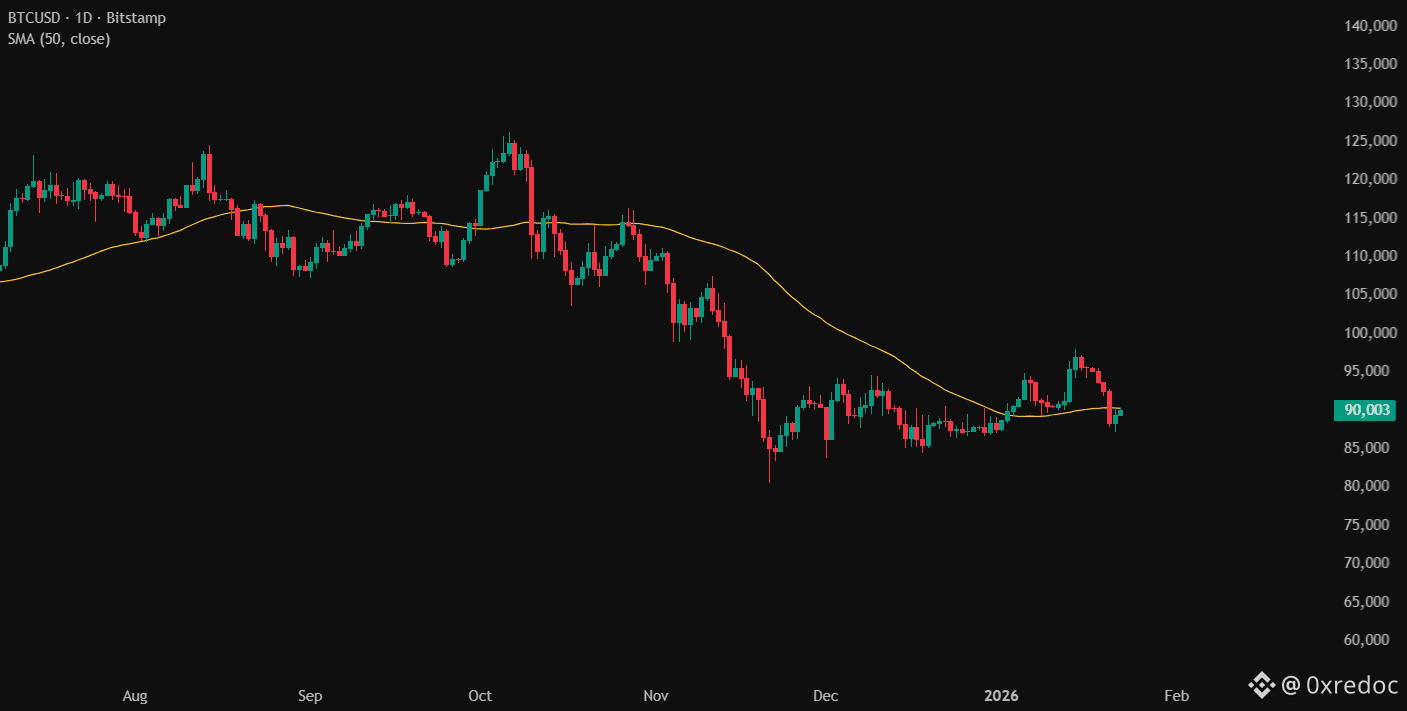

Prices are swinging sharply, confidence is fragile, and even long term holders are feeling the stress. Bitcoin briefly slipped below key levels, Ethereum is hovering around major support, and most altcoins continue to lag. This is not just random volatility. Several real forces are pushing against the market at the same time.

Here is a simple breakdown of what is happening and why it matters.

Global tension is hurting risk assets

Renewed trade threats from the United States and wider geopolitical uncertainty have pushed investors into a risk off mood. When traditional markets pull back, crypto often follows. Assets like Bitcoin and Ethereum are still closely linked to stocks, especially tech. When equities wobble, crypto usually reacts faster and harder.

US regulation momentum has slowed

Hopes for fast and clear crypto regulation in the United States have cooled. Key bills meant to bring clarity are facing delays, and industry support has weakened in some cases. While 2025 delivered progress through spot ETFs and early frameworks, uncertainty around final rules is keeping investors cautious.

Macro conditions remain tight

Inflation is proving sticky, and interest rates are not falling as quickly as markets expected. The Federal Reserve is moving carefully, keeping liquidity tight. Crypto remains highly correlated with tech stocks and the Nasdaq, so any weakness in AI spending or growth expectations hits digital assets directly.

Liquidations are amplifying moves

Heavy leverage continues to be a problem. When prices drop, forced liquidations kick in and push prices even lower. Recent liquidation waves have wiped out billions in a short time, turning small dips into sharp sell offs and shaking market confidence.

Altcoins face deeper challenges

Outside of Bitcoin and Ethereum, many tokens are struggling. On chain activity has slowed, retail speculation has cooled, and investors are questioning how many projects truly capture long term value. Since late 2024, the broader altcoin market has steadily trended down as capital rotates into core assets and stablecoins.

Background risks add pressure

State linked hacking groups, including those tied to North Korea, continue to set records for crypto theft. At the same time, concerns around crime, coercion, and future technology risks add to the overall feeling of caution, even if some of these threats are long term.

Still, the outlook is not entirely bearish. Institutional demand through ETFs remains strong and could absorb more supply than ever before. Some believe the traditional four year crypto cycle is fading, replaced by longer trends driven by regulation and macro policy. Many expect near term pain, especially early in the year, but see potential upside later in 2026 if rates ease and policy clarity improves.

For now, crypto is headline driven and macro sensitive. News on trade policy, central banks, or regulation can flip sentiment quickly. In this environment, staying liquid and avoiding over leverage matters more than chasing short term moves.