After analyzing where crypto infrastructure money is quietly moving in 2025. I realized Walrus is positioned around a problem most traders still underestimate is how data actually moves once blockchains grow up. When I look back at past cycles the biggest winners were rarely the loudest projects. They were the ones that aligned early with how the model was evolving under the surface. My research into Walrus followed that same pattern. At first glance it looks like another decentralized storage protocol, but the deeper I went the more it became clear that Walrus is not competing on storage size but on data behavior. Most blockchains were designed for transactions not for the constant read write demands of modern applications. Games, AI agents, DeFi dashboards and social dApps don't just store data once. They interact with it constantly. In my assessment this is where Walrus starts to separate itself from older models that were built mainly for permanence rather than performance.

The real data problem blockchains are running into

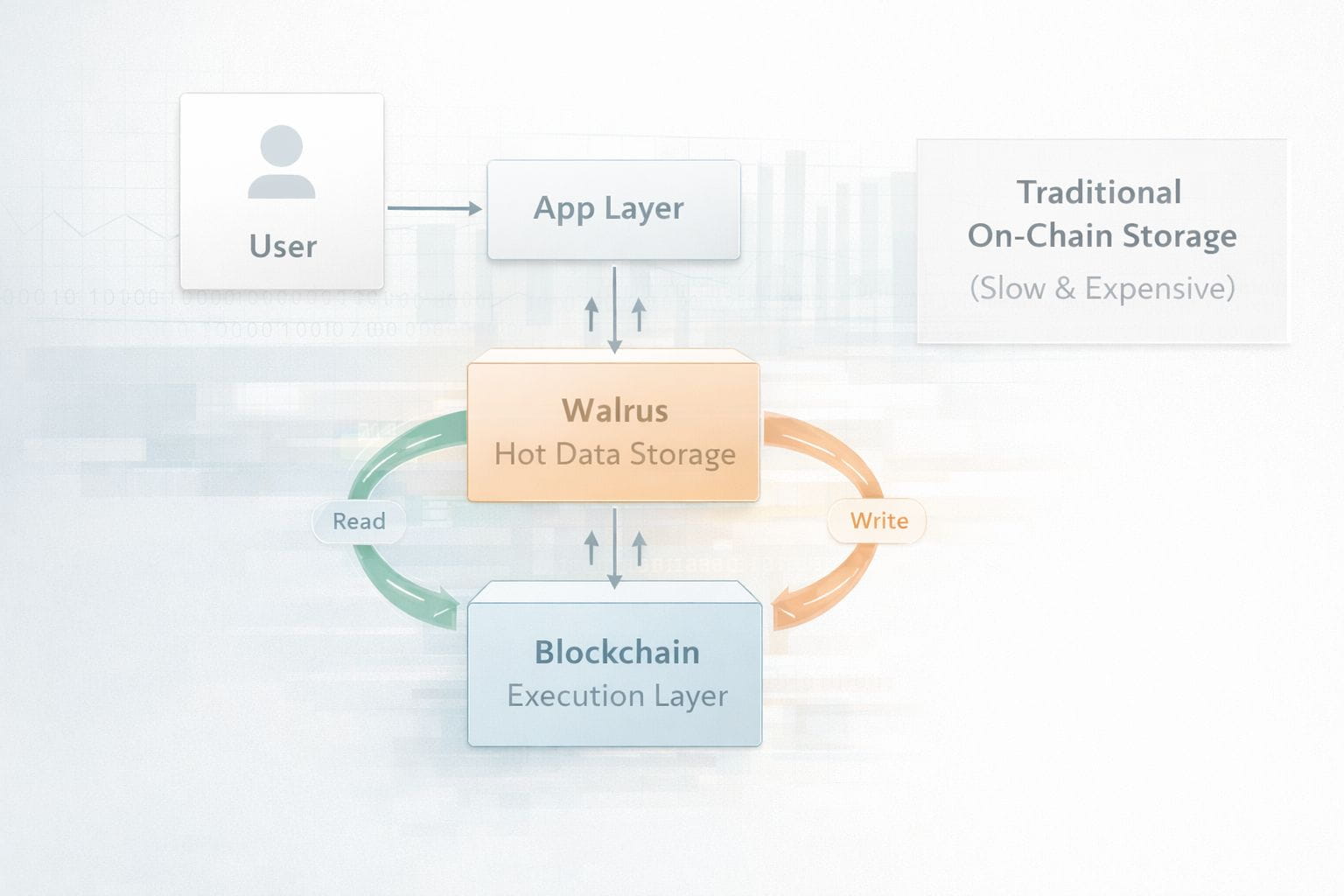

One data point that stood out during my analysis comes from Electric Capitals 2024 developer report which showed that application layer activity continues to grow faster than base layer innovation. More apps mean more off-chain and semi on-chain data. Yet most chains still treat data as an afterthought. Walrus is designed specifically to handle large blobs of frequently accessed data without forcing everything into expensive on-chain storage. Sui's architecture plays a big role here. Public Sui documentation and performance tests frequently reference transaction finality under one second and parallel execution at scale. That matters because storage systems plugged into slow chains inherit those bottlenecks. Walrus benefits from Sui's object based model which allows data objects to be accessed and updated without global contention. I often explain this to non technical friends like this is instead of one checkout line for the whole store everyone gets their own lane.

