Plasma’s commitment to full EVM compatibility is not a cosmetic design choice but a strategic pillar that shapes how the network positions itself in a crowded, multi-chain world. New Layer 1 blockchains often face a painful paradox: they promise superior performance and novel features, yet those same differences raise barriers for developers who are already deeply invested in existing ecosystems. The result is frequently a technically impressive but underused “ghost chain.” Plasma addresses this problem at its root by aligning itself completely with Ethereum’s execution standard, allowing it to focus on specialization without sacrificing adoption.

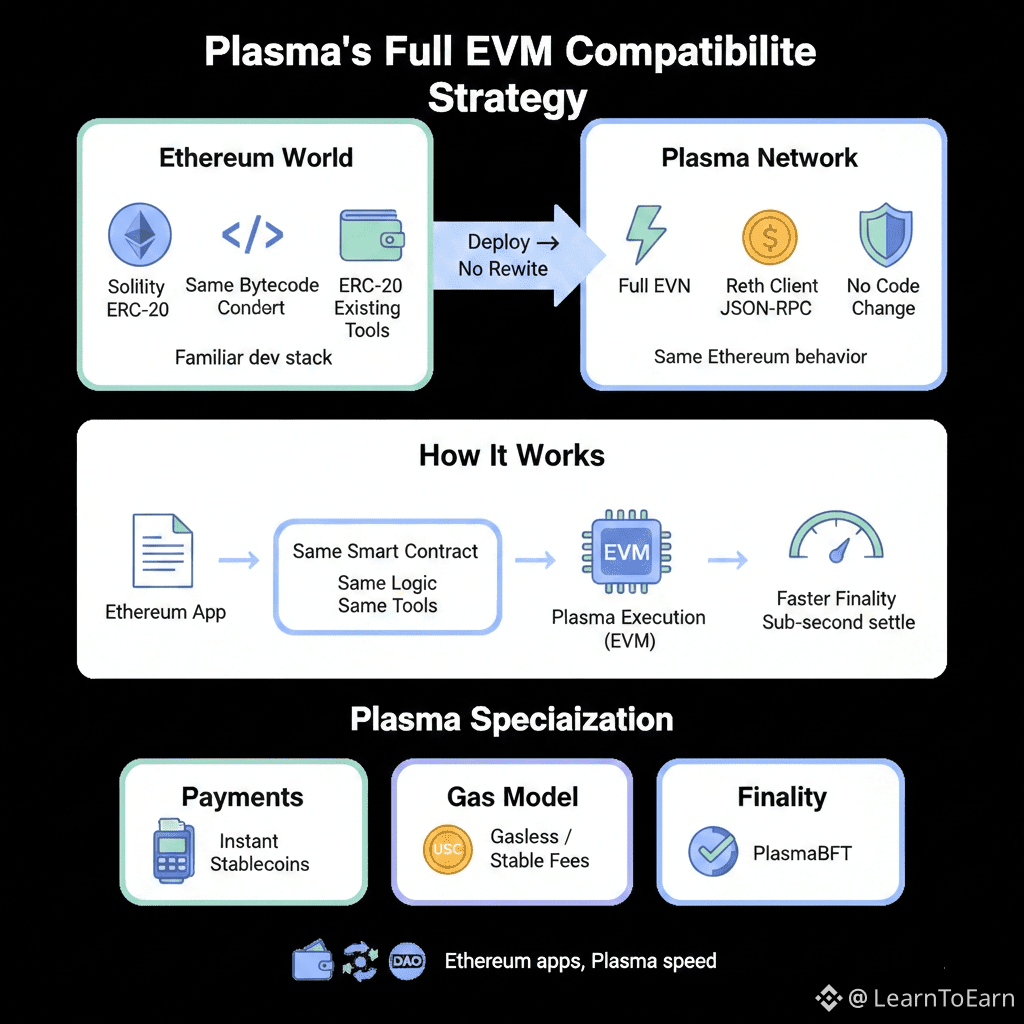

Full EVM compatibility on Plasma is defined with strict technical precision. Smart contracts compiled for Ethereum produce the same bytecode when deployed on Plasma, execute with identical opcode behavior and gas semantics, and interact with an identical state structure. This fidelity is achieved by building the execution layer on Reth, a modular and high-performance Ethereum client written in Rust. Plasma nodes expose the same JSON-RPC interfaces as standard Ethereum clients, meaning wallets, developer frameworks, indexers, and monitoring tools can connect without modification. From the perspective of a Solidity contract, there is no detectable difference between running on Ethereum mainnet and running on Plasma.

