There is a quiet exhaustion settling into crypto. Not the kind that comes from loss, but the kind that follows repetition. The same patterns replay cycle after cycle: assets are accumulated with conviction, only to be liquidated the moment flexibility is required. Liquidity arrives, but belief leaves. Over time, this rhythm teaches participants an unhealthy lesson, that long-term thinking is incompatible with access. Walrus exists to unlearn that lesson.

At its heart, Walrus is not reacting to market hype or chasing the next efficiency gain. It is responding to a deeper structural mismatch. Crypto markets were built to move value quickly, but not to hold it intelligently. Speed was optimized. Ownership was celebrated. Yet the moment capital needed to function beyond passive holding, it was forced into churn. Walrus introduces a missing layer: the ability for capital to remain committed while becoming useful.

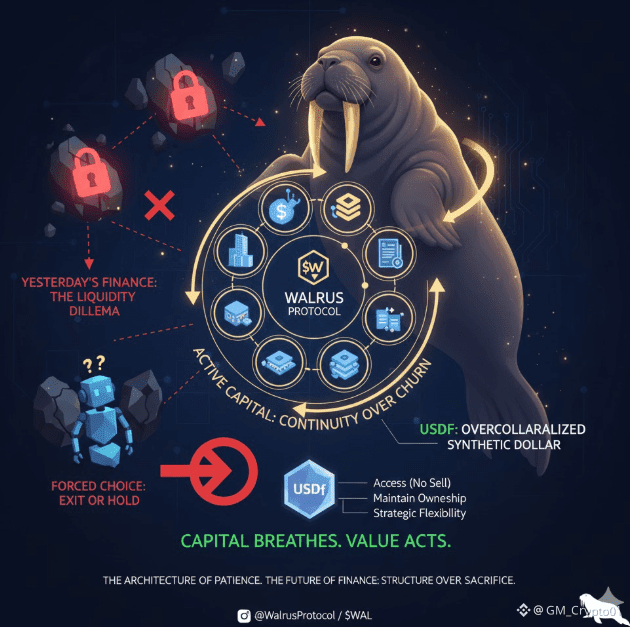

Think of Walrus as infrastructure that understands intent. Assets are held for a reason. Research, alignment, time horizon, and risk appetite all converge into a position. Forcing liquidation to unlock liquidity erases that intent and replaces it with urgency. Walrus instead allows liquid digital assets and tokenized real-world assets to be deposited as collateral, preserving exposure while issuing USDf, an overcollateralized synthetic dollar. The user does not leave the position to gain flexibility; flexibility emerges from the position itself.

This distinction reshapes behavior. When access no longer requires exit, decisions stop being reactive. Capital can move deliberately. Opportunities can be evaluated without the background noise of fear. Liquidity becomes something you live with, not something you scramble for. Over time, this changes the psychology of participation. Markets feel less like arenas and more like systems.

USDf is central to this transformation, but not because it promises novelty. Its importance lies in what it enables structurally. Stability is not manufactured through optimism or dependence on constant inflows. It is earned through overcollateralization and transparency. Participants understand what backs their liquidity, how risk is managed, and why the system remains coherent under stress. Trust becomes architectural rather than emotional.

As Walrus matures, its relevance extends beyond individuals. Builders begin designing with continuity in mind. Institutions see familiar balance-sheet logic expressed in programmable form. Tokenized real-world assets, often constrained by crypto’s tendency toward forced exits, finally operate in an environment aligned with how value behaves outside of trading screens. Liquidity stops being a destructive event and becomes an ongoing condition.

Yield, too, finds a new identity. Instead of being chased through constant migration and short-term incentives, it emerges from capital efficiency. Assets work because they are structurally empowered, not because they are perpetually moved. Volatility remains, but it loses its ability to dictate behavior. Capital absorbs it rather than reacting to it.

What Walrus ultimately represents is a shift from urgency to patience, without sacrificing dynamism. It acknowledges that markets will always move, but refuses to believe that movement must come at the expense of conviction. This is not a rejection of liquidity, but its maturation. Liquidity becomes supportive instead of extractive.

In a landscape crowded with protocols competing for attention, Walrus chooses a quieter path. It builds for the moment when on-chain finance is judged not by how fast value can leave, but by how well it can stay and still function. That moment is closer than it seems.