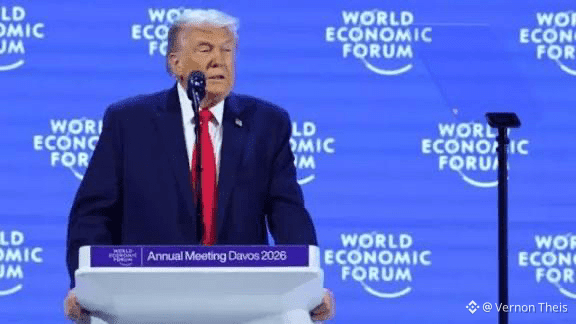

The World Economic Forum in Davos brings together heads of state, central banks, major financial institutions, and technology leaders to discuss monetary policy, financial regulation, and digital innovation. In recent years, cryptocurrencies and blockchain have shifted from a marginal topic to a structural pillar of these discussions.

1️⃣ Regulation and Legal Certainty

A core focus at Davos is global regulatory alignment. Progress in this area reduces legal uncertainty and enables:

Increased institutional capital inflows

Expansion of crypto ETFs and regulated investment products

Broader adoption by banks and traditional asset managers

📈 Direct impact: lower regulatory risk → higher liquidity and stronger medium- to long-term valuation support.

2️⃣ Real-World Asset (RWA) Tokenization

The tokenization of government bonds, equities, real estate, and commodities has been a central theme. This trend:

Expands blockchain use cases beyond speculation

Bridges traditional finance with on-chain infrastructure

Drives demand for smart contracts, stablecoins, and settlement layers

📈 Direct impact: reinforcement of crypto as a global financial infrastructure.

3️⃣ Stablecoins and Monetary Policy

Davos discussions also emphasize regulated stablecoins and their interaction with fiat currencies and CBDCs. Clear frameworks:

Reduce systemic risk

Increase institutional confidence

Favor compliance-oriented protocols

⚠️ Risk: non-compliant projects may face declining liquidity or exclusion from institutional flows.

4️⃣ Short-Term Market Volatility

While Davos sets strategic direction, it does not produce immediate policy decisions. Markets react to:

Statements from policymakers

Regulatory signals and expectations

Shifts in macro sentiment

📉📈 Result: heightened short-term volatility, particularly among altcoins.

📌 Technical Conclusion

Short term: elevated volatility and speculative price action

Medium term: gradual improvement in confidence and liquidity

Long term: institutionalization of crypto as part of the global financial system

👉 In summary, Davos does not set prices — it sets direction. Greater regulatory clarity and the expansion of tokenization are structurally positive for established cryptocurrencies, while weaker or non-compliant projects may be left behind.

If you want, I can link this macro framework directly to Bitcoin, Ethereum, or specific altcoins for a more targeted investment analysis.

#WEFDavos2026 #TrumpCancelsEUTariffThreat #TrumpTariffsOnEurope #WhoIsNextFedChair