Saw something in the trade queue this afternoon

Three €2M tokenized securities moved nearly simultaneously. The queue executed without pause. Ops didn’t have a single field to intervene. Compliance only saw the post-execution report. Margin exposure shifted subtly, not enough to trigger a block, just enough that capital efficiency tightened by roughly €150K across the batch

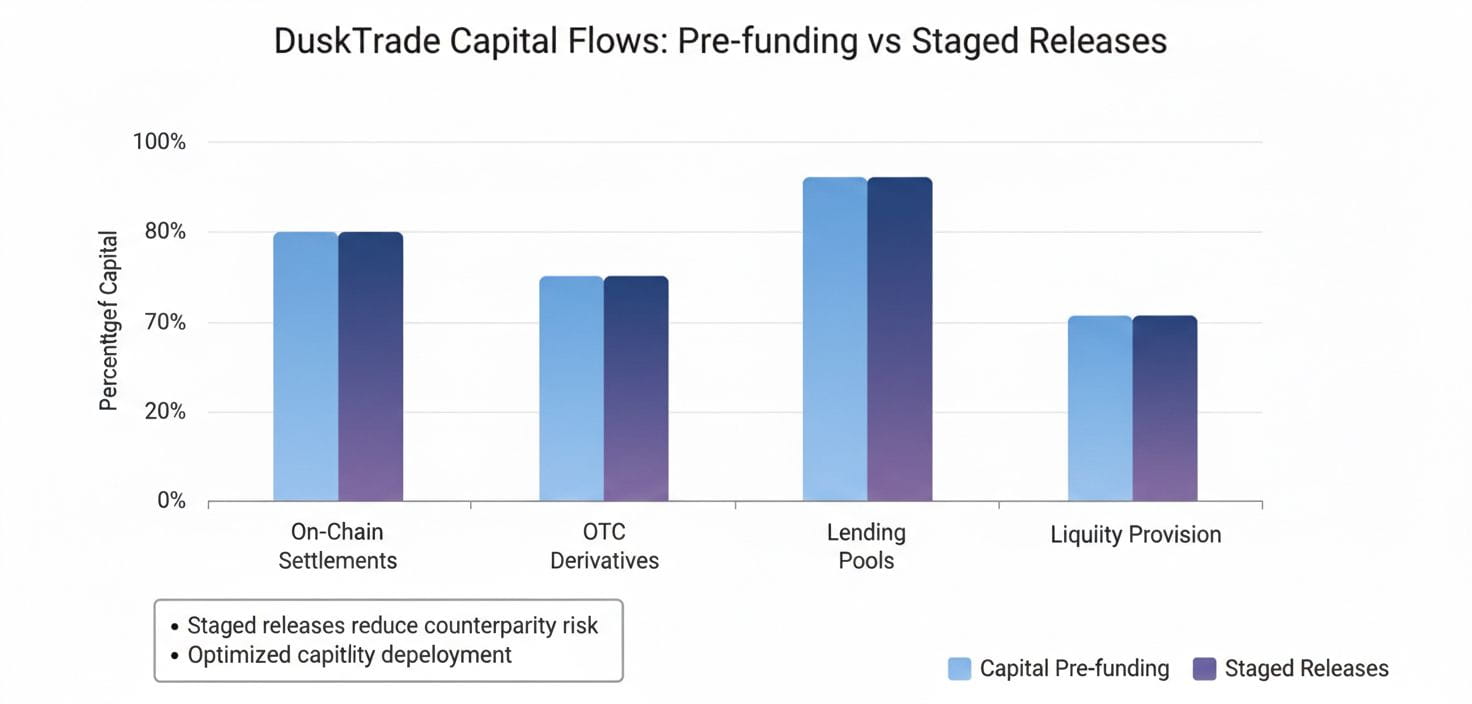

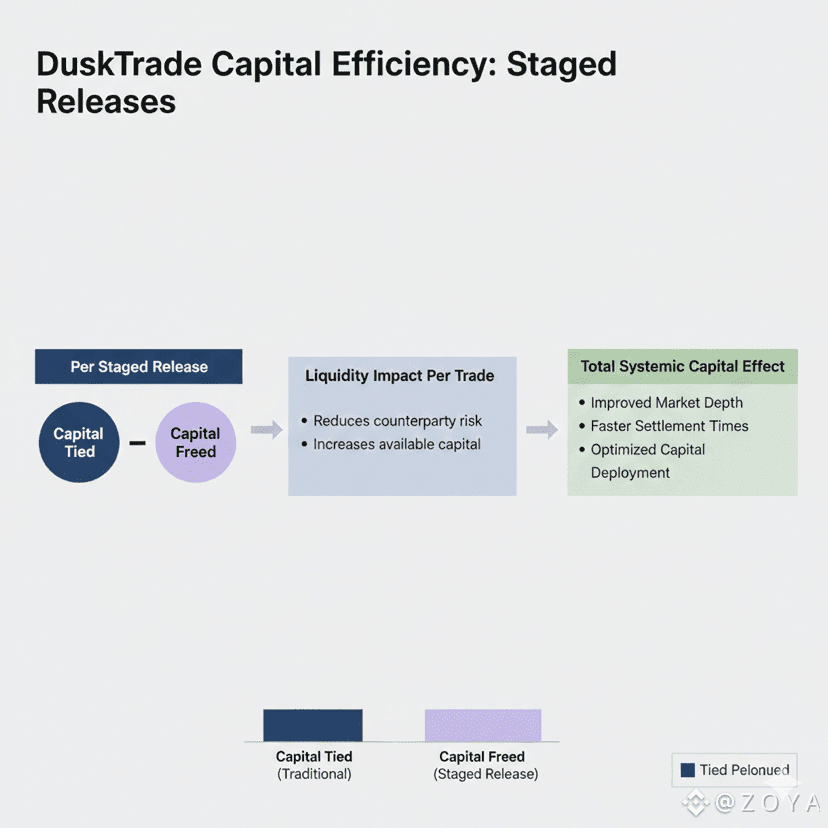

The industry still believes liquidity is just speed. Dusk shows otherwise. Moonlight transactions preserve confidentiality, yes, but they also enforce capital discipline. You can’t pre-fund more than your entitlement allows. You can’t stage release without documented clearance. No shortcuts

That hit me when I noticed the delayed pre-fund check. Normally, a desk would absorb the drift, pretend it’s negligible. Here the system flagged it automatically. Manual intervention wasn’t optional. Only authorized reviewers could approve a temporary adjustment. €150K reallocated in seconds, eyes on the log, dashboards unchanged, yet liquidity subtly constrained

Why now? The 2026 DuskTrade rollout is imminent. Tokenized RWAs will move in real-time, and every timing gap is a measurable cost. Small micro-frictions now compound into systemic capital stress if ignored

Feels like a tiny operational kink, but it rewires behavior fast