When I analyzed why many high performance blockchains still struggle at scale. I realized the bottleneck is not transactions anymore. It's how data lives, moves and stays private and that is where Walrus quietly enters the picture. After publishing my earlier thoughts on Walrus. I went back and re-read my notes developer discussions and network data. What stood out was not just the storage technology itself but the timing. Crypto in 2025 is no longer obsessed with raw TPS numbers the conversation has shifted toward usable infrastructure, AI agents, real applications and compliance aware systems. In my assessment Walrus is positioned exactly at that intersection.

Most users don't think about where dApp data actually sits. They assume everything "on-chain" magically works. My research shows that this assumption breaks down fast once applications scale. Games, DeFi protocols and AI driven tools generate massive data that does not belong inside expensive execution layers. Walrus exists because that problem is no longer theoretical. It's already slowing builders down.

Why data availability has become cryptos quiet battlefield?

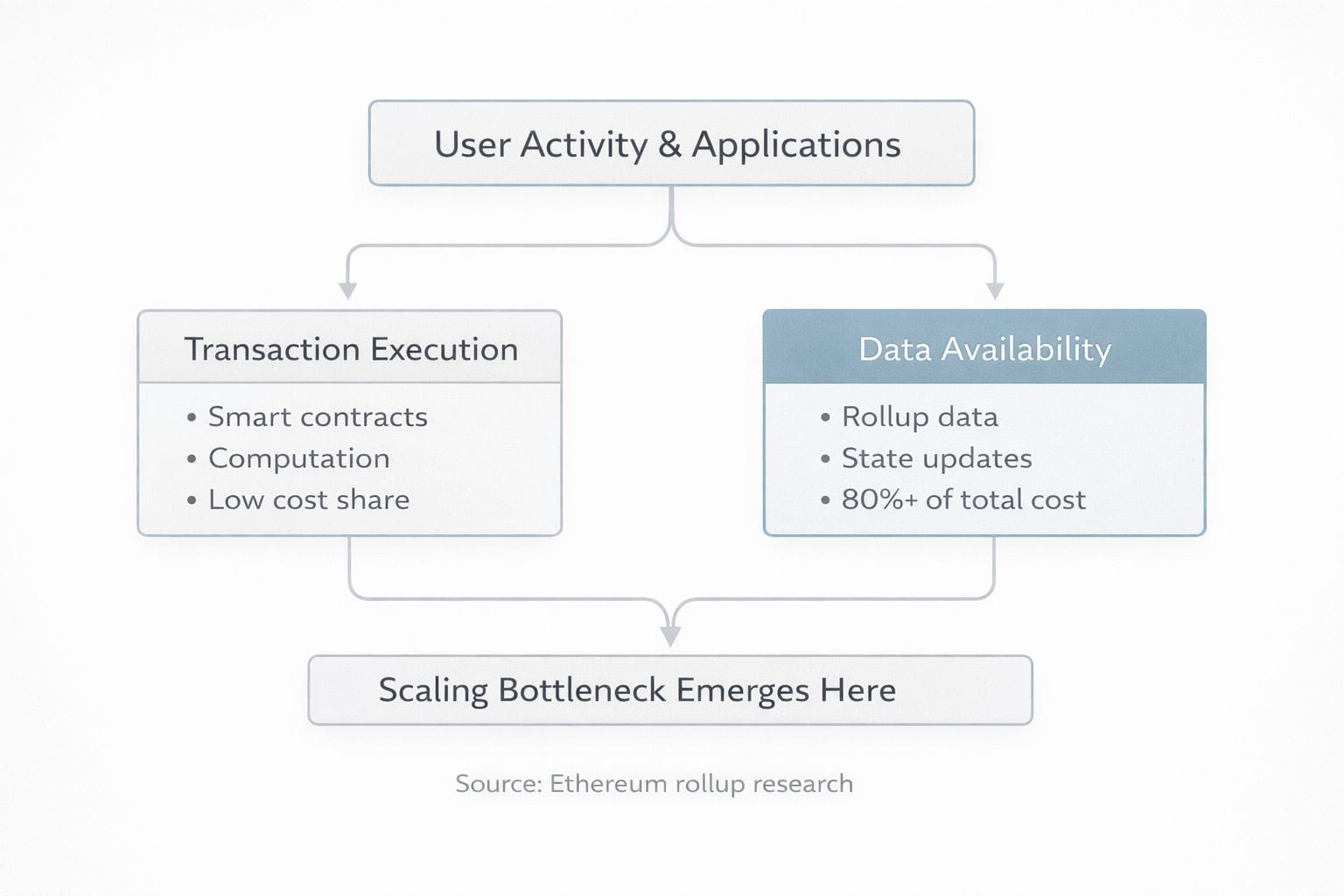

To understand Walrus you have to understand the trend it's riding. Ethereum rollups have made data availability a central topic not an afterthought. According to Ethereum Foundation research notes over 80 percent of rollup costs come from posting data rather than computation. That statistic alone reframed how I looked at infrastructure projects.

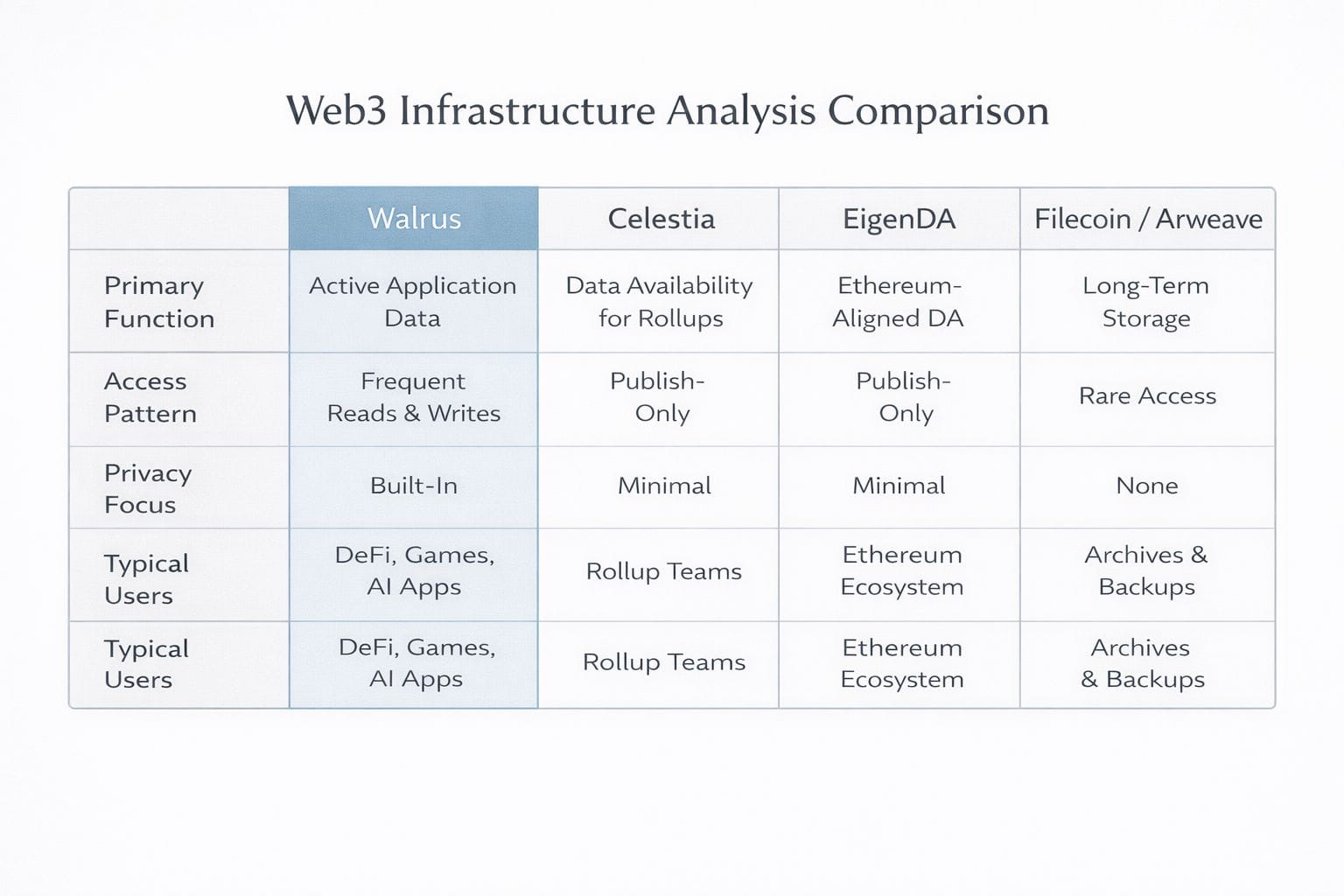

Celestia entered this space with a modular approach and public documentation highlights its goal of serving as a general purpose data availability layer. EigenDA followed with Ethereum aligned data services. These are strong solutions but they are optimized for publishing transaction data not necessarily for application level storage that needs frequent reads and writes. Walrus targets that specific gap.

