Watching the blockchain space for years, I’ve noticed one consistent pattern: projects often overpromise and underdeliver. Many Layer 1s talk about DeFi, NFTs, or tokenized assets, but few build systems that institutions can actually use. Dusk is different. It’s moving past conceptual promises into measurable execution, and its approach demonstrates a rare alignment between infrastructure, compliance, and real-world asset adoption.

Execution Over Hype

Dusk has consistently avoided flashy, short-term hype. The Layer 1 was designed from day one for regulated, privacy-preserving financial applications. Its modular architecture enables separate execution and consensus layers to work together, supporting confidential transactions without sacrificing verifiability. This isn’t a marketing gimmick — it’s structural engineering aimed at solving a real problem for financial institutions: how to operate on-chain while remaining compliant.

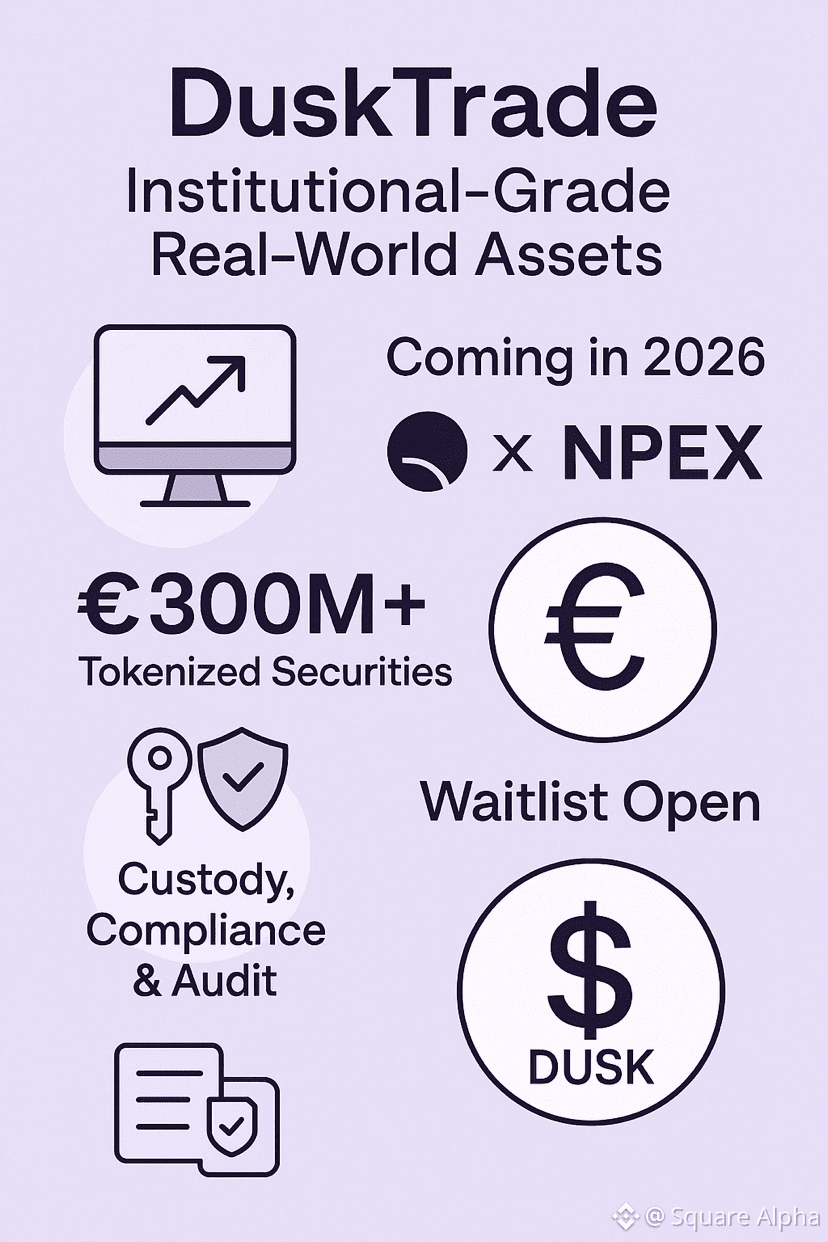

DuskTrade: Institutional-Grade Real-World Assets

The upcoming DuskTrade platform, launching in 2026, represents a significant milestone. Partnering with NPEX, a regulated Dutch exchange, Dusk plans to bring over €300 million in tokenized securities on-chain. Unlike other RWA experiments that exist only in theory, this initiative is designed for operational reality. Custody, compliance, and audit requirements are not afterthoughts — they’re embedded into the platform.

The opening of the DuskTrade waitlist in January signals more than marketing; it reflects readiness for early institutional adoption. From an investor’s perspective, the integration of tokenized real-world assets directly onto a blockchain provides structural demand for $DUSK, linking usage with real financial flows rather than speculative cycles.

