There is a certain kind of stress that only appears when money is moving. It’s not the dramatic stress of trading or speculation. It’s a quieter stress. The kind you feel when you send money to someone and you hope it arrives on time. The kind a freelancer feels when a payment is delayed and rent is due. The kind a small business feels when it needs to pay suppliers across borders and every bank step adds friction. The kind families feel when they send support to relatives in another country and the fees eat into what they wanted to give. This isn’t a crypto story. This is a human story. And Plasma was built inside this reality.

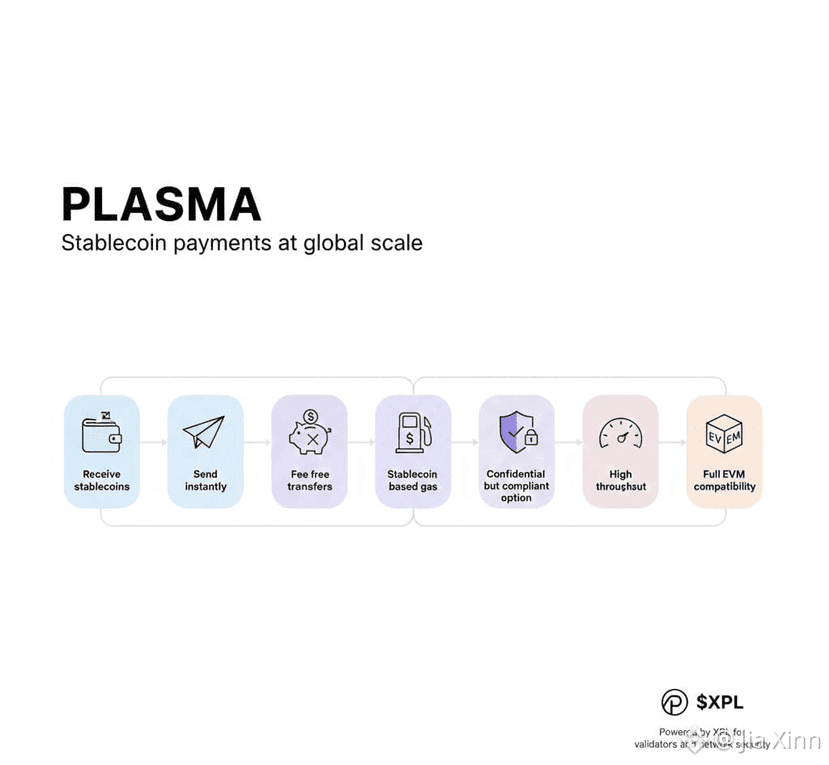

Plasma, powered by the XPL token, is a project designed around a very specific belief. Stablecoin payments should feel as simple as sending a message. They should not feel like a technical event. They should not require special knowledge. They should not become unpredictable when the network is busy. They should be cheap enough for everyday life and fast enough to feel natural.

That might sound obvious, but it’s also one of the hardest goals in all of blockchain. Because the more stablecoins grow, the more pressure they put on the networks they run on. And when those networks were designed for general activity, stablecoin payments become trapped inside the same congestion, fee spikes, and uncertainty that comes with everything else. Plasma’s purpose is to break stablecoins out of that crowd. It is built as stablecoin-first infrastructure, and it is trying to become the chain where digital dollars move at global scale without drama.

This is a full deep dive into Plasma and XPL, told as a complete lifecycle story from the first idea to where the project may be heading years from now. I’ll keep everything in clear simple English with a calm flow, and I’ll explain everything in long readable paragraphs without bullets or clutter. The goal here is not hype. It’s understanding.

The first idea behind Plasma begins with a truth that has slowly become impossible to ignore. Stablecoins are not a side product of crypto anymore. They are the main working currency of the industry. In many regions, stablecoins are already more useful than most volatile assets because people can actually plan with them. They can hold value in something that behaves like dollars while still enjoying the speed of crypto settlement. They can move funds across borders quickly. They can settle trades. They can pay workers. They can manage business cash flow.

Stablecoins became the tool that quietly turned crypto into something practical.

But stablecoins also revealed a weakness in the ecosystem. Stablecoin usage is growing faster than the rails designed to carry it. When stablecoins run on networks that are shared with thousands of other applications, the experience becomes inconsistent. Fees change unexpectedly. Transfers can be delayed. Confirmation times vary. And when you are making payments, unpredictability feels like danger.

Plasma was created because payments require a different kind of infrastructure than everything else. Payments demand stability. Not only stable value, but stable performance. A payment system cannot work “most of the time.” It must work all the time. A payment chain cannot be a fun experiment. It must be boring in the best way.

So Plasma’s first decision was philosophical. Instead of competing to be the chain for every narrative, it chose to specialize. It chose stablecoin payments as the primary reason for its existence. This is why Plasma is often described as a stablecoin-first Layer 1 network designed for high-volume, low-fee, near-instant transfers.

