A few months ago, I was putting together a simple yield aggregator for some stablecoin positions. Nothing fancy. Just automating a few swaps based on live rates. The setup was familiar: pull data from oracles, run decisions off-chain, then push execution on-chain. It worked, but it felt clumsy. Data had to be fetched from outside, logic lived elsewhere, and the chain only stepped in at the final moment. Costs added up, not just in gas, but in time. Oracle delays, API hiccups, small pauses that stacked up. Having traded infrastructure tokens for years and jumped between different stacks, it bothered me. Not because transactions were slow—they weren’t—but because the chain itself couldn’t think. The memory and decision layer sat outside, turning something that should feel seamless into a chain of patches.

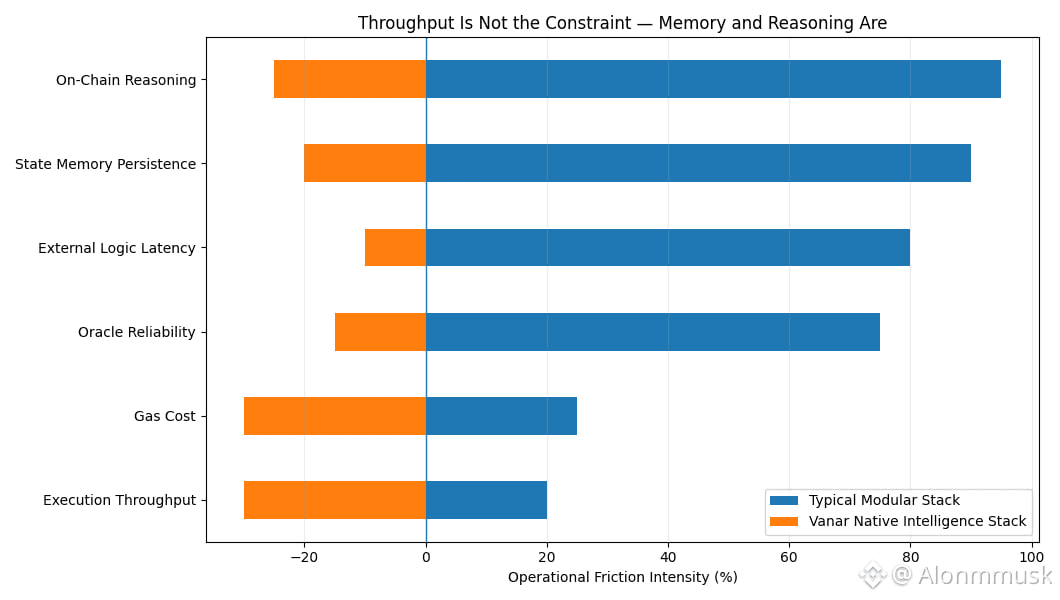

That friction points to a deeper issue in how blockchains are built today. Most of them chase throughput. More TPS. Cheaper fees. Faster blocks. But the real bottleneck often isn’t execution, it’s data handling and reasoning. Anything involving analysis—compliance checks, routing logic, conditional actions—gets pushed off-chain. That introduces fragility. Oracles go down. Data leaks happen. Systems break in ways users never see until something fails. From the outside, apps feel unreliable. Payments hesitate. Automations stall. Assets need manual checks. The chain moves value quickly, but it doesn’t decide well. When that happens, trust erodes quietly, and costs creep up over time.

I think about it like a warehouse. You can have conveyor belts moving boxes at insane speeds. That part works. But if the system can’t remember where inventory sits, or decide the best route without a human stepping in, everything jams during peak hours. Boxes pile up, mistakes multiply, and speed stops mattering. Without built-in memory and logic, blockchains stay transport layers, not operational systems.

That’s why this approach caught my attention. Instead of racing on raw speed, it leans into intelligence. The chain stays EVM-compatible, but layers in native data handling and on-chain reasoning. The goal isn’t to win TPS charts, but to let logic run where the data lives. Data gets compressed into small, verifiable forms—“seeds” that preserve context without hauling full payloads around. Agents can query and act on that data directly, without bouncing through external services. It’s not flashy, but it changes behavior. Developers don’t need half a dozen dependencies just to make decisions. The chain remembers, reasons, and executes in one place. Recent updates reinforce this direction. In December 2025, they hired a payments infrastructure lead from TradFi. On January 19, 2026, the AI integration went live, enabling on-chain reasoning for things like compliance checks or conditional execution.

Architecturally, the system stays narrow by design. The base layer executes contracts with low fees and familiar tooling, but it avoids feature sprawl. Instead, it stacks focused components. Neutron handles semantic memory, compressing things like invoices or records into context-rich seeds that stay cheap to store and easy to verify. That matters because it reduces the gas cost of complex actions that depend on history. Then there’s Kayon, the reasoning engine. It rolled out in beta last quarter, with mainnet planned for Q2 2026. Kayon lets contracts make simple inferences directly on-chain, like approving actions based on compressed data, without calling external APIs. Rather than leaning on rollups or heavy sharding, the bet here is that a smarter core chain matters more for autonomous systems. You can see the intent in partnerships like the Worldpay announcement at Abu Dhabi Finance Week in December 2025, where programmable, self-executing payments were the focus.

The VANRY token fits cleanly into this picture. It pays transaction fees on the base layer, with a burn component to manage supply. Validators stake it to secure the network, earning inflation-based rewards that started near 5% and taper over time. When Neutron or Kayon consume compute, fees are paid in VANRY, tying demand directly to real usage. Governance also runs through it, including recent proposals to expand AI subscriptions starting Q1 2026, where users pay in VANRY for advanced tooling. There’s no yield theater here. It’s just the economic layer that keeps execution and intelligence aligned.

From a market standpoint, circulation sits above 1.9 billion tokens, with daily volumes around 5–6 million tokens, roughly $50k in turnover at current prices. It’s quiet. Not hyped. Since the AI stack went live this month, transaction counts have moved directionally higher in tests, crossing 100k daily, though real adoption is still early.

Short-term trading mostly follows narratives. The Worldpay partnership. The AI rollout. A recent CEO interview about shifting focus from execution to intelligence triggered a brief volume spike. I’ve traded moves like that before—20–30% swings that fade once attention shifts or unlocks approach. Volatility dominates in the short run. Long-term is different. If developers actually adopt Neutron for data-heavy apps or Kayon for agent-driven workflows, demand builds slowly through fees and staking. That kind of value doesn’t show up overnight. It shows up when people stop rebuilding the same logic elsewhere and just rely on the chain.

There are plenty of risks. Competition is heavy. Fetch.ai, general-purpose chains adding AI layers, and larger ecosystems all fight for attention. Regulation is another wildcard, especially around autonomous payments. A scenario that worries me is a failure in Neutron’s compression layer during a high-stakes settlement—corrupted metadata, invalid queries, frozen contracts. One mistake there could ripple outward fast. And it’s still unclear whether traditional finance players move beyond pilots when their existing systems already work.

In the end, this kind of infrastructure doesn’t win through launches. It wins through repetition. Quiet integrations. Second transactions that turn into habits. Whether focusing on memory and autonomy over raw throughput pays off will only be clear over time, as usage either compounds or stalls.

@Vanarchain #Vanar $VANRY