Picture a normal day in the life of money. Not crypto money, not trading money, just money as people actually use it. A business pays salaries. A family sends support to relatives. A company buys inventory. An investor shifts positions quietly. A fund settles a deal. A government issues debt. Almost all of this happens behind curtains that are not meant to be suspicious, but meant to be safe. Privacy is not a luxury in finance. It is part of how the world prevents exploitation, protects people, and allows markets to function without turning every move into public theater.

Now compare that to what most blockchains do by default. They turn money into a permanent public record. Every transfer becomes searchable. Every wallet becomes traceable. Every strategy becomes a pattern waiting to be discovered. Even when addresses are anonymous, behavior often isn’t. And that is the moment where the dream of “on-chain finance” crashes into human reality. Real finance cannot live inside a glass house.

Dusk Network exists because it refuses to accept that tradeoff. It is built for a future where financial activity can be private and still trustworthy, confidential and still verifiable, regulated and still accessible. DUSK is the token at the center of that network, but the token is only part of the story. The deeper story is that Dusk is trying to build a confidential financial engine for the real world, not just a privacy feature for crypto.

This deep dive is a completely new article about Dusk and the DUSK token, written with a different flow and different storytelling approach than before. I’m going to explain everything with clear words and long, calm paragraphs. No bullets, no clutter, no fragmented explanations. Just one unified story, moving from the first idea to what Dusk could become years from now.

The beginning of Dusk is not a marketing idea. It is a gap in reality. Blockchains proved they can create trust without central control, but they also created a new type of vulnerability. They made financial life observable. At first, transparency sounded like justice. The world had seen enough hidden corruption, enough closed-door systems, enough institutions that demanded trust while providing little proof. Crypto responded with open ledgers where anyone could verify what happened.

But as the industry matured, a new understanding started to rise. Full transparency is not the same as fairness. In finance, too much visibility can produce a different kind of imbalance. It can enable front-running. It can expose small users to targeted scams. It can reveal business relationships. It can allow competitors to copy strategies. It can even create personal risks in the real world if wealth becomes publicly traceable.

This is where Dusk enters the conversation with a calmer point of view. It argues that the future is not about choosing between privacy and trust. The future is about building systems where privacy and trust exist together. And that sounds simple until you realize how difficult it is to achieve.

Because privacy and verification usually fight each other. Privacy wants to hide details. Verification wants to reveal them. Dusk tries to solve this conflict through cryptography, and through a financial design philosophy that accepts that markets need confidentiality to operate normally.

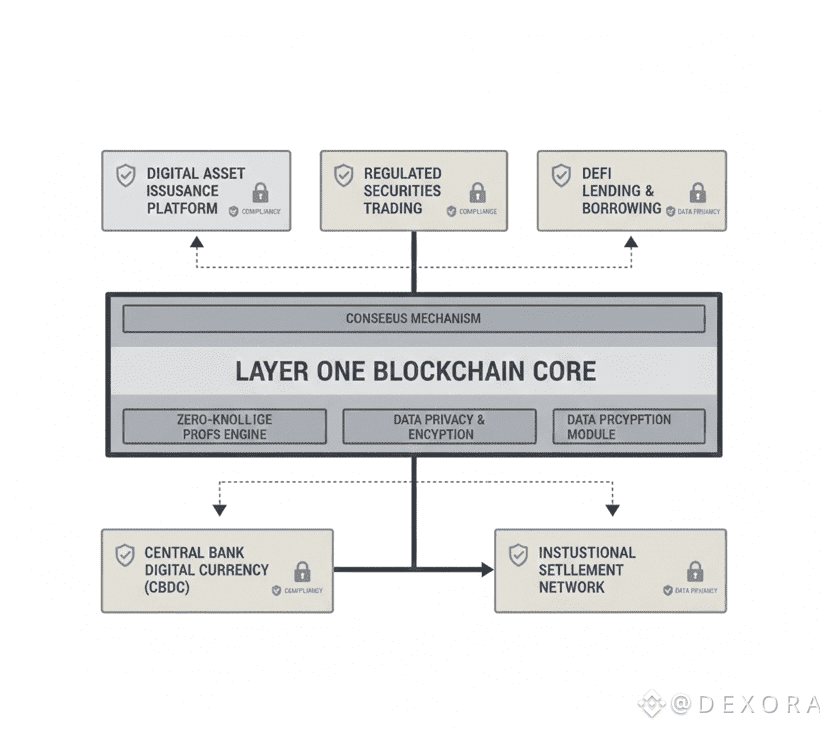

One of the earliest strategic decisions in Dusk’s lifecycle is that it is not trying to be a general-purpose chain for every trend. It is aiming for regulated finance and real-world assets, where privacy is not optional. This focus matters because the world is shifting toward tokenization, whether crypto communities like it or not. Tokenization is not only about memecoins. It is about financial instruments moving on-chain. Funds, bonds, equity-like products, invoices, and other assets that represent real legal value.