That focus changes everything. It changes how the chain is optimized. It changes what features matter. It changes who the target user is. It changes what success looks like.

In many blockchain ecosystems, success is measured by how much speculative activity happens. Plasma measures success in something simpler. Whether people can move stable value smoothly, at scale, in a way that feels like normal finance but without the limits of traditional banking.

The early framing of Plasma is strongly tied to stablecoins like USD₮ because USD₮ has become one of the most widely used stablecoins globally. When people send stablecoins across borders, they often use USD₮ because it is liquid and widely supported. Plasma recognizes that stablecoin usage is not just about the token itself, it is about the network experience around it. If the transfer feels slow, expensive, or confusing, the stablecoin loses part of its value.

So Plasma aims to make stablecoin transfers feel like the stablecoins were always meant to feel. Instant, cheap, and simple.

This is where the design begins to move beyond marketing and into structure.

One of the most important ideas behind Plasma is that stablecoins should not be treated as just another smart contract token among thousands. They should be native to the system. In practical terms, this means the chain is designed so stablecoin transfers can be optimized at the protocol level, not just handled like any other transaction. That is a major distinction. Because when a chain treats stablecoin transfers like everything else, it cannot guarantee stable fee behavior or stable throughput during high demand.

Plasma tries to make stablecoin movement its core job, and everything else becomes secondary.

This leads to one of Plasma’s most discussed goals. Near-zero or even zero-fee stablecoin transfers for the end user. People sometimes misunderstand this idea and assume it means “no cost at all.” In reality, networks always have costs. Validators must be rewarded. Hardware must be maintained. Security must be funded. But Plasma wants to abstract that cost away from the user experience, so sending stablecoins feels like a basic digital function, not a paid transaction event.

This is an important psychological move. Most people accept small fees in the background if the experience feels smooth. But they react negatively to visible fees when doing something as simple as sending money. Payment adoption depends on removing visible friction.

Plasma is trying to do that.

Another crucial part of Plasma’s design philosophy is solving the gas problem. In traditional crypto experiences, users often need to hold a separate token to pay network fees. This is one of the most common onboarding failures. A user wants to send stablecoins, but they can’t because they don’t have the gas token. That feels ridiculous to mainstream users. It is like being told you need a special key currency to open your own wallet.

Plasma aims to remove that friction through fee abstraction and a stablecoin-friendly gas model. The idea is to make it possible for users and apps to operate without forcing them to buy a second token just to move stablecoins. This matters because payment products live and die by simplicity. If you want stablecoins to compete with traditional payment apps, they must feel as easy.

This is one of those features that sounds technical, but it is actually emotional. When users don’t have to think, they feel safe. When they feel safe, they adopt.

Now we move into another major chapter of Plasma’s story, speed and settlement.

A payment network must feel immediate. You don’t want to pay for something and wait. You don’t want to send money and wonder when it will land. You don’t want to build a business workflow around uncertain settlement.

Plasma’s consensus is designed to provide fast finality, often described as sub-second finality through a BFT-style mechanism sometimes referred to as PlasmaBFT. The purpose of this is clear. Plasma wants the experience of sending stablecoins to feel instant and final. That brings blockchain payments closer to the expectations of modern digital users, who are used to instant confirmations in apps.

But unlike many Web2 payment systems, blockchain payments can provide settlement that is verifiable and direct, without relying on traditional banking intermediaries. Plasma is trying to combine the user experience of Web2 payments with the settlement benefits of blockchain.

This is the kind of combination that could reshape how money moves globally, especially in regions where banking systems are slow, expensive, or limited.

Now, Plasma also positions itself as EVM-compatible, and this is a strategic choice that impacts its future adoption more than people realize.

EVM compatibility means developers can use the familiar Ethereum tooling, smart contract languages, and frameworks. It means developers don’t have to relearn everything to build on Plasma. They can port applications, build new ones quickly, and integrate with an ecosystem of existing smart contract knowledge.

This matters because a chain without applications is not a payment economy. Plasma needs wallets, payment apps, merchant tools, bridges, stablecoin lending, payroll systems, remittance platforms, subscription tools, and everything else that makes stablecoins feel like a normal financial product.

By making itself EVM-compatible, Plasma aims to attract builders who want to ship quickly and focus on product rather than infrastructure learning.

Now let’s talk about liquidity, because payment networks require liquidity the same way roads require traffic. A network can be technically perfect, but if users can’t access stablecoin liquidity easily, it won’t grow.

Plasma has emphasized the idea of launching with deep stablecoin liquidity ready from the start. This is a crucial point, because many new chains fail not due to tech but due to emptiness. Users arrive, see no liquidity, see no applications, and leave. Plasma wants to avoid that by anchoring itself in stablecoin liquidity and practical usage from day one.

This is another sign of maturity. The project seems to understand that payments are not a “build it and they will come” market. Payments are a trust market. People need proof that the system is ready before they rely on it.

Now we come to the XPL token.

