As blockchain technology matures, the question of privacy and compliance in financial markets has moved from theoretical to urgent. Institutions, regulators, and developers alike face the challenge of adopting decentralized systems without exposing sensitive data or violating regulatory standards. Dusk, the Layer-1 blockchain founded in 2018, emerges as a solution, providing a platform where financial innovation meets confidentiality, auditability, and regulatory compliance. Unlike traditional public chains, Dusk is purpose-built to support institutional workflows, tokenized assets, and regulated decentralized finance, creating a bridge between the digital and traditional financial worlds.

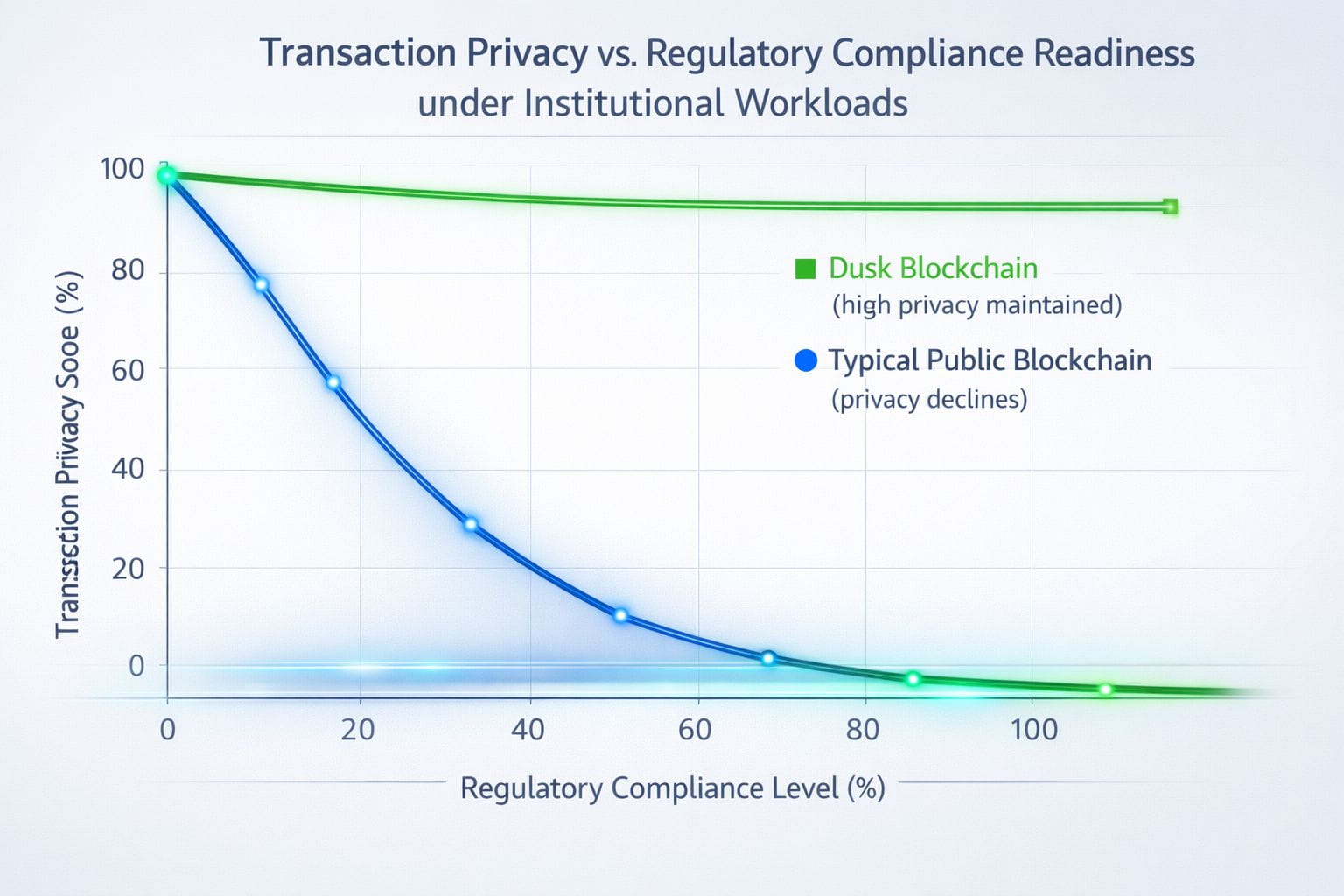

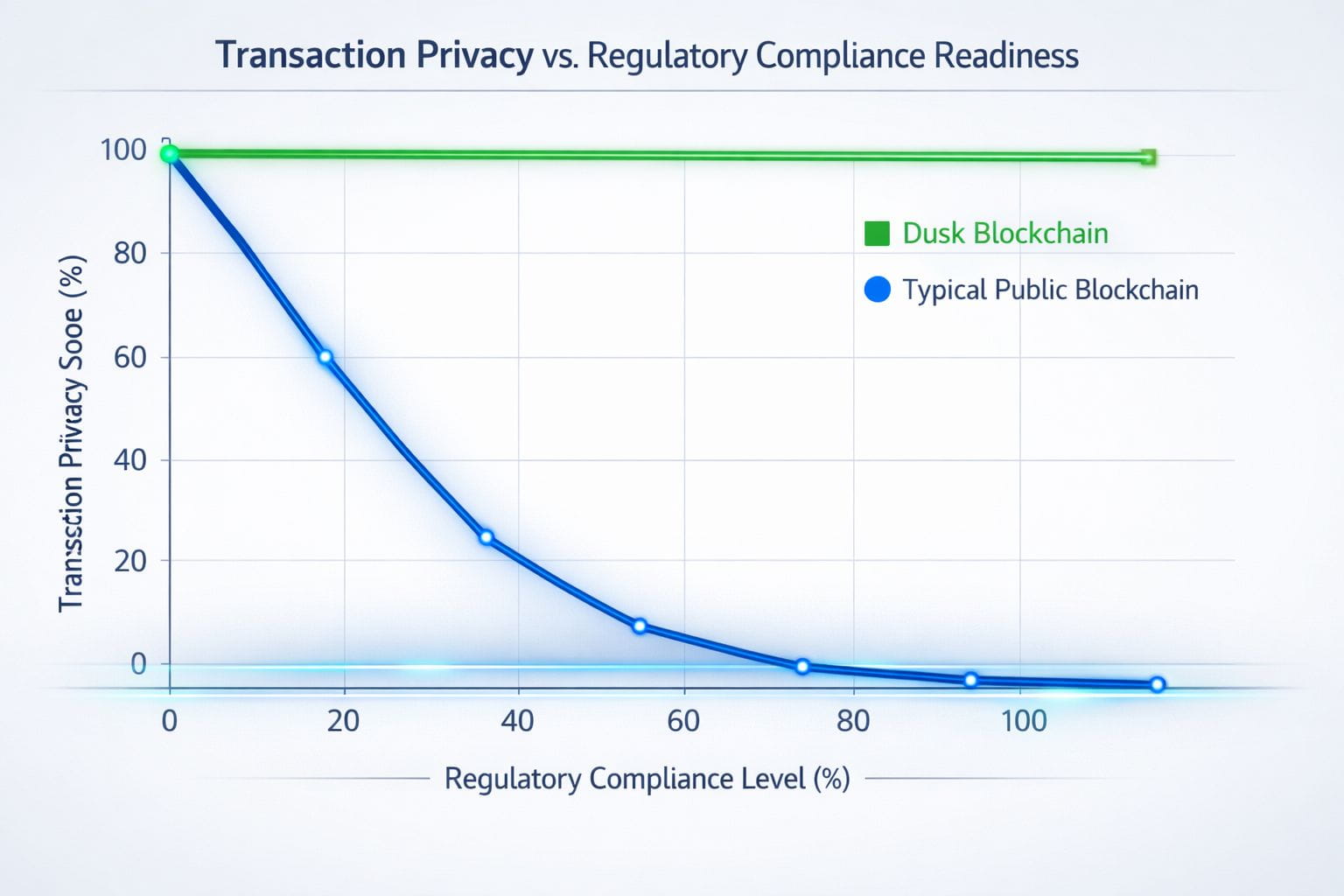

Dusk’s core strength lies in its privacy-first design. Utilizing zero-knowledge proofs, the platform enables secure transactions and smart contracts without exposing critical data. This allows institutions to manage confidential operations, such as client portfolios or trading strategies, on-chain while maintaining full compliance with KYC and AML regulations. By integrating self-sovereign identity protocols and programmable compliance logic, Dusk ensures that regulatory checks are seamless, transparent, and enforceable at the protocol level. Institutions no longer need to rely on manual or off-chain compliance processes, reducing operational risks and costs.

Beyond privacy, Dusk provides the infrastructure for the tokenization of real-world assets. Equities, bonds, investment funds, and other regulated instruments can be issued and traded natively on-chain with built-in compliance rules. This creates significant efficiencies in settlement and reporting. Transactions that traditionally took days or weeks can now settle in seconds, and automated reporting ensures that regulatory obligations are met instantly. Fractional ownership and programmable dividends expand opportunities for financial innovation while protecting sensitive market information.

Dusk’s architecture also supports privacy-aware decentralized finance. Lending protocols, liquidity pools, and automated market makers can function on-chain without exposing user positions or trade sizes. This addresses one of the biggest challenges in DeFi for institutional participation: front-running and data leakage. By combining confidentiality with interoperability, Dusk allows these financial operations to interact with other blockchain ecosystems while preserving the regulatory safeguards institutions require.