Real-world assets bring scale. They bring institutional interest. They bring a bridge to the global economy. But they also bring requirements that many blockchains cannot satisfy easily. Compliance, transfer restrictions, eligibility checks, controlled access, and sometimes private settlement terms. These assets need a chain that can support rules without forcing every detail into public view.

Dusk is designed to fit this world.

You can think of Dusk’s mission like building a bank-grade blockchain without building a bank. It wants open access at the protocol level, while still supporting the privacy and compliance frameworks that financial markets demand. That is a narrow target compared to chains that try to do everything, but it is also a powerful one, because the market Dusk is aiming for does not disappear with hype cycles. It grows with the global economy.

Now we move into the heart of what makes Dusk different. The cryptographic foundations.

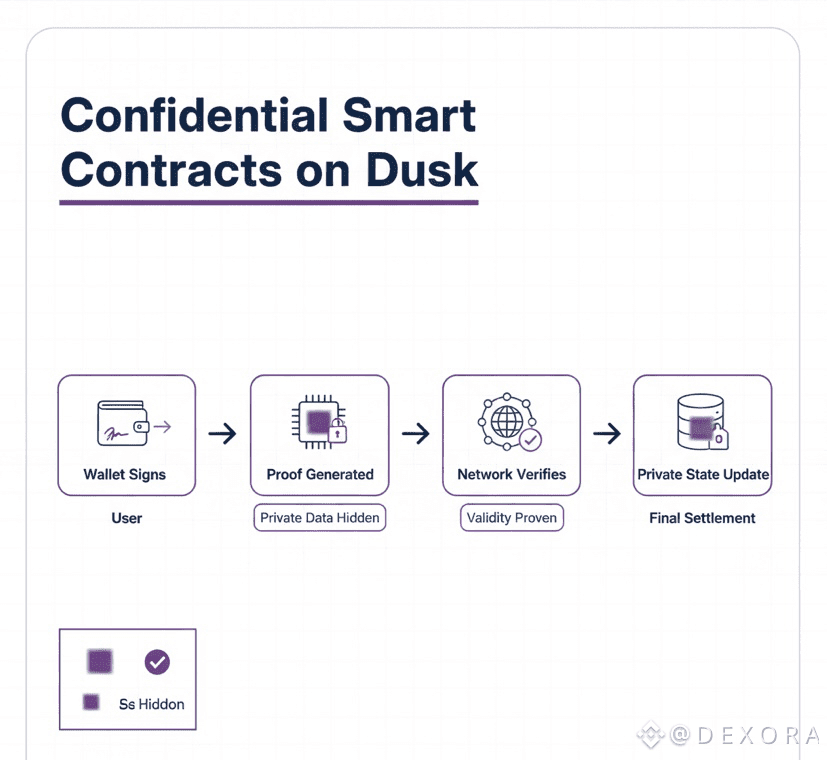

Dusk’s approach is built around the idea of proving correctness without exposing private data. This is where zero-knowledge technology becomes central. Zero-knowledge proofs allow someone to prove a statement is true without revealing the information behind it. This is not just a clever trick. It is a new trust model. It means the network can confirm that rules were followed without publishing private details.

In a financial context, this opens up an entirely different world. It can mean a transaction is valid without revealing the amount publicly. It can mean a participant is eligible without revealing their full identity to the public. It can mean a contract executed correctly without exposing the private state inside the contract.

This is why Dusk is often discussed as a privacy-first blockchain designed for financial applications. Not because it wants everything to be hidden, but because it wants private finance to exist on public infrastructure without becoming public property.

Now, one of the most important turning points in Dusk’s lifecycle is its emphasis on confidential smart contracts. Smart contracts are what make blockchains programmable. They allow rules to be automated. They allow financial products to behave like software. But on most chains, smart contracts are fully transparent. Everyone can see the contract state, the inputs, the outputs, and the interactions.

That transparency creates a problem. Many financial products cannot operate correctly if everything is visible. A private fund cannot reveal all participants and positions. A regulated security token cannot expose investor data publicly. A business cannot reveal all internal financial flows to competitors. Even individuals often want financial privacy the same way they want privacy in banking today.