This technical mirror has major strategic consequences. By removing the learning curve entirely, Plasma gains instant access to Ethereum’s vast developer base. Teams do not need to learn new languages, adapt to unfamiliar tooling, or redesign deployment pipelines. Existing, audited codebases can be redeployed quickly, allowing developers to focus on leveraging Plasma’s performance advantages rather than re-engineering their applications. In an environment where developer attention is scarce, this reduction in friction becomes a powerful growth engine.

Compatibility also enables Plasma to inherit liquidity and composability from day one. Native support for ERC-20 standards means stablecoins such as USDT, USDC, and DAI integrate seamlessly. Well-tested libraries from OpenZeppelin, decentralized exchange logic from Uniswap, and oracle interfaces from Chainlink all function as expected. New protocols on Plasma can be built from these mature components, achieving a level of robustness and sophistication that would otherwise take years to develop.

Just as importantly, Plasma launches with a complete infrastructure stack already in place. Wallets, development frameworks, indexing services, analytics platforms, and RPC providers can support the network immediately because they already speak Ethereum’s language. This eliminates the early-stage tooling gap that often slows adoption on new chains and allows developers to concentrate on product design and user experience rather than infrastructure workarounds.

Plasma’s differentiation emerges from how this familiar execution environment is embedded within a specialized system. While contract execution follows Ethereum’s rules, transaction ordering and finality are handled by PlasmaBFT, a Byzantine Fault Tolerant consensus mechanism that delivers deterministic, sub-second finality. For developers, function calls behave the same way, but their results settle faster than traditional payment networks, enabling real-world point-of-sale and high-frequency settlement use cases. On the economic side, Plasma introduces a stablecoin-first model with gas abstraction and protocol-managed paymasters, enabling gasless transactions or fee payments directly in stablecoins without requiring any changes to existing contracts. Security is further reinforced by anchoring Plasma’s state to Bitcoin, providing an additional layer of neutrality and censorship resistance while remaining invisible to application logic.

Compared to other high-performance blockchains, Plasma occupies a distinctive middle ground. It offers the ease of onboarding associated with Ethereum Layer 2 solutions while retaining the sovereignty and specialization of a dedicated Layer 1. Unlike networks that introduce entirely new virtual machines and languages, Plasma avoids fragmenting developer effort. Unlike rollups, it is not constrained by external finality timelines. This balance allows Plasma to combine ecosystem maturity with performance tuned specifically for stablecoin settlement.

These design choices unlock practical applications that are difficult or impossible elsewhere. Payment processors can offer instant, gasless stablecoin payments with immediate settlement. High-frequency decentralized exchanges can deploy proven AMM designs with lower latency and stronger finality. DAOs can run payroll and treasury operations using familiar multi-sig contracts while benefiting from instant global settlement and predictable costs.

There are, of course, trade-offs. By embracing the EVM, Plasma inherits its limitations, including single-threaded execution and well-known smart contract attack vectors. The burden of security assurance shifts toward Plasma’s consensus, economic abstractions, and cross-chain components. There is also an ongoing tension between extending the system for payment-specific optimizations and preserving strict compatibility. Plasma’s long-term success depends on maintaining this balance without eroding the very frictionless experience it promises.

