There is a moment every serious participant in markets eventually recognizes. It arrives quietly, usually after enough cycles have passed to dull the excitement. You realize that most financial systems are not designed to help capital think long term. They are designed to keep it moving. Fast. Constantly. Often unnecessarily. Crypto, despite its promise of sovereignty and ownership, amplified this tendency. Liquidity became synonymous with exit, and access became inseparable from sacrifice.

Walrus begins from a different emotional truth: most capital does not want to leave. It wants to stay where it believes, while still remaining useful.

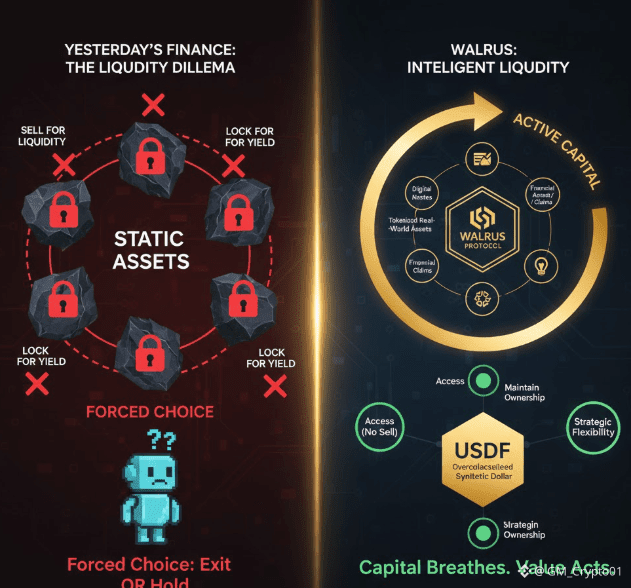

Imagine capital not as a number hopping between pools, but as something with intention. It sits in assets because there is conviction there. Research, alignment, time, and risk tolerance all led to that position. Yet real life does not pause for market structure. Opportunities emerge elsewhere. Obligations appear. Flexibility becomes necessary. Traditional on-chain systems respond to this moment with a blunt instruction: sell first, decide later. Walrus questions why that instruction ever became normal.

Instead of forcing capital to abandon itself, Walrus gives it another option. Assets, whether digital-native tokens or tokenized real-world value, can be deposited as collateral and remain exactly where they are in spirit and exposure. Ownership does not dissolve just because liquidity is required. From this foundation, USDf is issued, an overcollateralized synthetic dollar that represents access without exit. The innovation is not the existence of a synthetic dollar; those have existed before. The innovation is that the system respects the psychology of holding while solving the mechanics of liquidity.

What changes when capital no longer has to choose?

The first thing that disappears is urgency. Decisions slow down, not because markets become less dynamic, but because panic is no longer built into the infrastructure. When liquidity is always available without liquidation, timing becomes strategic rather than defensive. Capital can wait, observe, and act deliberately. The market stops feeling like a treadmill and starts feeling like a landscape.

Walrus also introduces a quieter but more powerful shift: it re-centers balance-sheet thinking on-chain. In traditional finance, mature systems are built around collateralization. Assets are pledged, not constantly sold. Credit flows without destroying long-term positions. Crypto skipped this step in its rush toward speed and composability, leaning instead on perpetual churn. Walrus restores that missing layer, not by copying old systems, but by translating their most resilient principles into transparent, programmable infrastructure.

USDf plays a crucial role in this story because it is not designed as an escape hatch, but as a working instrument. It provides stability without pretending volatility does not exist. Overcollateralization is not a marketing term here; it is the structural guarantee that trust is earned, not requested. Users can see the backing, understand the mechanics, and evaluate risk without relying on faith. This creates a different kind of confidence, one rooted in visibility rather than promises.

As time passes, the impact extends beyond individual users. Builders begin to design differently when liquidity is no longer a disruptive event. Protocols can assume continuity instead of churn. Institutions, long hesitant to engage deeply with on-chain systems, recognize familiar logic beneath novel execution. Tokenized real-world assets, often awkwardly wedged into crypto frameworks, finally find a home where liquidation is not the default outcome. Different forms of value coexist without competing for survival.

The market’s relationship with yield evolves as well. Yield stops being something hunted through constant repositioning and incentive migration. It becomes a function of efficiency and structure. Capital works because it is well placed, not because it is restless. This does not eliminate risk or volatility, but it changes how they are experienced. Volatility becomes something navigated, not something feared.

What makes Walrus especially relevant now is timing. The on-chain economy is maturing, whether narratives keep up or not. There is already enough infrastructure for trading, swapping, and speculation. What has been missing is infrastructure that allows capital to behave like capital instead of inventory. Walrus fills that gap quietly, without spectacle, by addressing the most human friction in finance: the forced choice between belief and access.

Over weeks and months, participants notice something subtle. They are no longer designing strategies around exits. They are designing around continuity. They no longer treat liquidity as a crisis response. It becomes an ambient condition. Always present, always usable, never destructive. The system does not rush them. It does not punish patience. It assumes that holding can be intelligent.

By the time this realization settles in, the change has already occurred. Capital has moved, supported new opportunities, absorbed shocks, and adapted to reality without being torn from its foundations. Ownership remained intact. Conviction was preserved. Liquidity did its job without demanding a sacrifice.

Walrus is not trying to reinvent finance loudly. It is doing something more difficult. It is teaching on-chain capital how to grow up.