Dusk aims to support smart contracts where sensitive information can remain confidential, while the network still verifies the outcomes. That makes Dusk less like an experimental playground and more like a private financial machine running on public rules.

If it becomes widely adopted, we’re seeing a future where blockchain finance becomes less about broadcasting and more about proving.

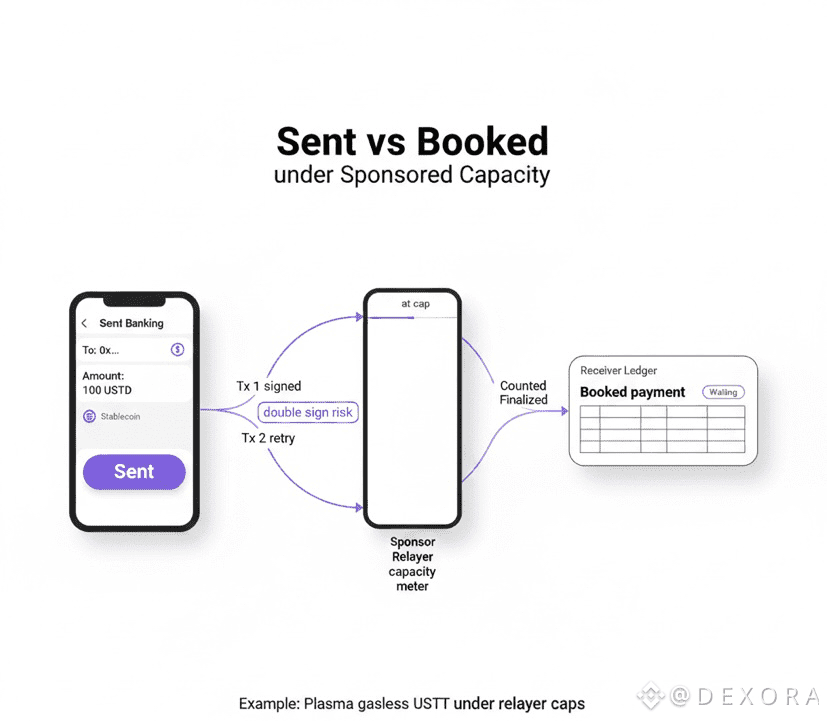

Now we must talk about the settlement side, because privacy alone does not build a financial chain. Finance requires finality. It requires reliability. It requires that when something settles, it stays settled.

Finality is not a glamorous word, but it is one of the most important words in financial infrastructure. In day-to-day finance, people rarely think about how settlement works because banks and payment networks hide it. But beneath the surface, there is always a clearing and settlement process that ensures transactions are final. If settlement is weak, markets become risky. If settlement is delayed, capital becomes inefficient. If settlement is unpredictable, institutions hesitate.

Dusk has built its network around a Proof-of-Stake-based consensus model designed to provide secure agreement and reliable finality. The network’s consensus approach has been described in ways that emphasize robust settlement for financial use cases, reflecting the idea that Dusk wants to be infrastructure, not entertainment.

They’re building for a world where a transaction is not just confirmed, but trusted as final.

That reliability becomes even more important when you consider the type of assets Dusk wants to support. Tokenized real-world assets don’t just represent numbers on-chain. They represent legal claims. Ownership rights. Payment obligations. Regulatory responsibilities. These assets cannot afford unstable settlement. A chain that wants to host them must be dependable.

Now, a blockchain is not only its technology. It is its economy. And this is where the DUSK token becomes part of the story.

DUSK is the native token of the Dusk Network. It plays the role that native tokens play in Proof-of-Stake systems by supporting network security through staking and incentivizing network participants. It also supports transaction activity and the economic mechanisms that keep the chain running.

But the deeper meaning of DUSK is not only in its utility. It is in what it secures. If Dusk becomes a real settlement layer for confidential finance, then DUSK is the token that secures that world. It becomes the economic force that defends private markets and ensures their reliability. In that context, DUSK becomes less like a tradable coin and more like the fuel behind a serious financial engine.

This is where many people misunderstand tokenized infrastructure. They focus only on price movements and ignore the role the token plays in keeping the network alive. A chain that wants to carry real value must have a security economy. Dusk uses DUSK to create that economy.

Now we reach the hardest part of Dusk’s lifecycle. The part that every infrastructure project faces. Adoption and usability.