Ultimately, Plasma’s full EVM compatibility reflects a pragmatic philosophy. Instead of forcing developers to abandon familiar tools in exchange for performance, it removes the choice entirely. Builders can bring their skills, code, and communities onto a network that is optimized for stablecoins yet deeply integrated with Ethereum’s ecosystem. By eliminating friction at the execution layer and innovating everywhere else, Plasma positions itself not as an experimental alternative, but as a practical and adoptable settlement layer capable of supporting stablecoins as true digital cash in the global economy.

The story of blockchain adoption is often told through breakthroughs in consensus algorithms, throughput metrics, or cryptographic innovation, yet the decisive factor in whether a network thrives usually lies elsewhere. It lies in the invisible layers that connect new technology to the habits, tools, and workflows developers already trust. Plasma’s decision to embrace full Ethereum Virtual Machine compatibility reflects a clear understanding of this reality. By ensuring that the entire Ethereum toolchain works out of the box, Plasma removes the friction that so often slows promising networks and positions itself as a production-ready stablecoin settlement layer from the very first day.

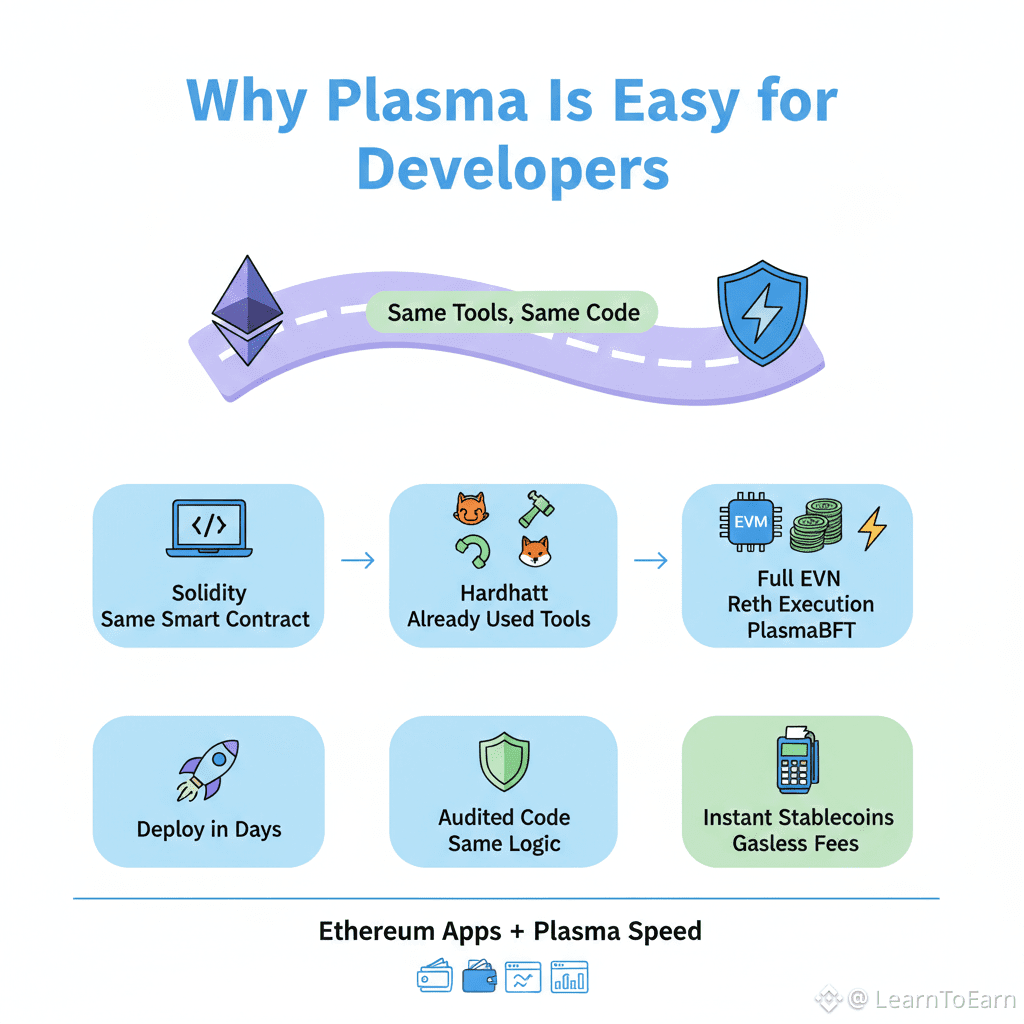

True compatibility requires more than surface-level similarity, and Plasma’s approach is grounded in strict protocol-level parity. Its execution layer, built on Reth, faithfully replicates Ethereum’s behavior at the bytecode level. Contracts compiled for Ethereum produce the same machine code when deployed on Plasma, and every opcode executes with identical logic and gas semantics. This guarantees that business logic behaves exactly as intended, whether it is a simple token transfer or a complex DeFi transaction. On top of this, Plasma implements the full Ethereum JSON-RPC specification without alteration, allowing wallets, frameworks, and infrastructure services to communicate with Plasma nodes as if they were interacting with a standard Ethereum client. Standard chain identification conventions complete this picture, making Plasma instantly recognizable to existing wallets and tools through a familiar network configuration process.

