In the world of crypto, many people assume that complete transparency automatically makes markets fair. The logic seems straightforward: if everyone can see everything, no one can cheat, and prices should naturally reflect the truth. But when you look at how traditional finance actually works, this idea doesn’t hold up.

Real-world financial markets are not fully transparent. Instead, they operate on careful control of information. A hedge fund doesn’t broadcast every trade it makes. A bank treasury doesn’t announce its plans before adjusting its positions. Companies don’t release all investor details to prove they are following the rules. Yet regulators still oversee these systems, enforce rules, and ensure compliance. The system works because information is shared strategically, not because it is completely open.

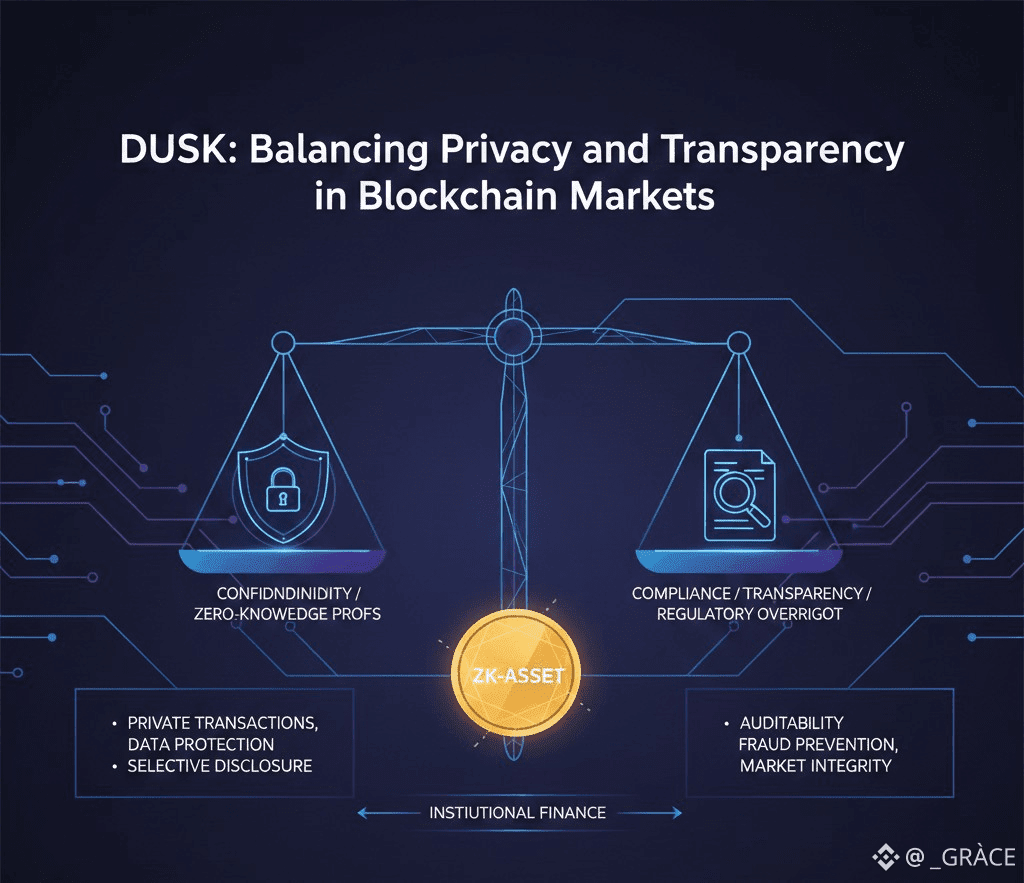

This is where Dusk comes into play. Dusk isn’t simply another privacy-focused blockchain. It is designed to mirror the way regulated markets manage information. Most blockchains today fall into one of two extremes. On one side are fully transparent systems that reveal every transaction, strategy, and counterparty to anyone watching. On the other side are completely private systems that hide everything, making them difficult for regulators or institutional participants to use. This creates a false choice: total openness or total secrecy.