DuskEVM: Reducing Adoption Friction

Adoption risk is one of the most significant barriers for Layer 1s aiming at institutions. DuskEVM solves this by providing an EVM-compatible execution layer that settles on Dusk’s Layer 1. This allows developers to deploy standard Solidity smart contracts without having to learn a new language or compromise privacy standards.

EVM compatibility isn’t just convenience; it’s a strategic accelerator. It lowers integration friction, encourages experimentation within a compliant framework, and ensures that both DeFi and RWA applications can scale without running into legal or technical bottlenecks.

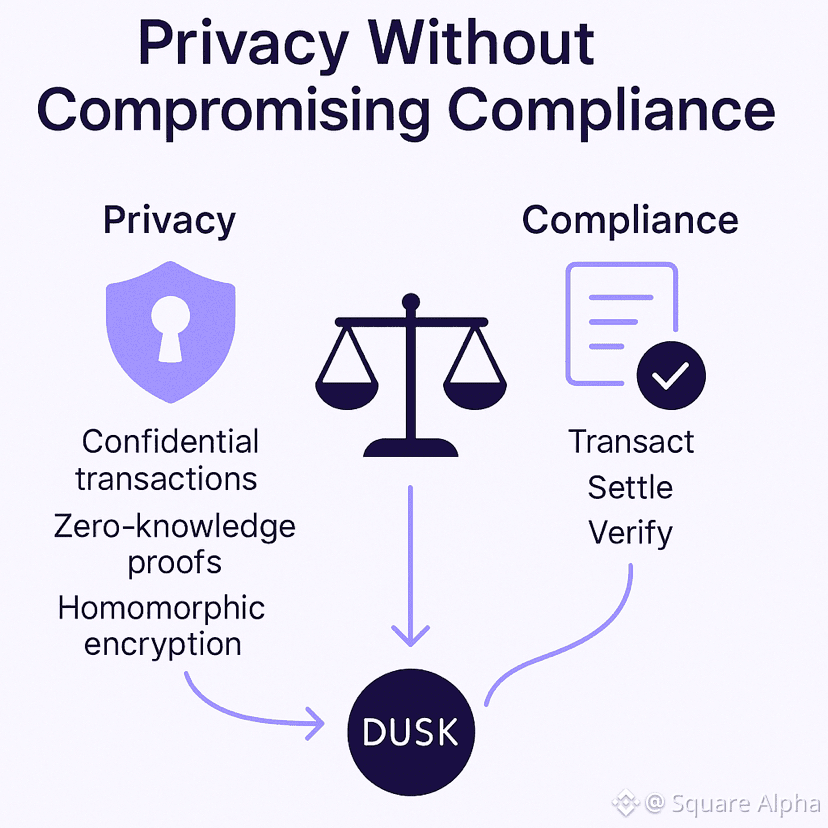

Hedger: Privacy Without Compromising Compliance

Privacy is a double-edged sword in finance. Hide too much, and regulators get nervous. Expose too much, and institutions expose sensitive information. Dusk’s Hedger module provides a thoughtful balance: confidential transactions verified using zero-knowledge proofs and homomorphic encryption.

The live Hedger Alpha demonstrates that privacy is not theoretical — it is being executed. Institutions can transact, settle, and verify compliance without revealing proprietary data. From a network perspective, this ensures that $DUSK gains functional relevance: every transaction, staking operation, and RWA settlement relies on tokenized activity.

Structural Implications for DUSK

The utility of DUSK is tightly integrated into network function. It is not a speculative asset; it secures network consensus, facilitates transactions on DuskEVM, and underpins RWA activity on DuskTrade. The projected introduction of institutional trading volume, combined with staking incentives, creates a demand structure grounded in real usage rather than hype cycles.

From a strategic perspective, this is rare. Most networks have high volatility and little structural token demand. Dusk is positioning DUSK as a core operational instrument, aligning incentives between developers, institutions, and validators in a predictable, auditable ecosystem.

Why This Moment Matters

The convergence of multiple live and upcoming systems — DuskTrade, DuskEVM, and Hedger — signals a network moving from conceptual promise to operational relevance. January 2026 is more than a calendar marker; it marks the first coordinated opportunity for real-world adoption. Execution is the differentiator here, and it is precisely what most other Layer 1s fail to achieve.

Conclusion: Measured Patience Meets Real-World Design

Dusk exemplifies the kind of blockchain design that rewards long-term thinking. It does not chase flash-in-the-pan adoption metrics or speculative trends. Instead, it focuses on infrastructure that supports institutional adoption, regulatory compliance, and privacy simultaneously.

For developers, institutions, and investors willing to watch, Dusk offers a coherent framework where technical execution aligns with financial reality. $DUSK’s relevance will grow as usage grows — not as narratives cycle. In a market saturated with untested promises, that disciplined approach is worth noting.