A few months back, I was setting up a cross-border transfer tied to a small investment position. Nothing large, just moving funds connected to tokenized assets between accounts. I’ve been trading these kinds of instruments for years and usually appreciate how fast blockchain settlement can be. This time, though, the privacy layer felt unfinished. Transaction details were visible enough that anyone watching the chain could start connecting dots, yet for compliance I still had to share information manually with a third party afterward. Nothing broke, but the process dragged. Extra steps, more exposure than I wanted, and that familiar uncertainty about whether the data was truly private or just hidden enough to get by. It was a reminder that even mature-looking infrastructure still stumbles where finance actually cares most.

That friction isn’t unique. Many blockchains try to sit in the middle between privacy and real-world oversight and end up satisfying neither side fully. Users want to shield sensitive details like amounts and counterparties without turning everything into a black box that regulators won’t touch. But most networks lean too far one way. Full anonymity scares institutions. Radical transparency leaves users exposed and privacy bolted on as an afterthought. The result is overhead everywhere. Layered solutions add cost. Audits slow things down. And using the system starts to feel like navigating process instead of moving value. For financial applications, where compliance isn’t optional, that imbalance keeps adoption slow. Developers hesitate. Institutions fall back to off-chain rails that may be clunky, but at least predictable.

I tend to think of it like a glass-walled conference room. You can see enough to know everything’s above board, but the conversation inside stays private unless someone deliberately opens the door. Without that balance, either everything is exposed and trust erodes, or everything is sealed off and accountability disappears.

That’s where Dusk positions itself. It treats privacy and oversight as design constraints, not features to tack on later. The chain is built specifically for financial markets where confidentiality matters, but audits are unavoidable. Instead of trying to host every type of application, it keeps its scope narrow, focusing on things like tokenized securities and payments. By avoiding non-financial activity, it reduces congestion and keeps settlement behavior predictable. That trade-off matters in practice. In finance, reliability beats versatility every time. The January 7, 2026 mainnet activation marked a real shift from experimentation to live infrastructure, introducing features like liquid staking that support participation without forcing long lockups. Around the same time, DuskEVM arrived, giving developers familiar Solidity tooling while enforcing privacy constraints at the execution layer, which has started attracting real-world asset-focused applications.

Under the hood, some of the choices explain the trade-offs clearly. The consensus model separates block proposal from validation, using a blind-bid mechanism where validators hide their stake amounts when competing to produce blocks. That reduces front-running and makes the process harder to game. In practice, block times have averaged around fifteen seconds, with throughput near one hundred transactions per second in recent post-mainnet testing as usage ramps up. Privacy comes from the Rusk VM upgrade rolled out in November 2025, which enables confidential smart contracts through zero-knowledge proofs. Transactions can prove compliance, such as meeting KYC requirements, without exposing the underlying data. The cost is heavier computation, which is why the design stays focused on financial primitives rather than open-ended execution.

The DUSK token stays deliberately simple. It’s used for transaction fees, with a portion burned to keep supply aligned with real activity. Validators stake DUSK to secure the network and earn rewards funded by fees and an inflation schedule that began around ten percent after mainnet and tapers over time. Finality depends on that stake, with slashing in place to discourage bad behavior. Governance runs through on-chain voting, where staked DUSK determines influence on upgrades. One recent example was the vote around the Chainlink integration announced in November 2025, aimed at enabling cross-chain real-world asset interoperability without weakening privacy guarantees. There’s no extra narrative here. The token exists to keep the system functioning.

From a market perspective, circulating supply sits near five hundred million tokens, with capitalization hovering around thirty million dollars amid post-mainnet volatility. Daily volumes in the five to ten million range suggest interest without excess, helped in part by listings like the HTX perpetuals launch on January 19.

Short-term trading has followed familiar patterns. Privacy narratives and RWA headlines drove sharp moves in early January 2026, including a roughly two-hundred percent run tied to mainnet excitement and partnership announcements. I’ve traded enough of these cycles to know how quickly that attention fades. Long-term, the question is quieter. If Dusk’s focus on compliant privacy leads to consistent institutional use, demand builds through fees and staking rather than hype. The upcoming NPEX deployment targeting more than three hundred million euros in tokenized assets will be a real test. Participation has already climbed, with staking now around forty percent of supply, which strengthens security but still leaves the ecosystem early.

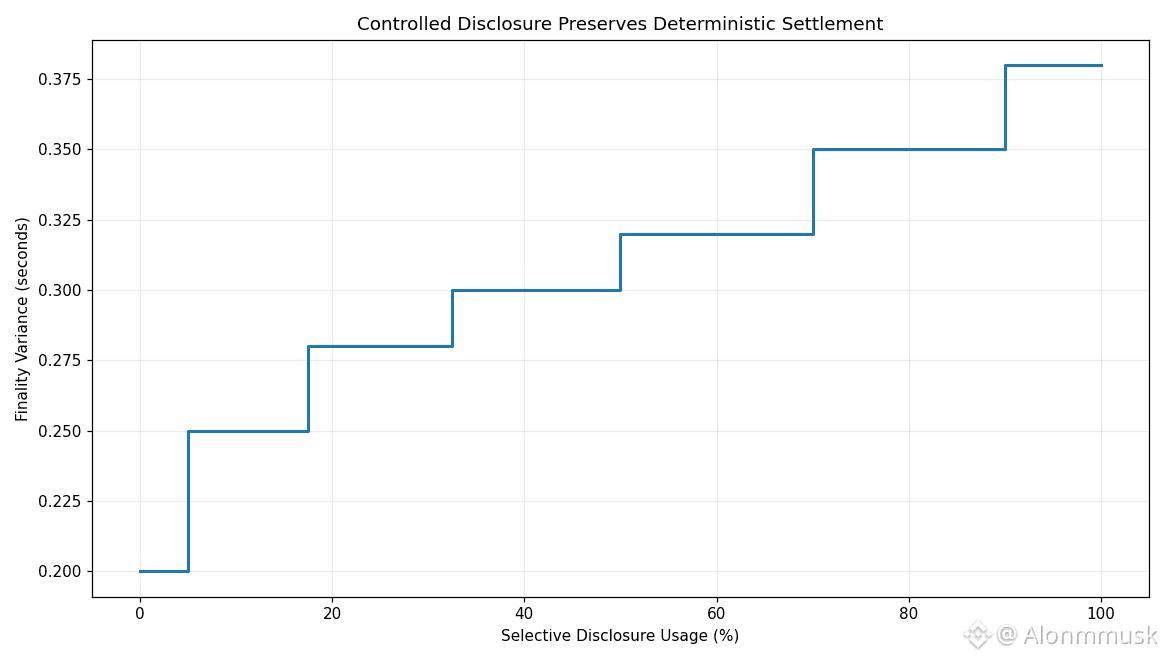

Risks remain. Privacy-first chains without compliance hooks may attract different builders. General-purpose platforms offer scale without the trade-offs Dusk enforces. Regulatory alignment in Europe is still evolving, and the MTF licensing effort could face delays if frameworks tighten. A serious failure scenario is also worth acknowledging. If selective disclosure breaks under pressure during a major real-world asset settlement, confidence could disappear quickly, especially among regulated users. Developer traction is another open question. With only a small number of live applications so far, it’s unclear whether enough teams will accept the constraints in exchange for audit-ready privacy.

In the end, infrastructure like this proves itself slowly. Not through launches or headlines, but through repetition. If users come back because the system behaves the same way every time, the trade-offs start to make sense. Whether Dusk’s narrow focus becomes an advantage or a limitation will show up over cycles, one settlement at a time.

@Dusk #Dusk $DUSK