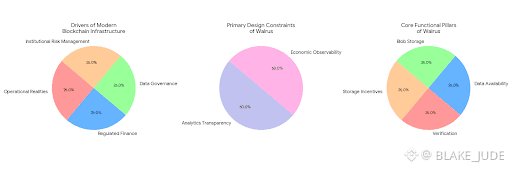

Walrus emerges at a moment when blockchain infrastructure is being redefined less by ideological decentralization narratives and more by the operational realities of regulated finance data governance and institutional risk management. Designed as a decentralized blob storage and data availability protocol native to the Sui ecosystem Walrus is not merely a solution for storing large files off chain. It represents a deeper architectural statement about how blockchain networks mature when analytics transparency and economic observability are treated as primary design constraints. From its earliest technical assumptions Walrus positions data intelligence as inseparable from protocol functionality aligning storage incentives and verification into a system that can be reasoned about in real time by sophisticated financial actors.

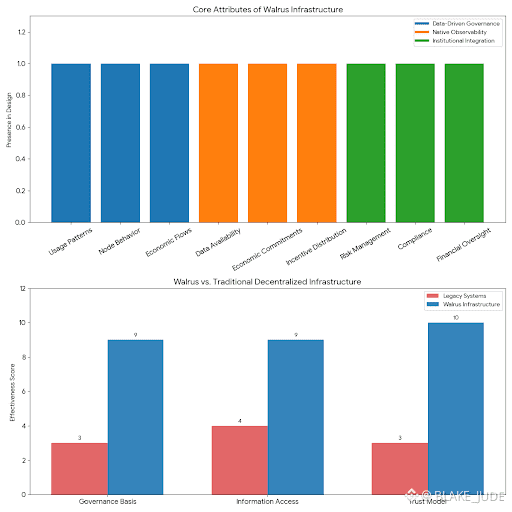

The foundational insight behind Walrus is that data availability is not a passive utility but an active financial primitive. In institutional contexts the ability to verify not only that data exists but that it remains continuously available under economic guarantees is central to trust. Walrus operationalizes this principle through an on chain coordination layer built on Sui where storage commitments payments and lifecycle parameters are expressed as verifiable state transitions rather than informal service level promises. This transforms storage from an opaque technical service into an analyzable financial contract. Institutions evaluating counterparty exposure operational continuity or systemic risk are therefore able to observe the health of the storage layer directly on chain which reduces reliance on off protocol assurances.

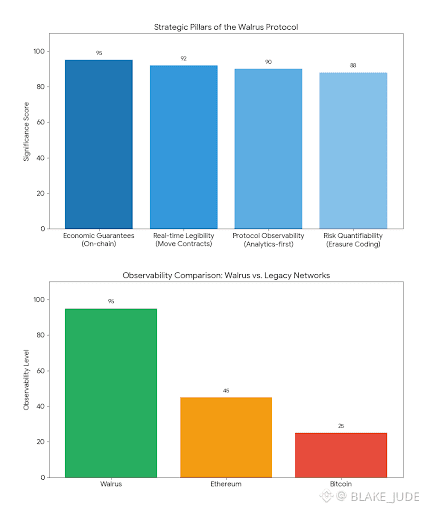

At the architectural level Walrus uses erasure coding instead of full replication. While this is often described in terms of cost efficiency its deeper significance lies in how it enables probabilistic risk modeling. By encoding blobs across a distributed set of nodes with mathematically defined recovery thresholds the protocol allows availability guarantees to be quantified rather than assumed. This creates a natural interface for analytics where node participation rates shard distribution entropy and recovery margins can be monitored continuously. For regulated entities accustomed to stress testing and scenario analysis this approach aligns closely with established financial risk frameworks.