For developers, this technical foundation translates into an uninterrupted workflow. Local development feels identical to Ethereum, using the same Solidity syntax, OpenZeppelin libraries, and testing frameworks. Hardhat, Foundry, and familiar local nodes power compilation and testing without requiring Plasma-specific SDKs or abstractions. When it comes time to deploy, existing scripts and configuration files are simply pointed at a Plasma RPC endpoint, and contracts are deployed and verified using the same processes developers already know. Frontend integration follows the same pattern, with web3 and ethers-based applications connecting by switching an RPC provider and users interacting through their existing wallets. Even advanced monitoring, debugging, and analytics workflows remain unchanged, as tools like Tenderly, The Graph, and Dune can ingest and analyze Plasma data using the same assumptions they apply to Ethereum.

This seamless experience is not just a matter of convenience. It has strategic implications that directly affect Plasma’s ability to grow. Development teams can migrate or redeploy audited Ethereum applications in days rather than months, dramatically reducing time to market. Familiar tooling and well-understood patterns lower security risk, allowing audits to focus on Plasma-specific components instead of re-evaluating core contract logic. By requiring no new languages or tooling, Plasma opens its doors to the largest developer talent pool in Web3, enabling immediate productivity rather than prolonged onboarding. Tooling compatibility also extends to capital and liquidity, as asset issuers, bridges, and institutional service providers already standardized around EVM integrations can support Plasma with minimal operational effort.

In the end, Plasma’s tooling strategy creates an advantage that is easy to overlook but difficult to replicate. In a multi-chain world where developer attention is scarce, familiarity becomes a powerful accelerant. Plasma does not ask builders to abandon proven workflows or experiment with immature ecosystems. It meets them where they already are, inside their existing projects and toolchains, and offers a network that combines that familiarity with sub-second finality, stablecoin-first design, and robust security anchoring. By eliminating friction at the tooling level, Plasma ensures that innovation can move as fast as its infrastructure allows, turning technical potential into real-world applications without delay.

