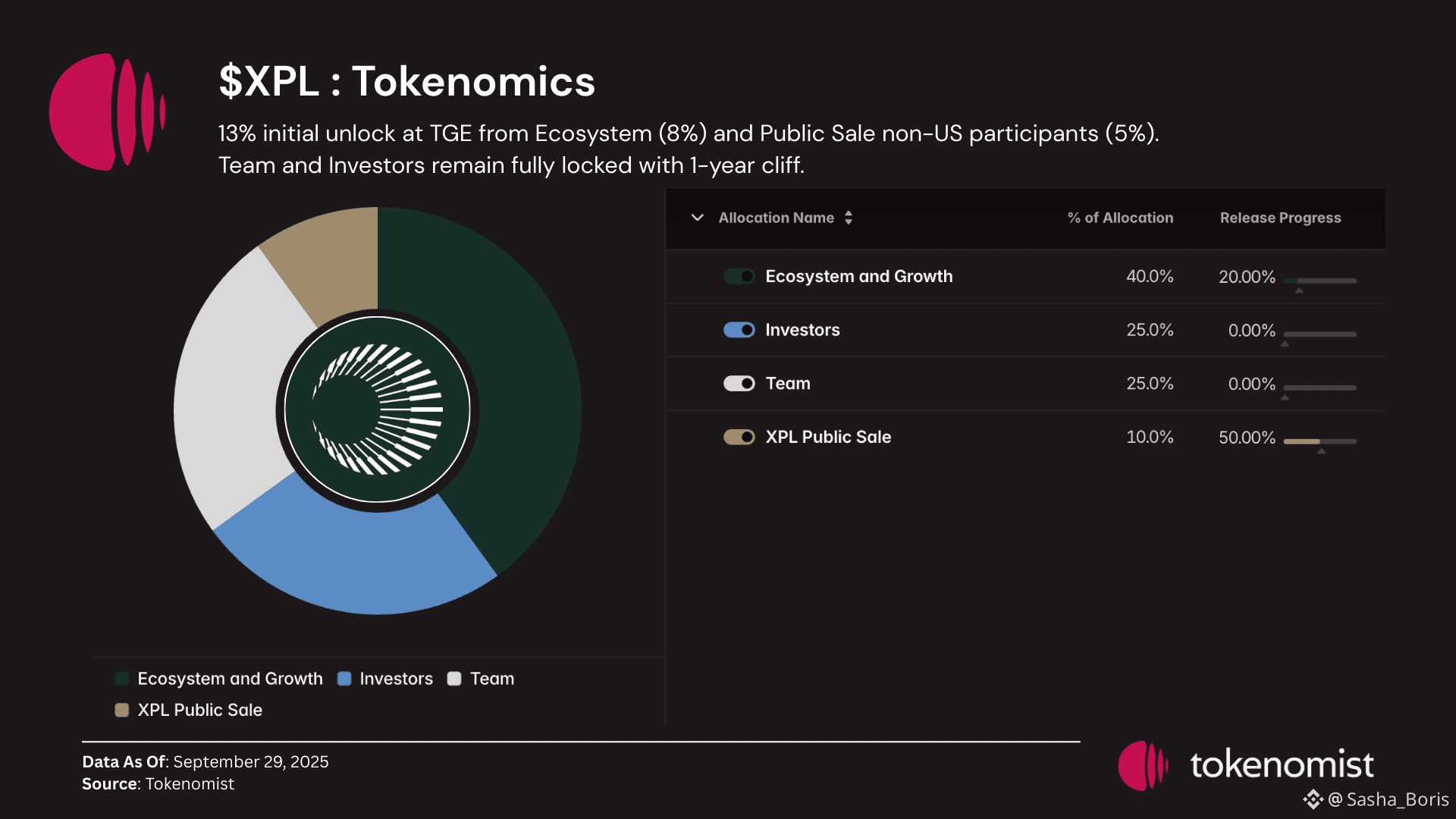

At mainnet beta, Plasma launched with an initial supply of 10 billion XPL. This supply is divided across four major categories designed to balance early participation, long-term commitment, and ecosystem expansion.

