Stablecoins have quietly become one of the most important breakthroughs in modern finance. They are no longer just a crypto niche product, they are evolving into the rails for global money movement. Plasma’s recent $24M Seed and Series A raise marks a defining moment for this transition.

Led by Framework and Bitfinex, with participation from major institutions and respected industry figures, this funding round represents more than capital. It represents conviction. Conviction that stablecoins are moving from experimentation to infrastructure, and conviction that Plasma is building the right foundation to support that shift.

Today, over $220 billion worth of stablecoins exist, with trillions of dollars transferred every month. Yet most of this activity relies on blockchains that were never designed for stablecoins. High fees, failed transactions, congestion, and architectural compromises continue to slow adoption. Plasma exists to remove these bottlenecks entirely.

Unlike general purpose chains, Plasma is built from the ground up for stablecoin payments. Its architecture reflects a clear understanding of how digital dollars are actually used in the real world. Speed matters. Reliability matters. Cost matters. Plasma delivers on all three.

At its core, Plasma is a high performance Layer 1 that pairs a Fast HotStuff derived PlasmaBFT consensus mechanism with a Reth based EVM execution layer. This enables sub second finality while preserving Ethereum level developer familiarity. The result is a chain that feels intuitive for builders while being powerful enough for global scale payments.

One of Plasma’s most important breakthroughs is zero fee USD₮ transfers. USD₮ is the largest stablecoin in the world, holding close to 70 percent market share. By making USD₮ transfers fee free, Plasma removes friction at a level no other blockchain currently matches. This is a critical step toward everyday stablecoin usage, from remittances to payments to onchain finance.

The backing from Bitfinex and USD₮0 strengthens this positioning even further. Plasma is not competing on narratives, it is aligning directly with the largest players in stablecoin issuance and liquidity. That alignment gives Plasma an advantage that is structural, not promotional.

What also sets Plasma apart is its long term vision for security. By leveraging Bitcoin as a security layer, Plasma anchors its infrastructure to the most battle tested network in crypto. This approach reflects maturity and patience, traits that are often missing in fast moving blockchain ecosystems.

The $24M raise enables Plasma to accelerate development across testnet, mainnet, and ecosystem expansion. Payments, remittances, DeFi, and personal finance applications are all part of the roadmap. The goal is not to build isolated tools, but to create a complete stablecoin native environment where money can move freely and reliably.

There is also a deeper story unfolding. Stablecoins are increasingly viewed as strategic financial infrastructure. Governments, regulators, and traditional institutions are paying attention. In this environment, blockchains designed for speculation struggle, while blockchains designed for money thrive. Plasma clearly falls into the second category.

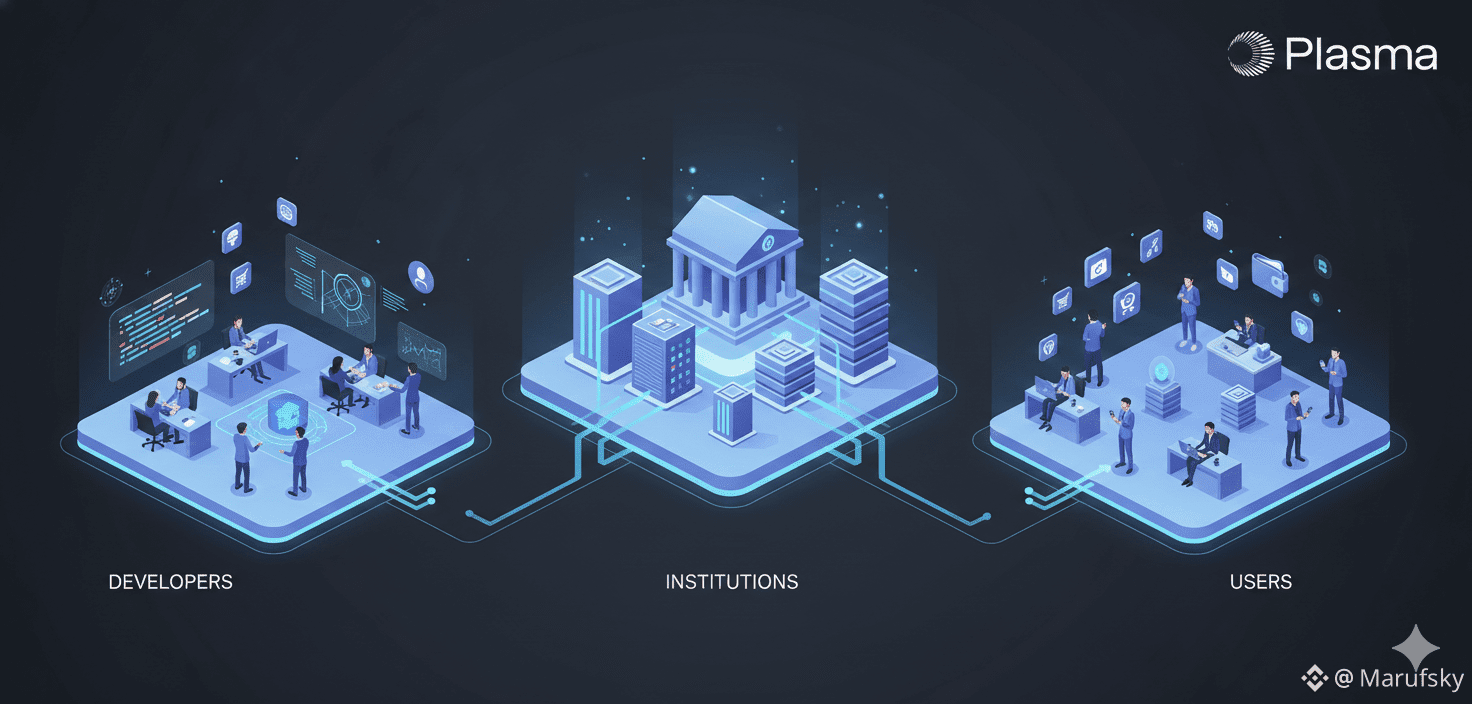

For developers, Plasma offers a familiar EVM environment without the usual tradeoffs. For users, it offers speed and cost efficiency that feel invisible but transformative. For the broader ecosystem, it offers a path toward stablecoin adoption at a global scale.

Plasma is not promising a distant future. It is building practical infrastructure for the present moment. The $24M raise is a milestone, but the real impact will be measured by how seamlessly value moves across borders, platforms, and people.

As stablecoins continue their march toward mainstream adoption, Plasma is positioning itself as the chain that makes that future possible.