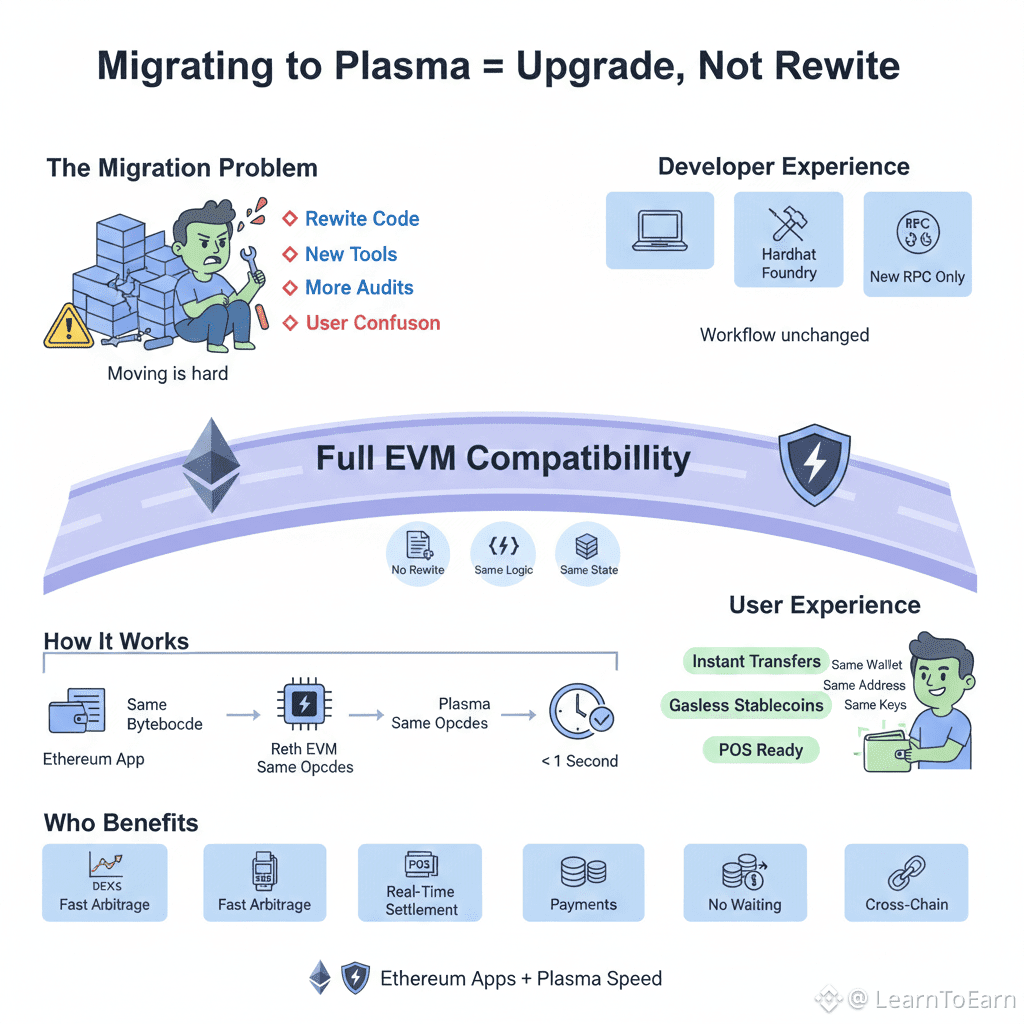

In the fast-moving world of blockchain, teams are constantly tempted by new networks that promise faster execution, lower fees, or purpose-built features. Yet this promise collides with a stubborn reality: migrating an existing decentralized application is usually expensive, risky, and disruptive. Code must be rewritten, assumptions revisited, audits repeated, and users re-educated. These switching costs create a migration paradox in which developers recognize better infrastructure but remain anchored to older systems because moving is simply too costly. Plasma was designed to break this paradox. As a high-performance stablecoin settlement layer, it approaches migration not as a painful rebuild, but as a rational upgrade made possible through full, bytecode-level Ethereum Virtual Machine compatibility.

Seamless migration only works if it preserves what already functions while improving what does not, and Plasma addresses this across three tightly connected layers: contract logic, developer tooling, and user experience. At the deepest level, Plasma’s execution environment is a faithful replica of Ethereum’s EVM, built on a Reth-based architecture. Smart contracts compiled for Ethereum produce the same bytecode when deployed on Plasma, and every opcode behaves identically. This means there is no recompilation, no wrapper logic, and no translation layer. A contract that works on Ethereum works on Plasma in exactly the same way. Just as importantly, storage layouts are preserved. Upgradeable proxies, complex mappings, and carefully arranged state variables retain their slot positions because Plasma uses the same storage derivation rules as Ethereum. Existing contract state can be migrated or snapshotted without corruption, allowing live applications to move without breaking internal logic or user balances.