Ten percent of the total supply, or 1 billion XPL, was allocated to the public sale. Tokens purchased by non-US participants are unlocked at mainnet beta, while tokens purchased by US participants follow a fixed 12-month lockup schedule that completes in late July 2026. This structure affects early circulating supply while still allowing broad public participation.

The largest allocation, 40 percent or 4 billion XPL, is reserved for ecosystem and growth initiatives. A portion of this allocation is available immediately at mainnet beta to support liquidity provisioning, exchange listings, early DeFi activity, and strategic partnerships. The remainder vests gradually on a monthly basis over a three-year period, ensuring sustained funding rather than short-term incentive spikes.

Both the team and investors each receive 25 percent of total supply, equivalent to 2.5 billion XPL per group. These allocations follow a long-term vesting schedule. After a one-year cliff from mainnet beta, one-third of the tokens unlock, with the remaining balance vesting monthly over the following two years. Full vesting completes three years after launch, aligning insiders with the long-term health of the network.

Public sale structure and implications

The public sale was designed to seed a broad and diverse holder base while maintaining regulatory clarity. The distinction between US and non-US unlock schedules reduces immediate circulating supply from US participants and introduces a known future unlock event. For market participants, this makes supply expansion more predictable and easier to price in over time.

Because the public sale represents only a small fraction of total supply, Plasma’s long-term economics are driven more by network usage, staking participation, and ecosystem growth than by early sale dynamics.

Staking, emissions, and validator incentives

Plasma uses a Proof-of-Stake model to secure the network. Validators earn rewards in XPL for proposing and validating blocks, while token holders can delegate stake to participate in network security.

The protocol’s inflation model starts at 5 percent annually and decreases by 0.5 percent each year until it reaches a long-term baseline of 3 percent. Importantly, emissions only activate once external validators and delegated staking are fully live. Tokens that are locked under team and investor vesting schedules do not earn staking rewards while locked, ensuring that emissions primarily benefit active network participants.

This declining inflation curve is designed to provide strong early security incentives while gradually reducing dilution as the network matures.

Fee burning and supply balance

To counteract inflation, Plasma implements a base-fee burning mechanism similar in spirit to EIP-1559. A portion of transaction base fees is permanently removed from circulation. As transaction volume increases, especially from high-frequency stablecoin transfers, the burn mechanism can offset or even exceed new token issuance.

This creates a direct link between real network usage and long-term token supply dynamics. In periods of high adoption, XPL can trend toward supply neutrality or deflation; in periods of low activity, inflation dominates but remains capped and predictable.

Ecosystem funding and growth strategy

The 40 percent ecosystem allocation is a central pillar of Plasma’s strategy. These tokens are intended to fund liquidity programs, developer incentives, infrastructure partnerships, and integrations with stablecoin issuers, payment processors, and exchanges.

By releasing a portion of these tokens immediately at mainnet beta, Plasma prioritizes early momentum and usability. The remaining gradual vesting ensures that incentives can be sustained over several years rather than front-loaded, which helps manage sell pressure and encourages longer-term alignment with builders and partners.

Alignment of team and investors

The shared vesting structure between team and investors signals intentional alignment. Both groups are subject to the same long-term timeline, reducing asymmetry and reinforcing the idea that value creation depends on sustained adoption rather than short-term market movements.

This structure also supports hiring and operational stability, as team members are incentivized to remain engaged through multiple stages of network growth.

What to monitor going forward

Several factors will shape XPL’s economic performance over time. Unlock schedules, particularly the public sale unlocks and the three-year vesting horizon, will influence circulating supply. The balance between staking emissions and fee burning will depend heavily on real transaction volume. Most importantly, Plasma’s success hinges on whether it can attract and retain meaningful stablecoin payment flows beyond crypto-native use cases.

Conclusion

XPL’s tokenomics are built around function rather than hype. With a fixed initial supply, predictable vesting, declining inflation, and a usage-linked burn mechanism, Plasma has designed an economic system intended to support a high-throughput, stablecoin-focused blockchain over the long term. The structure gives the network the tools it needs to grow responsibly; whether it succeeds will depend on execution, partnerships, and sustained real-world usage.