The tight integration with Sui further reinforces the analytics first posture of Walrus. Because storage payments and commitments are coordinated through Move based smart contracts the economic state of the protocol remains legible in real time. Institutions can observe aggregate storage liabilities upcoming payment obligations and reward distributions with a level of granularity comparable to traditional settlement systems. This stands in contrast to earlier networks such as Bitcoin where analytics are largely reconstructive or Ethereum where complex contract interactions often obscure aggregate exposure without specialized tooling. Walrus benefits from designing observability into the protocol from inception rather than retrofitting analytics after deployment.

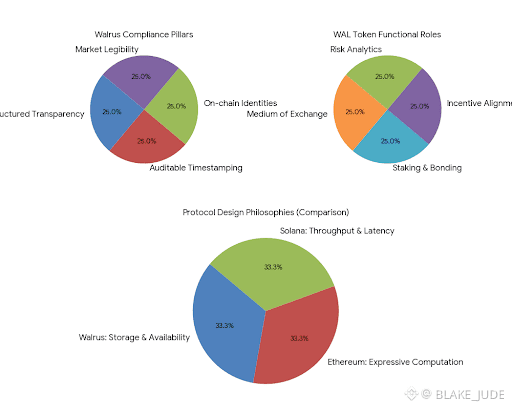

Compliance awareness within Walrus is expressed through structured transparency rather than restrictive controls. The protocol does not attempt to enforce regulatory policy at the storage layer. Instead it ensures that all economically relevant actions are auditable timestamped and attributable to on chain identities. This distinction is critical for institutional participants. Compliance teams do not require protocols to act as regulators but they do require systems where data flows payment obligations and counterparty roles can be reconstructed with confidence. Walrus satisfies this requirement by making the storage market legible while preserving decentralized operation.

The WAL token functions as more than a medium of exchange for storage services. Its role in staking and incentive alignment introduces embedded risk analytics into the core of the protocol. Because storage nodes are economically bonded to performance deviations in availability or reliability are reflected directly in staking metrics and reward flows. This creates a continuous feedback loop where protocol health is priced by market behavior. Institutional participants whether acting as storage consumers or token holders gain access to real time indicators of network integrity which allows exposure to be adjusted dynamically rather than reactively.

When compared analytically to networks such as Ethereum or Solana Walrus illustrates a shift in design philosophy rather than a competitive displacement. Ethereum prioritizes expressive computation but depends heavily on external data availability layers and third party analytics providers to meet institutional reporting standards. Solana emphasizes throughput and low latency execution yet its historical reliability challenges highlight the difficulty of reconciling performance with operational transparency. Walrus narrows its functional scope to storage and availability but executes that scope with financial grade introspection. This specialization allows analytics to be native rather than layered which increasingly aligns with institutional preferences.

Governance within Walrus reflects this data driven orientation. Decisions around protocol parameters incentive structures and storage economics are informed by on chain telemetry rather than abstract ideology. Because the system produces granular data on usage patterns node behavior and economic flows governance debates can be grounded in empirical evidence. This mirrors the evolution of traditional financial infrastructure where policy adjustments are modeled and stress tested before implementation. Walrus implicitly acknowledges that mature decentralized systems must internalize this methodology to remain credible.

Perhaps most importantly Walrus reduces operational blind spots that persist across many decentralized networks. In numerous blockchain systems participants rely on delayed or partial information often mediated by third party analytics dashboards. Walrus minimizes this gap by ensuring that critical aspects of protocol function including data availability economic commitments and incentive distribution are natively observable. For institutions managing fiduciary responsibility this level of transparency is a prerequisite rather than an enhancement.

Viewed holistically Walrus represents a broader shift toward analytics first blockchain infrastructure where trust is constructed through continuous measurement rather than static assumptions. Its design reflects an understanding that institutional adoption is driven by integration with established frameworks of risk management compliance and financial oversight. By embedding data intelligence directly into the protocol layer Walrus contributes to a new class of blockchain systems that are decentralized yet legible auditable and economically intelligible. In doing so it signals the maturation of blockchain technology toward financial grade infrastructure where analytics form the foundation of systemic trust.