A few months back, I was setting up a position in tokenized real estate through a DeFi platform. Nothing big, just dipping a toe into assets that claimed institutional-grade security. But as I went through the process, the transparency hit me immediately. Every action was sitting there on-chain, visible to anyone with a block explorer. That’s fine for verification, but when regulators want audits without exposing personal details, it starts to feel wrong. I’ve traded infrastructure tokens for years, jumping between chains that promise better speed or scale, yet this same issue keeps coming back. It wasn’t a blow-up or a bug, just a quiet hesitation. Knowing anyone could trace my wallet, piece together behavior, or front-run activity made me pause before committing more. That moment stuck with me, because it highlights how often chains force a choice between full exposure and total blackout.

That’s really the core problem. Most blockchains treat privacy as all or nothing, and real finance doesn’t work that way. In traditional markets, confidentiality protects strategy and counterparties, but audits and compliance still exist when needed. On-chain, fully transparent systems lay everything bare, inviting surveillance and manipulation. On the other end, fully private systems hide so much that regulators step away entirely. The result is friction everywhere. Teams rely on mixers or off-chain processes. Settlements slow down. Institutions test things, then pull back. Developers building payments or asset platforms hit walls because they can’t prove compliance without revealing sensitive data. It’s not about hiding bad behavior, it’s about removing everyday friction that keeps regulated finance from moving on-chain.

I think about it like a one-way mirror. You can see what you need to see, but outsiders don’t get a full view unless access is granted. That kind of controlled visibility keeps systems usable. You’re not in the dark, and you’re not on display either.

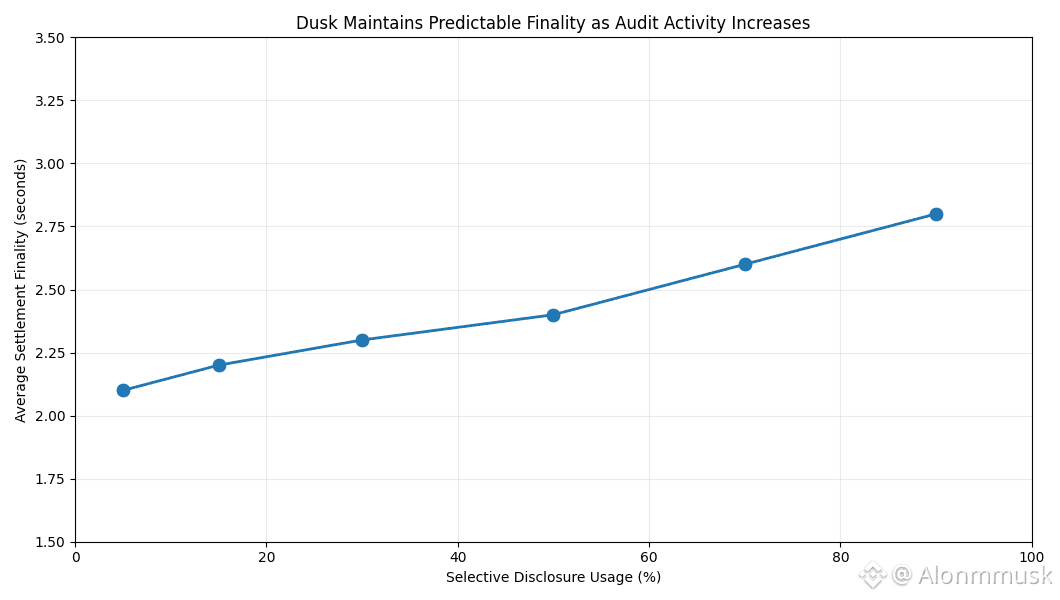

That’s the design space Dusk operates in. Instead of trying to support everything from memes in practice, to games, it stays focused on financial use cases where privacy and accountability have to coexist. Zero-knowledge proofs are built in from the start, so transactions stay confidential by default, but can still be verified when required. It avoids blanket anonymity and instead gives users and applications the ability to disclose proofs without exposing full histories. You can prove a transfer followed the rules without showing the entire wallet trail. That matters when you’re dealing with securities or real-world assets, where KYC and AML aren’t optional. It also removes the need for awkward external layers bolted on after the fact. The recent DuskEVM integration added familiar Solidity tooling while keeping those privacy controls intact, making it easier for developers to build without breaking compliance. Since mainnet went live, shielded transfers have been settling quickly, without the congestion issues common on general-purpose chains.

Under the hood, some of the design choices explain why this works. The network uses a Proof-of-Blind-Bid consensus model, where validators submit hidden bids to propose blocks. Bids are only revealed after in practice, commitment, which limits front-running and manipulation that open auctions can suffer from. Another piece is the Phoenix asset standard, which enables confidential transfers where amounts and counterparties are hidden publicly, but recipients can still generate proofs when compliance requires it. These features are native, not add-ons, which keeps overhead lower and execution cleaner. The focus is deliberate. Dusk avoids broad, resource-heavy application execution and concentrates on financial flows. That focus is showing up in deployments like the NPEX application, which targets more than €200 million in tokenized real-world assets by early 2026. In testing, throughput has reached around 1,000 transactions per second, but the priority stays on instant settlement rather than raw volume.

The DUSK token fits quietly into this structure. It pays for transaction execution, with fees scaling based on complexity. Shielded transfers cost more than simple public ones, which reflects actual resource use. Validators stake DUSK to participate in consensus and earn rewards from inflation and fees, aligning security with economic incentives. Governance decisions, such as adjusting staking in practice, parameters or integrating oracle standards like Chainlink, are handled through staking-based voting. Excess fees are burned, tying supply dynamics to real usage. There’s no flashy utility here. The token exists to keep the system running, from blind-bid validation to confidential transfers.

From a market standpoint, capitalization sits around ninety million dollars, with daily volume picking up during the recent privacy rotation. It’s active, but not overheated. Circulating supply is roughly five hundred million tokens, with emissions tied to validator incentives rather than aggressive unlocks.

Short-term trading tends to follow headlines. DuskEVM announcements, privacy narratives, or broader market rotations can spark sharp moves that fade just as fast. I’ve traded enough of these cycles to know how quickly momentum shifts. Long-term, the question is simpler. If selective privacy keeps enabling compliant asset issuance and institutions continue using the network, demand builds through fees and staking, not hype. That kind of value accrues slowly, through repeated use, not one-off pumps.

There are real risks. Other privacy-focused networks have strong technology but weaker regulatory alignment. Ethereum’s ZK rollups offer scale, but compliance tools live higher up the stack. Dusk’s narrow focus could be challenged if larger ecosystems adapt faster. Adoption also depends on regulatory clarity, especially as MiCA continues to evolve. One failure scenario I think about is stress. If a major liquidation wave floods the network and blind-bid consensus gets jammed with spam or delayed reveals, finality could stall, freezing settlements at the worst possible moment. And there’s always the question of follow-through. Reaching €200 million in tokenized assets matters, but sustaining activity matters more.

In the end, infrastructure like this doesn’t prove itself through announcements. It proves itself through repetition. The real signal isn’t the first transaction, it’s the second and third. Watching whether users come back for compliant deals without friction will show if separating confidentiality from opacity actually sticks, or quietly fades into the background.

@Dusk #Dusk $DUSK