The 24-hour financial news cycle is designed to keep you on edge. Between flashing red banners about geopolitical tension and dire warnings of a global debt collapse, it’s easy to lose sight of your strategy. For most investors, the challenge isn't a lack of information—it’s the inability to filter out the "manufactured fear."

To cut through the noise, we look to the sharp insights of market strategist José Luis Cava. He suggests that while the media obsesses over obvious threats, the real market drivers are often hidden in plain sight.

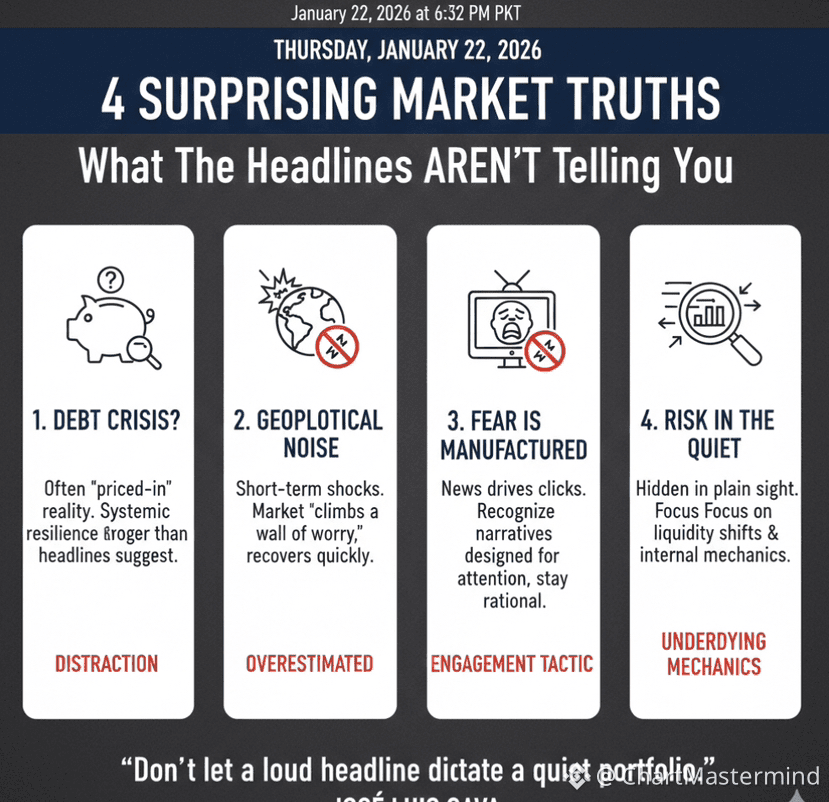

Here are four truths that challenge the current fear-driven narrative:

1. The "Debt Crisis" is Often a Distraction

While headlines scream about ballooning government deficits, the market often treats this as "priced-in" reality. Cava argues that a debt crisis rarely happens when everyone is looking for it; the systemic resilience of the current financial plumbing is sturdier than the doomsday predictions suggest.

2. Geopolitical Noise vs. Market Signal

Wars and tensions dominate the front pages, but their long-term impact on equity markets is frequently overestimated. Historically, the market "climbs a wall of worry," absorbing geopolitical shocks far faster than the news cycle allows for.

3. Fear is a Manufactured Product

Financial media thrives on engagement, and nothing drives clicks like catastrophe. By recognizing that many "imminent threats" are simply narratives designed to capture attention, you can maintain the emotional distance necessary for rational decision-making.

4. Risk Hides Where No One is Looking

The greatest dangers aren't the ones being debated on TV. Cava suggests that true risk lies in liquidity shifts and internal market mechanics—the quiet technical changes that happen behind the scenes while the public is distracted by the latest political drama. The Bottom Line: Don't let a loud headline dictate a quiet portfolio. Success in today’s market requires the discipline to ignore the "fog" and focus on the underlying mechanics of price action.