The platform’s modular design is particularly significant. By separating settlement, execution, and privacy layers, Dusk allows developers to choose the right configuration for their applications. This flexibility supports a wide range of use cases, from secure payments between institutions to cross-chain token transfers, without compromising security or compliance. Its consensus protocol, optimized for rapid finality, ensures predictable and reliable transaction settlement—critical for institutional adoption.

Adoption of Dusk can also generate strategic advantages for financial institutions. Privacy-preserving infrastructure reduces operational risk and protects proprietary information. Real-world asset tokenization unlocks liquidity and investment flexibility previously unattainable in traditional markets. Compliance embedded directly into smart contracts enhances auditability and reduces the burden of regulatory reporting. Collectively, these benefits make Dusk a compelling choice for banks, investment firms, custodians, and other regulated entities exploring blockchain solutions.

Looking forward, Dusk’s potential extends beyond individual institutions. As tokenized assets, regulated DeFi, and privacy-preserving financial infrastructure become mainstream, Dusk could serve as a backbone for entire ecosystems of digital finance. Its compatibility with Ethereum and other major networks ensures that assets can move freely while remaining compliant, creating a network effect that supports innovation without sacrificing trust or confidentiality.

In conclusion, Dusk empowers institutions to embrace the future of digital finance securely and efficiently. By combining privacy, compliance, and modular functionality, it enables a new era of regulated financial applications, from tokenized securities to confidential DeFi operations. For organizations seeking to innovate while maintaining the highest standards of regulatory adherence, Dusk represents not just a technology, but a strategic platform capable of transforming the way financial markets operate