Privacy systems are harder to build on. Confidential smart contracts require different development patterns. Testing becomes more complex because you can’t simply inspect everything publicly. Debugging becomes more challenging because private state cannot be viewed the same way. Developers need strong tools, strong documentation, and strong support to build confidently.

Dusk must prove that it can turn privacy from a concept into a developer-friendly environment. It must make private finance not only possible, but practical. Because real adoption comes when builders can ship products without fear that the platform will slow them down.

The user experience challenge is even bigger. Users want privacy, but they don’t want to think about privacy tools. They want privacy to feel normal, like it feels in traditional banking. They want to use applications without understanding cryptographic proofs. They want the result, not the mathematics. A chain that supports confidential finance must make the experience smooth enough for normal people.

If Dusk can make privacy feel effortless, then it becomes a powerful tool for the next era of blockchain adoption.

Now, let’s talk about what kind of future Dusk is building toward, because this is where the project’s long-term identity becomes clearer.

The world is moving toward tokenization, and not slowly. Financial institutions are exploring it. Governments are exploring digital rails. Funds are exploring on-chain settlement. Meanwhile, public awareness around data privacy is increasing. People are more conscious of how their information is tracked, analyzed, and used. In finance, this consciousness is even sharper, because financial information is one of the most sensitive types of information in human life.

Dusk sits in the middle of this reality. It is building for a world where money becomes programmable and global, but where privacy remains a human right and a financial necessity.

If it becomes successful, it could enable a new generation of financial applications that were previously too sensitive for public chains. Private compliant trading platforms. Tokenized securities with confidentiality features. Financial instruments that settle quickly but do not expose every participant. Markets where compliance and privacy are not enemies.

This kind of future would not look like the early DeFi world, where everything is open and everyone can watch. It would look more like professional markets, but running on open infrastructure.

That is the kind of maturity Dusk is aiming for.

But there are challenges on the road.

One challenge is competition. Many networks want to become the home of real-world assets. Some are building compliance layers. Some are building privacy add-ons. Some are integrating identity frameworks. Dusk must prove that native privacy-first architecture is not only a feature, but a necessary design choice for the kind of financial products it wants to support.

Another challenge is regulatory perception. Privacy in crypto has sometimes been misunderstood, and Dusk must continue to communicate its purpose clearly. The world must see that privacy-first finance is not about escaping rules, but about protecting participants while following rules. Dusk’s long-term success depends on building that trust with both institutions and communities.

Another challenge is time. Regulated markets move slowly. Adoption is not immediate. Partnerships take time. Legal frameworks evolve slowly. Dusk must survive long enough to reach the moment when the world is ready for confidential on-chain finance at scale.

This is where Dusk’s philosophy matters the most. It is built for the long game. It is not a trend chain. It is an infrastructure chain.

Now, what could Dusk become in five to ten years.

In one future, Dusk becomes a known settlement layer for private regulated assets. Issuers use it to create compliant tokenized products. Marketplaces use it to allow trading without exposing private data publicly. Investors participate without turning their financial identity into a public record. Compliance checks happen through cryptographic proofs rather than public broadcasting.

In that future, Dusk becomes a bridge between two worlds. The world of traditional finance, where privacy is normal, and the world of blockchain, where verification is powerful.

In another future, Dusk remains a specialized network used by a smaller number of high-value applications. Not every chain needs to be a mainstream social platform. Some chains win by being trusted by serious users. Dusk could become such a chain.

And in a difficult future, Dusk could struggle to gain adoption if the market chooses simpler solutions or if competitors capture the RWA narrative faster. This is always possible. But the core problem Dusk solves will remain real.

The internet will not suddenly decide that financial privacy no longer matters.

Now, to end this deep dive in a meaningful way, we must return to the human reality that sits underneath all of this.

People want financial freedom, but they also want financial safety. They want global access, but they do not want their lives exposed. They want markets to be fair, but they don’t want to be watched like a target. They want systems they can trust, but they don’t want that trust to require constant public exposure.

Dusk is built for that balance.

I’m not saying Dusk is already the final answer. But I can see that they’re building something the world will need more as crypto grows up. We’re seeing blockchain finance move from experiments into structures that must support real value, real regulations, and real human lives.

If it becomes successful, Dusk will be remembered not because it made finance louder, but because it made finance safer. Not because it made everything public, but because it made privacy compatible with trust.

And years from now, when the world finally expects tokenized finance to behave like real finance, the chains that last will be the ones that understood something simple.

Money can move fast, but dignity should never be sacrificed along the way.