Walrus operates on Sui which itself brings a different data model to the table. Sui's object based architecture allows parallel transaction processing and according to Mysten Labs public benchmarks this design enables predictable performance under load. That matters because storage systems behave very differently under burst usage. In my analysis Walrus benefits from being built natively inside this architecture rather than retrofitted later. Another data point that influenced my thinking came from Filecoin's network statistics. Filecoin surpassed 18 exbibytes of raw storage capacity according to public dashboards yet real usage remains a fraction of that number. This highlights a key truth: capacity alone does not equal usefulness. Walrus focuses less on raw capacity and more on access patterns which is where real world applications feel pain. If I were explaining this to a non technical friend. I would say this is Filecoin and Arweave are like long term warehouses while Walrus is closer to a smart logistics hub. Both are valuable but they serve different needs. In a future dominated by real time apps logistics often matter more than storage size. No analysis is complete without addressing uncertainty. Walrus is early and early stage infrastructure always carries execution challenge. My research into past cycles shows that many technically strong projects failed because they could not attract enough developers. Technology alone does not create value usage does. Competition is another real factor. Celestia's network growth has been rapid with dozens of rollups announcing integrations according to public network trackers. EigenLayer backed services benefit from Ethereum's gravitational pull. Walrus needs to find its own space instead of jumping into crowded markets where others already have the upper hand. There is also token behavior challenge. Infrastructure tokens usually drift along without much action then suddenly spike in value when people finally notice real adoption. Traders who lack patience usually exit too early. In my assessment WAL fits this pattern more than the typical hype driven altcoin. Regulatory uncertainty is worth mentioning as well. Sure Walrus puts privacy first but regulators around the world keep a close eye on privacy tech. Think about all those warnings from Chainalysis and the FATF about systems that hide too much. Walrus has to walk a fine line protecting privacy while giving companies enough transparency to feel secure. A chart tracking how the network grows against the token price over time with the moments where they drift apart standing out. I would also throw in a table lining up Walrus, Celestia, EigenDA, Filecoin and Arweave breaking them down by data type, how often people access the data, privacy features and who actually uses them.

Here is how I would approach trading WAL if I'm really relying on research. I'm not looking at this as some fast in and out trade. My strategy would revolve around structural levels and network confirmation. If WAL drops down to a solid support area that's held up after some big selling now that is when I start watching. I'm not chasing those wild spikes you get from news or hype. For me, it's all about finding a solid range where the stock settles in then waiting to see real signs things are turning. That is when I'm interested. A clean break above a mid range resistance with rising on-chain activity would be more meaningful than any short term volume spike. If price revisits support while fundamentals remain unchanged. That is typically where risk reward becomes attractive. I would also watch relative strength. If WAL begins outperforming other storage or data availability tokens during a flat market that would signal early rotation. Conversely weakness during broad market strength would be a warning sign. Risk control matters here. I would define invalidation clearly possibly below a structural support level that if broken signals loss of market confidence. This is not about being right. It's about staying solvent. If I were adding visuals I would describe a price chart with accumulation zones breakout levels and volume overlays. A second chart could show comparative performance between WAL and a basket of data infrastructure tokens over the same period.

Stepping back and looking at the bigger picture

After stepping back from the charts and the hype. My conclusion feels grounded. Walrus is not trying to replace every storage solution in crypto. It's trying to serve a very specific and increasingly important role is active, privacy aware data for real applications. In my assessment this focus aligns perfectly with where crypto is heading. AI agents on-chain games and enterprise grade DeFi all need infrastructure that goes beyond transactions. They need data that moves fast stays available and respects privacy. Walrus may not trend every day and that is exactly why it's interesting. For creators, traders and builders who value fundamentals over noise. This is the kind of project that deserves sustained attention rather than momentary hype.