A few months back, I started looking into tokenized bonds for a small portfolio test. Nothing aggressive, just a way to get some real-world exposure on-chain and smooth out volatility. What caught me off guard wasn’t fees or complexity, but friction. Every transaction left a trail that felt too exposed for something meant to resemble traditional finance, while compliance checks slowed everything down whenever proof was required. I kept asking myself whether my data was actually private, or just hidden until someone dug deeper. Having traded infrastructure tokens for years, I’ve seen how these kinds of gaps quietly turn solid ideas into half-used products, where users hesitate because the rules feel unclear.

That tension runs through most on-chain finance today. Privacy and regulation are treated like opposing forces instead of requirements that have to coexist. Some chains lean hard into anonymity, which makes institutions uncomfortable because records can’t be verified cleanly. Others default to full transparency, exposing users in ways that make sensitive assets like securities or payments risky to use. The result is friction everywhere. Developers struggle to build compliant apps without stitching together custom solutions. Users deal with slow settlements because proving compliance often means revealing more than they want. It’s not just about speed. It’s about trust breaking down when something clears quickly but fails scrutiny later, or passes audits but leaks too much along the way.

I usually think about it like a bank’s safety deposit boxes. Your assets are private by default, but access is logged and auditable if needed. No one is peeking inside unless there’s a reason. Break that balance, and confidence disappears. Either regulators can’t verify anything, or customers feel exposed.

That’s the space Dusk is deliberately trying to occupy. It behaves like a specialized layer-one chain built for assets that need both confidentiality and proof. Instead of chasing every DeFi trend, it narrows its scope to regulated flows like tokenized securities. Privacy isn’t optional or layered on later. It’s part of how the system works. Transactions stay confidential by default, but selective disclosure is built in so audits don’t require tearing everything open. In practical terms, that reduces the need for off-chain workarounds institutions usually rely on. One concrete example is DuskEVM, an EVM-compatible layer that brings zero-knowledge proofs directly into smart contract execution. Developers can port familiar Ethereum code, but execution stays shielded and settles with cryptographic proof instead of raw data. Another is the use of XSC contracts, which encode legal constraints directly into contract logic, enforcing things like compliance rules at the protocol level rather than relying on external checks every step of the way. Since mainnet went live and the Q1 2026 upgrade added liquid staking, the network has been able to handle these flows with fast finality through its segregated Byzantine agreement consensus, avoiding the congestion issues that show up on broader chains.

The DUSK token plays a quiet, functional role in all of this. It’s used for transaction fees, validator staking, and governance. Validators stake DUSK to secure the network under proof-of-stake, while holders vote on upgrades like the recent hyperstaking adjustments that tie rewards more closely to participation. Fees help finalize settlements, and a portion gets burned to keep inflation in check. Liquid staking has also made it easier for participants to stay involved without locking capital completely, which matters when uptime and reliability are critical for regulated assets.

From a market standpoint, capitalization sits around 110 million dollars, with daily volume hovering near 70 million recently. It’s active, but not euphoric, especially following the Chainlink integration for cross-chain real-world assets that went live toward the end of 2025.

Short-term trading tends to follow familiar patterns. Privacy narratives, RWA headlines, and launches like Dusk Pay for MiCA-aligned stablecoin payments can push sharp moves that cool off quickly. I’ve traded enough of these rotations to know how fast sentiment flips. Long-term, the question is quieter. If integrations like the NPEX partnership, which targets more than 300 million euros in tokenized assets, actually scale, demand grows through real usage rather than hype. Developer participation through programs like CreatorPad also matters more than price action here. Current network behavior, with daily transaction counts climbing into the thousands after recent upgrades, hints at early habit formation, even if it’s easy to miss when focusing on charts.

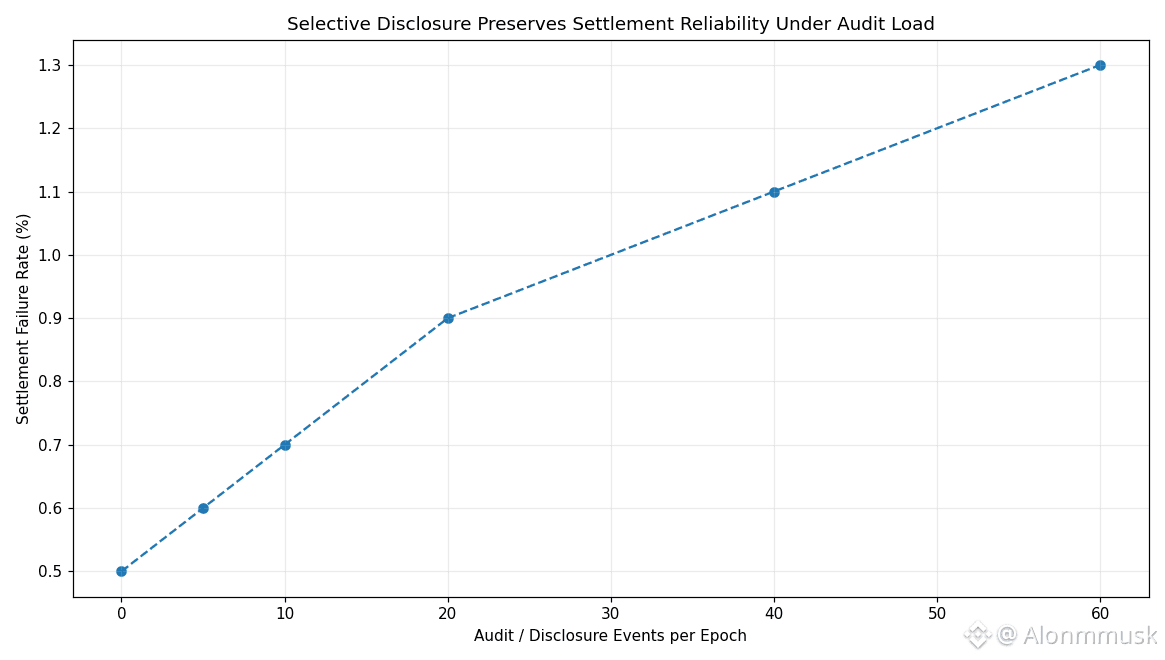

There are still real risks. Competing privacy-focused platforms, or Ethereum-based privacy layers, could pull developers away with broader ecosystems. Regulatory interpretation is another wildcard. Selective disclosure only works if regulators accept it at scale. One failure scenario that’s hard to ignore is technical. If a zero-knowledge proof fails during a high-value RWA settlement and exposes unintended data, trust could evaporate quickly, especially among institutions that can’t afford that kind of uncertainty.

In the end, infrastructure like this earns its place slowly. Not through announcements, but through repetition. The real signal isn’t the first transaction, but the second and third, when privacy works quietly and compliance doesn’t get in the way. Watching how Dusk behaves post-upgrade is a reminder that regulated on-chain finance doesn’t arrive with noise. It settles in, transaction by transaction, and only time will show whether this balance holds.

@Dusk #Dusk $DUSK