This binary-level compatibility extends to all standard precompiles and execution patterns. Cryptographic operations, delegate calls, and deeply nested DeFi logic execute with the same mathematical certainty they have on Ethereum. As a result, the security assumptions embedded in audited codebases remain valid. Migration does not expand the attack surface inside the contract itself; it simply changes where that contract is executed.

Above the contract layer sits the tooling and infrastructure that developers rely on every day, and here Plasma reduces migration to a matter of configuration rather than redevelopment. The same development commands, the same testing frameworks, and the same deployment scripts continue to work. The only changes are practical ones: pointing to a new RPC endpoint, specifying a different chain ID, and using a different block explorer URL. Wallets connect using the standard “add network” flow, indexers redeploy by targeting a new endpoint, oracles feed data through familiar interfaces, and analytics platforms parse Plasma blocks using the same schemas they already apply to Ethereum. From a developer’s perspective, the workflow is uninterrupted. Tests pass, scripts run, and infrastructure behaves exactly as expected.

For users, the migration experience is designed to be nearly invisible. They continue to interact with dApps using the same wallet, the same private keys, and the same addresses. There is no new key management burden and no unfamiliar signing process. At the same time, users immediately benefit from Plasma’s native advantages. Transactions finalize in under a second, interfaces feel instant, and stablecoin transfers can be gasless thanks to Plasma’s protocol-level paymaster system. The application code does not change, yet the user experience improves dramatically. Assets can be bridged from Ethereum to Plasma through secure bridges, preserving continuity while unlocking higher performance.

This technical ease translates directly into strategic and economic value. Different categories of applications gain distinct advantages from migration. Stablecoin-focused exchanges benefit from faster arbitrage and tighter pricing due to sub-second finality. Payment and commerce applications become viable for point-of-sale use, something Ethereum cannot realistically support. Lending protocols gain more reliable liquidations, treasury operations settle instantly across borders, and cross-chain applications reduce confirmation delays that frustrate users. What was once constrained by Ethereum’s probabilistic finality becomes responsive enough for real-time financial use.

The performance dividend is not incremental; it is transformative. Finality moves from minutes to moments, and the mental model for users shifts from waiting for confirmations to experiencing immediate settlement. This opens entirely new markets, from everyday retail payments to institutional workflows that demand predictable costs and deterministic outcomes. For teams operating in regions with unstable local currencies, Plasma offers a fast, dollar-denominated rail that Ethereum cannot deliver at scale.

In practice, migrating a mature application such as a decentralized exchange can be accomplished in a matter of days. Teams begin by reviewing their codebase for hardcoded assumptions and setting up Plasma endpoints. Existing deployment scripts are run against a testnet, contracts are verified on an Etherscan-style explorer, and frontends are updated to point to new addresses. Liquidity strategies are planned, monitoring tools are configured, and the application is launched in stages. The bulk of the work is operational rather than architectural, allowing teams to focus on strategy instead of refactoring.

This does not mean migration is entirely without challenges. Liquidity must be bootstrapped, communities must be convinced, oracle coverage must be ensured, and teams must learn how to fully exploit Plasma’s unique features. Yet these are manageable challenges, not structural barriers. They can be addressed through incentives, clear communication, phased rollouts, and targeted education, rather than fundamental rewrites of core systems.

At an ecosystem level, Plasma’s migration-friendly design creates powerful network effects. As more applications move, composability increases, innovation accelerates, and users enjoy a consistent interface with dramatically better performance. Developers spend less time rebuilding what already exists and more time creating what comes next.

Ultimately, Plasma reframes migration as an upgrade rather than a forklift operation. It allows teams to extend their Ethereum-based applications into a specialized execution environment optimized for speed, finality, and stablecoin use, without abandoning the ecosystem that made those applications successful in the first place. Plasma does not position itself as a rival seeking to replace Ethereum, but as a complementary layer where Ethereum’s most valuable applications can operate at the pace modern finance demands. By turning the porting paradox into a clear and low-friction pathway, Plasma invites entire sectors of the decentralized economy to step onto a faster lane, carrying their proven code, their users, and their trust with them.