While most traders still obsess over transaction speed and fees. My research suggests the next real advantage in crypto is coming from how blockchains handle data and Walrus is positioning itself right at that pressure point. When I analyzed recent market narratives. I noticed something familiar. Every cycle crypto finds a new bottleneck to argue about. In 2020 it was fees in 2021 it was scalability in 2023 it became modularity. In my assessment 2025 and beyond are shaping up to be about data. Applications are no longer simple token transfers. They generate state history media, AI context and user specific information that must live somewhere reliable. Walrus is quietly stepping into that gap.

What initially caught my attention was not price action but architecture. Walrus is built on Sui. A blockchain that publicly demonstrated parallel execution and object based design capable of handling tens of thousands of transactions per second as cited in multiple Sui Foundation technical updates. That level of performance matters because data heavy applications don't just write once and forget. They read, update and reference data constantly and most existing storage layers were never optimized for that behavior.

Why Walrus focuses on active data instead of static storage?

One way I explain Walrus to non technical friends is by using a warehouse analogy. Traditional decentralized storage solutions act like long term storage units. You put something in lock it away and maybe come back months later. Walrus treats data more like inventory in a busy logistics hub constantly moving in and out. This difference may sound subtle but it changes everything about performance and cost.

According to public Filecoin network statistics the network has surpassed 18 exabytes of storage capacity but much of that capacity is optimized for long term archival use rather than rapid repeated access. Walrus by contrast uses erasure coding combined with blob storage to ensure data remains retrievable even if parts of the network go offline while still prioritizing speed. My research into decentralized storage benchmarks suggests that retrieval latency is one of the biggest pain points for app developers not raw capacity. Cost structure is another overlooked factor. AWS S3 pricing publicly listed at around $0.023 per gigabyte per month for standard storage sets the benchmark most enterprises compare against. Decentralized alternatives often struggle to match that while maintaining performance. Walrus's model spreads encoded data across nodes in a way that reduces redundancy overhead without sacrificing availability. In theory that allows lower long term costs for applications that constantly read and update data rather than storing cold archives. Privacy matters more than most traders think. Chainalysis keeps pointing out that metadata leaks are a big worry for institutions. Walrus takes advantage of Sui's object centric setup letting users control exactly who sees what. You don't have to put everything out in the open only show what's needed. That kind of control is a big deal for businesses, games and AI powered dApps that deal with sensitive user info.

How Walrus compares to other scaling and data solutions?

In my assessment, It's a mistake to compare Walrus directly to Layer 2 scaling solutions like Optimism or Arbitrum. Those systems focus on execution scaling not data storage. A more fair comparison is with data availability and storage projects like Celestia, EigenDA, Filecoin and Arweave. Celestia according to its public documentation is optimized for publishing transaction data so that other chains can verify it. That is powerful but it does not solve application level storage needs. Arweave which has reportedly stored hundreds of terabytes of permanent data based on network dashboards focuses on immutability rather than active state. Filecoin's great at storing tons of data in a decentralized way but it still struggles when you need to access the same files over and over. Speed just is not its strong suit. Walrus sits somewhere between these categories. It does not aim to be permanent storage for history nor just a data availability layer for rollups. It targets living data. That positioning may explain why it hasn’t been heavily marketed yet. The thing with infrastructure is. It's not flashy. You don't see it trending on social media but take it away and suddenly everyone notices. It's the stuff that quietly keeps everything running.