Dusk takes a middle path. Its technology allows sensitive market activity to remain private while still being verifiable when needed. This approach recognizes a key truth: markets don’t fail because participants hide information. They fail when information leaks at the wrong time and causes unintended behavior.

Think of Dusk as a tool for managing exposure. It allows applications to control who sees what, and when. Transactions can be confirmed, rules enforced, and finality achieved without broadcasting every detail publicly. This mirrors how traditional markets operate behind the scenes, where selective disclosure is the norm.

This control over visibility matters because exposure affects behavior. In fully transparent systems, traders often split orders, reroute trades, or avoid certain venues to hide their intentions. Liquidity becomes fragmented, not because demand is low, but because participants want to avoid being constantly observed. Serious investors tend to move toward environments where transparency doesn’t compromise execution quality. Dusk reduces this signaling risk without removing accountability. Regulators don’t need a live feed of every move; they need assurance that rules are followed and the ability to investigate problems when they arise.

The significance of controlled visibility grows even more with tokenized real-world assets. Issuing, trading, and settling these assets each require different levels of disclosure. Issuers need to prove an asset exists. Investors want privacy around holdings. Regulators require audit trails in specific cases. Forcing one uniform visibility model across all stages creates friction. Dusk’s design treats exposure as flexible, letting applications decide what to reveal, to whom, and when.

There are trade-offs. Selective disclosure is more complex to design and audit. Wallets, developer tools, and liquidity routing require careful planning. Complexity can slow adoption when benefits aren’t immediately obvious. But the upside is significant. As markets move toward regulated, tokenized instruments, success will not always go to the loudest or fastest projects. It will go to the platforms trusted by issuers, acceptable to regulators, and comfortable for participants who don’t want to operate under constant surveillance.

The question isn’t whether privacy is good or bad. The question is whether a blockchain can manage visibility in a way that aligns with regulatory reality. Dusk suggests that controlled disclosure, not full transparency, is the missing piece. In this framework, the most valuable blockchain infrastructure may be the one quietly ensuring the market functions efficiently, even when no one is paying attention.

Dusk also highlights a broader lesson for crypto adoption. Users and institutions will gravitate toward platforms that make them feel secure, not exposed. Excessive transparency can drive participants away, while too much secrecy can prevent adoption entirely. Finding the right balance is essential for long-term growth, particularly as the ecosystem expands to include real-world assets and institutional participants.

Ultimately, Dusk’s approach reflects a mature view of market mechanics. Instead of forcing an ideological debate about privacy, it focuses on structural realities. Markets work best when the right people see the right information at the right time. This principle, long established in traditional finance, is now being brought to blockchain technology in a thoughtful way.

The impact of this approach could extend beyond just Dusk. As tokenized assets and regulated blockchain markets grow, controlled visibility could become a standard feature. Platforms that fail to consider exposure management may struggle with adoption, liquidity, and trust. Those that master it may attract serious capital and long-term institutional engagement.

Dusk’s model also encourages innovation. Developers can create applications with configurable visibility, allowing new types of financial products to exist on-chain while respecting privacy, compliance, and market efficiency. This is a critical step for bridging the gap between decentralized technology and real-world financial needs.

In the end, the conversation about blockchain privacy is less about ideology and more about practicality. It’s about designing systems that recognize human and market behavior. Transparency isn’t a silver bullet, and privacy isn’t inherently suspicious. What matters is the ability to manage exposure thoughtfully, ensuring rules are followed without forcing participants to operate in a glass box.

Dusk may not make headlines every day, but its quiet approach addresses one of the most important challenges in blockchain adoption. By giving participants control over visibility while maintaining regulatory compliance, it creates an environment where markets can operate efficiently, participants can feel safe, and capital can move without unnecessary friction. That combination may ultimately define the next generation of blockchain infrastructure.