Another important data point comes from AWS itself. According to Amazons public cloud pricing storage costs scale predictably but data retrieval and transfer fees add up quickly for active applications. Decentralized storage protocols historically struggled here. Filecoins own dashboards show that while the network stores hundreds of petabytes much of that data is cold storage. Walrus is targeting the opposite end of the spectrum is hot frequently accessed data that apps rely on every second. Privacy is also not optional anymore. Chainalysis 2024 crypto crime report highlighted how metadata exposure can reveal user behavior even when transactions are encrypted. Walrus integrates privacy aware data handling aligned with Sui's design, which allows selective access instead of full transparency by default. That is a subtle shift but one institutions care deeply about.

How Walrus compares when you stop looking at marketing charts?

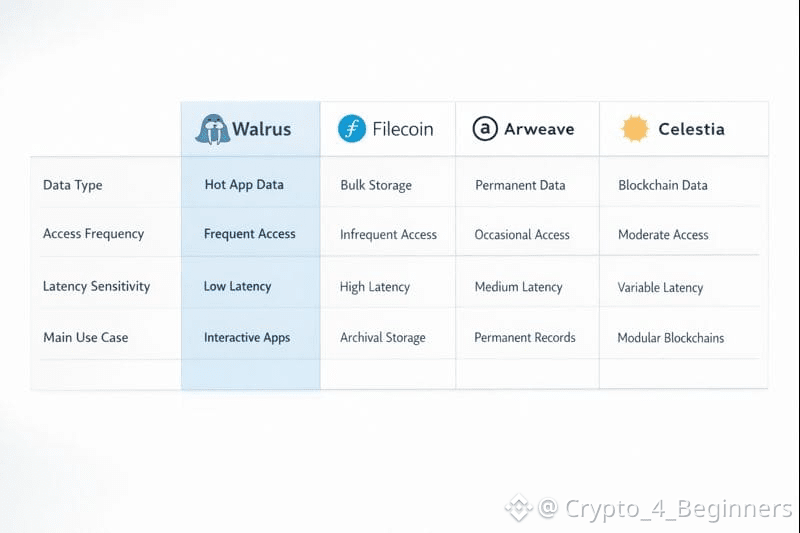

In my assessment the fairest way to evaluate Walrus is not to compare it headline to headline with Filecoin or Arweave but to compare use cases. Arweave's public metrics show over 200 terabytes of permanently stored data which is impressive but permanence is its core value. Filecoin according to Protocol Labs updates excels at decentralized archival storage and retrieval markets. Walrus sits in a different lane. It competes more directly with modular data availability solutions like Celestia and EigenDA. Celestias mainnet numbers show more people are using blobs thanks to rollups. Still Celestia is not really about letting apps interact with data. It's about publishing data so others can verify it. Walrus on the other hand, is built for apps that need to read, update and work with data all the time.

If I were putting this into a visual. I would set up one table comparing Walrus, Filecoin, Arweave and Celestia. I would look at things like what kind of data they handle how often people need to access that data how sensitive they are to delays and who actually uses them. I would make another table that takes common app types on-chain games, AI agents, DeFi dashboards and matches them to the kind of data they need. That way you can see which protocol is the best fit for each use case. Here is another chart idea is a flow diagram that shows how data travels from a user to an application then into Walrus. Then right next to it show what happens when you push that same data through old school on-chain storage. The difference is pretty clear. Seeing that side by side would make the efficiency gap obvious even to non technical readers. No serious analysis is complete without addressing challenges. Walrus is still early and early infrastructure projects face adoption challenge above all else. If developers don't build on it the technology alone won't matter. My research into past infrastructure tokens shows that timing is critical. Being too early can look exactly like being wrong. Competition is another factor. Modular data availability is one of the hottest trends in crypto right now, with projects like Celestia gaining strong mindshare. According to Messari's modular blockchain reports, capital and developer attention are flowing fast into this category. Walrus must clearly communicate why application level data needs are different from rollup data availability. There is also token related uncertainty. Without sustained usage staking and governance incentives can lose appeal. Honestly I have watched this whole story play out before and it never ends well for people who just sit back and hope for the best without paying attention to the basics. WAL's real value down the line comes from people actually needing storage and accessing data not just hype or wild stories. Here is how I would play WAL ~ not just chasing hype but actually digging into the structure. I'm treating this as a thesis trade not some fast in and out. When I look at other infrastructure tokens in their early days, they usually hang around in these long boring accumulation zones before anyone really catches on. If WAL drops down into a clear support area and the markets quiet. That's when I would start building a position. No rush. Let it breathe. Here is how I would approach it is First, I would mark out the main accumulation zone and set a higher level for confirmation. If the price pushes above that mid range resistance and I see on-chain activity picking up that tells me the markets waking up to adoption but if the price drops through long term support and there is no bad news about the networks. That is my cue to step back. One chart I would describe here would show WAL's price structure over time with marked accumulation zones, resistance levels and volume expansion phases. Another would overlay on-chain metrics such as storage usage growth against price action to highlight divergence or confirmation.

My Closing thoughts after stepping back

After stepping back from the charts and reading through developer discussions again, my conclusion hasn’t changed. Walrus is not trying to be everything to everyone. It’s targeting a specific, growing problem that becomes more obvious as blockchains mature. That focus alone gives it a chance to matter. In my assessment, the market is still early in understanding how valuable data infrastructure will become. Traders who only chase narratives may miss that shift. Those who pay attention to how applications actually work might see Walrus differently.