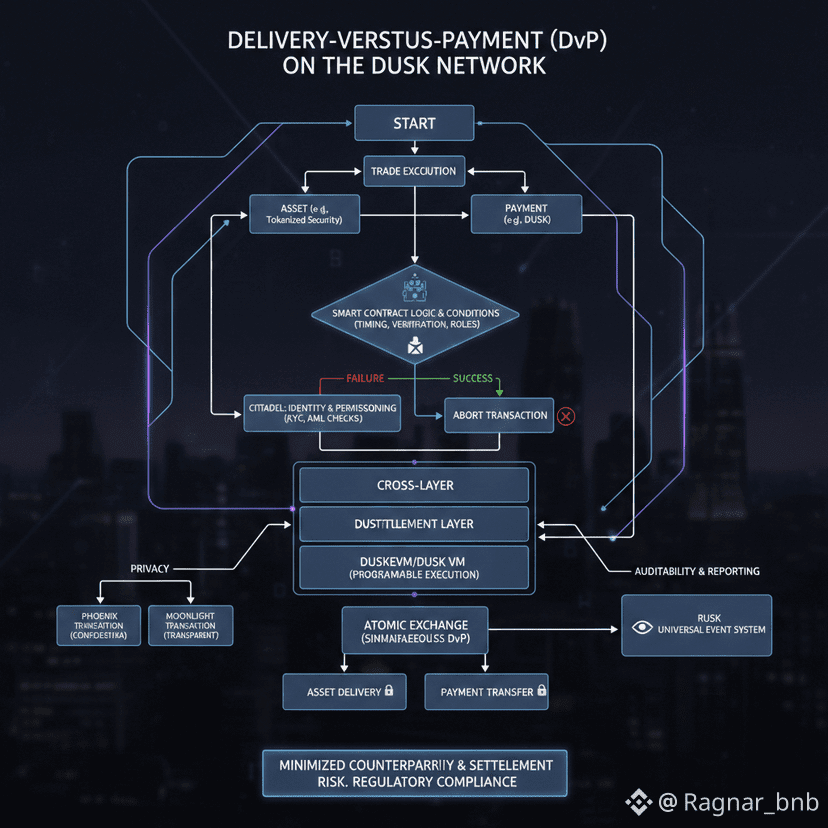

Picture this: DvP on the Dusk Network makes sure that when assets change hands, the payment happens at the exact same moment. It's like a super secure handshake. This handshake is key in the financial world, where everyone needs to know the deal is solid. Dusk puts DvP right into its system, making blockchain settlements play by the same rules as old-school finance.

Think of it as separating the action from the paperwork. Dusk handles the final, unchangeable settlement and makes sure the data's there. Meanwhile, DuskEVM and Dusk VM let you program how the exchange works. This setup means assets and payments only swap when everything checks out. If anything goes wrong, the whole thing stops—no half-finished deals.

Dusk's DvP gets a boost from the network's rock-solid finality. Once a DvP deal is confirmed, consider it done, no take-backs. This is huge for big institutions dealing with stuff like securities. They can't have trades suddenly reversing. This finality means clearing and settlement can run on autopilot without causing chaos.

Here's where it gets really cool: privacy. Dusk lets you do DvP with either Phoenix transactions for secret deals or Moonlight transactions when you need to show your cards. Phoenix hides the details—trade size, who's involved, the price—while still proving everything's legit. Moonlight is for when you have to report to the authorities.

Dusk makes sure everyone plays by the rules, right from the start. Thanks to Citadel, you have to prove you're eligible, with things like KYC and AML checks. This all happens during the deal, stopping any shady trades from going through. It means less reliance on outside checks and balances.

Smart contracts are used to lay out the DvP rules nice and clear. These contracts say exactly how and when assets and payments change hands. You can use them on DuskEVM for regular workflows or on Dusk VM for more customized setups. Either way, the outcome is governed by rules that everyone can see and check.

DvP on Dusk can handle tokenized assets and real-world assets, too. You can trade tokenized stocks, bonds, and other regulated investments for DUSK or other approved tokens. This brings the speed and ease of blockchain to traditional finance, all while staying compliant.

The system is set up with multiple layers that talk to each other. The native bridge makes sure everything lines up so that the DvP transactions are atomic across the network’s modular setup.

For audits and reports, the Rusk Universal Event System tracks every DvP deal. It spits out events that monitoring tools and regulators can use to check things without revealing secret info. It's all about balancing privacy with the need for oversight.

From a risk perspective, DvP on Dusk cuts down on risks between parties and during settlement. Because everything happens at once, you don't have to worry about one side backing out after the other has delivered. This lines up with how things are done in securities settlement, making Dusk a solid choice for exchanges and trading venues.

Basically, Delivery-versus-Payment on the Dusk Network gives you a built-in way to settle deals securely, privately, and in line with the rules. By mixing finality, identity checks, smart contracts, and privacy features, Dusk makes atomic exchanges possible for modern regulated markets. DvP is a key thing for getting big institutions on board and building real financial systems on Dusk Network.