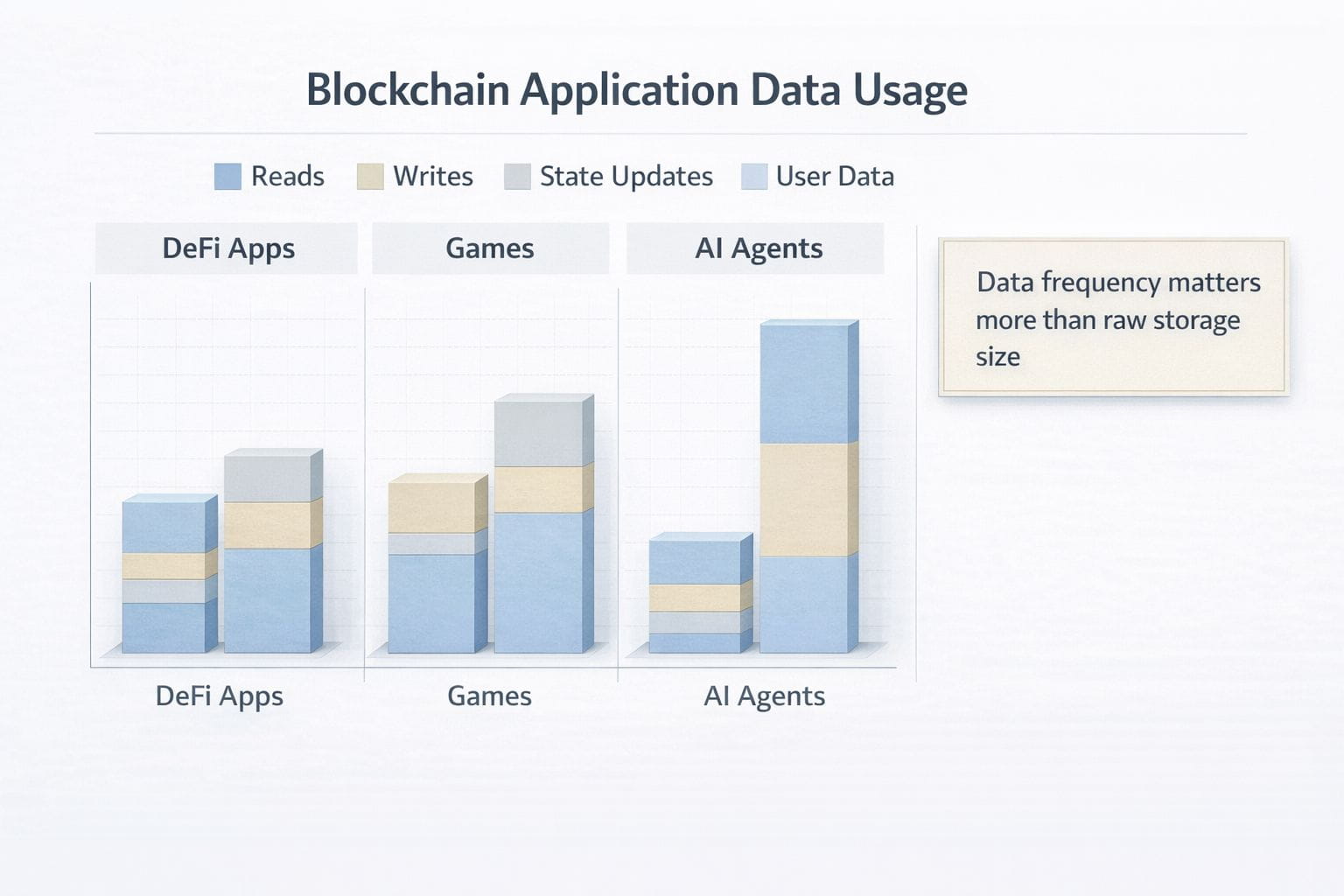

If I had to break this down visually. I would start with a chart showing how often people read and write data in different apps think DeFi, gaming, AI agents and use that to spotlight where Walrus really shines. Then I would throw in a chart that tracks how archival storage ramps up over time compared to how much people are actually using their data day to day. Maybe even a table to lay out the differences between Walrus, Filecoin, Arweave and Celestia. How fast you can get your stuff whether you can change it and what each one's actually for. Let's talk about challenge. You can't have a real analysis without digging into what might go sideways. Walrus is still early and early stage infrastructure always faces adoption uncertainty. Developers may stick with familiar solutions even if they are inefficient. My research into past infrastructure cycles shows that better technology does not always win immediately.

There is also competitive pressure. People are talking a lot about EigenDA and Celestia in the modular blockchain space lately. If these projects move past just data availability and start handling application storage too, Walrus is going to have a tougher fight on its hands. Then there is the whole token economics thing nobody really knows how that will shake out. If people don't actually use WAL for something real it stops being useful and just turns into another token people trade for fun.

Execution challenge matters too. Building a decentralized storage network that is fast, cheap and reliable is extremely difficult. If performance fails under real world load sentiment could shift quickly. In crypto narratives change faster than fundamentals.

Here is how I see WAL from a traders angle

I don't think of WAL as some quick flip. It's more of an infrastructure play. These tokens usually just grind sideways for a while sometimes it feels endless then out of nowhere they shoot up once people finally start using them. So I'm not into chasing pumps or jumping in because of hype. I would rather watch those quiet periods where price hangs around old support zones during low volume trading. That's where I start paying attention. If WAL drops back to an early support range, I’d start building a position step by step. I always set a clear stop if it breaks below the main support. I'm out. If price pushes through a mid range resistance and there’s real proof of on-chain growth like more data stored or new integrations showing up that's when I get interested. At that point I would probably take some profits near big psychological resistance levels just to lock something in but I would keep a core chunk riding in case the bigger trend kicks in. Managing challenge is non negotiable. If the network stalls out or some other project takes over Sui's data layer. I will walk away no matter what the chart says. No use sticking around if the story falls apart. Discipline matters more than conviction.

Stepping back and looking at the bigger picture

After stepping back from charts and narratives, my conclusion is straightforward. Walrus is betting on a future where blockchains behave less like ledgers and more like operating systems. That future requires fast, private and cost efficient data handling. My research suggests most blockchains are not ready for that shift yet.

Walrus may not trend on social media today, but infrastructure rarely does until it becomes unavoidable. For traders willing to look beyond surface metrics, WAL represents a calculated bet on where crypto applications are heading, not where they’ve been.