XPL is the native token of the Plasma network. Its role is tied to the network’s functioning and security. In many Layer 1 systems, the native token is used for validator incentives, staking, and maintaining network integrity. It becomes the economic foundation that supports the chain’s consensus.

Plasma’s purpose is to make stablecoin payments feel smooth, but the chain still needs a security engine behind the scenes. XPL fills that role. It supports validator incentives and network participation. It becomes the token that helps the network maintain reliability while stablecoin transfers remain user-friendly.

This is how many strong systems are designed. Users don’t need to think about the infrastructure token every day, but the network still depends on that token to function.

Plasma also includes ideas around Bitcoin integration, including discussions of Bitcoin-anchored security and native Bitcoin bridging that can bring BTC into smart contract environments. This is important because Bitcoin is widely seen as the strongest and most durable asset in the crypto ecosystem. If Plasma can integrate Bitcoin security ideas with stablecoin-first design and smart contract compatibility, it creates a unique identity. It becomes a network that respects the credibility of Bitcoin while serving the practical demand of stablecoins.

This mix is powerful because it connects three major crypto realities. Bitcoin as the most trusted base asset. Stablecoins as the most useful payment tool. Smart contracts as the programmable layer for modern finance.

Plasma is trying to bring them into a single network experience.

Now, to really understand Plasma, you have to look beyond the chain and into the human behavior it is designed to serve.

Stablecoins are not only for traders. The world is full of people who need money to move. Migrant workers sending remittances. Freelancers working online across borders. Small businesses paying suppliers internationally. Merchants accepting global payments. Communities funding projects. Families supporting each other. These are all real use cases that exist today.

Traditional finance can handle many of these things, but it often does so slowly, expensively, and with restrictions. Stablecoins solve the speed problem. They solve the access problem. But they sometimes struggle with the usability problem, because blockchain infrastructure was not built primarily for consumer payments.

Plasma is built to close that gap.

If it becomes widely adopted, the most important benefit might not even be technical. It might be emotional. People will feel that sending money is not heavy anymore. Not stressful. Not full of steps. Not full of hidden costs. Just simple value moving like information.

That is what payments should feel like.

Now, we must also be honest about the challenges ahead, because payment networks are among the hardest systems to build and grow.

The first challenge is trust. People don’t adopt new payment rails easily. They need reliability over time. Plasma must prove stability under load, stability under attack, and stability through market cycles.

The second challenge is regulation. Stablecoins exist in a complex regulatory environment. Governments pay attention to stablecoin growth because stablecoins touch banking, monetary policy, and global transfers. Plasma must remain adaptable as rules evolve.

The third challenge is competition. Many networks want stablecoin volume. Some already have massive liquidity, large user bases, and integrated wallets. Plasma must offer something clearly better in user experience and stablecoin-native design.

The fourth challenge is sustainability. Near-zero fees are attractive, but networks must still fund security. Plasma must balance a smooth user experience with a strong incentive model that keeps validators motivated.

The fifth challenge is ecosystem adoption. Plasma needs wallets, merchants, apps, and integrations. Without them, the chain becomes a payment road without destinations.

These challenges are significant, but they also show why Plasma’s mission is meaningful. It is aiming for a category where winning creates lasting value.

Now, where could Plasma be heading in five to ten years.

In one future, Plasma becomes a major stablecoin settlement layer, where stablecoin transfers feel instant, cheap, and reliable. Wallets integrate it. Merchants accept it. Remittance platforms build on it. Businesses use it for treasury movement and payroll. Stablecoins move through Plasma as naturally as email moves through the internet.

In that future, XPL becomes the security backbone of a payment economy. It becomes the stake behind global stablecoin settlement. The token’s meaning becomes deeper because it supports real usage rather than speculative hype.

In another future, Plasma becomes a specialized network used heavily in specific corridors, regions, or applications. It doesn’t have to dominate the entire world to be valuable. Payment rails can be meaningful even when they serve particular routes extremely well.

In the most ambitious future, Plasma becomes part of how the global financial system modernizes. Not as a replacement for everything, but as an open settlement rail that reduces friction, reduces costs, and expands access for people who have been underserved by traditional banking infrastructure.

And now we arrive at the ending that Plasma quietly points toward.

The future of crypto is not only about building new assets. It is about making money movement normal.

We’re seeing a world where digital dollars are becoming common. Where people value stability. Where businesses value speed. Where communities value access. Where borders matter less than they used to, because work and life are increasingly global.

Plasma is trying to be the network where that world feels smooth. Where sending value feels like sending information. Where stablecoins stop feeling like a crypto trick and start feeling like a real payment language.

I’m not saying Plasma will be the only network that matters in this space. But I can see why it exists. It exists because stablecoins are already the most practical product crypto ever created, and now they need rails that match their importance.

If Plasma succeeds, years from now you might not remember the first time you heard the name Plasma. You will just experience the result. Money that moves without weight. Payments that arrive without worry. A financial system that feels less like a maze and more like a path.

And that is a future worth building.