When I think about Plasma, I don’t imagine a protocol trying to win attention. I imagine something far less visible: infrastructure that disappears into routine. The kind of system people rely on daily without ever feeling the need to explain how it works. Money moves, balances update, nothing breaks and nobody tweets about it.

That mental image reframes the entire project. Most blockchains feel like tools you’re expected to study before you’re allowed to use them. Plasma feels like it’s starting from a more uncomfortable premise: stablecoins are already money for millions of people, and the chain’s responsibility is to interfere as little as possible.

In that context, technical features stop sounding like selling points. Full EVM compatibility, fast settlement, modern consensus these aren’t personality traits here. They’re background conditions, like electricity or bandwidth. The real design question sits elsewhere: can moving dollars on-chain feel closer to sending a message than executing a protocol?

This is where gasless stablecoin transfers stop being a gimmick and start revealing intent. It’s not about shaving seconds or reducing fees. It’s an admission that the default crypto experience is inverted. In everyday life, nobody is asked to first acquire a volatile asset just to be permitted to move value. Plasma doesn’t try to retrain users out of that expectation. It adapts the protocol to it, even if that means the system temporarily absorbs complexity on the user’s behalf.

Of course, that choice isn’t neutral. Sponsoring transactions introduces decisions: limits, eligibility, abuse prevention. Decisions create policy, and policy concentrates power. The interesting part isn’t pretending that tension doesn’t exist—it’s whether the system is designed with the expectation that those rules will need to evolve, loosen, and decentralize over time. Plasma’s architecture feels aware that neutrality is something you move toward slowly, not something you declare on day one.

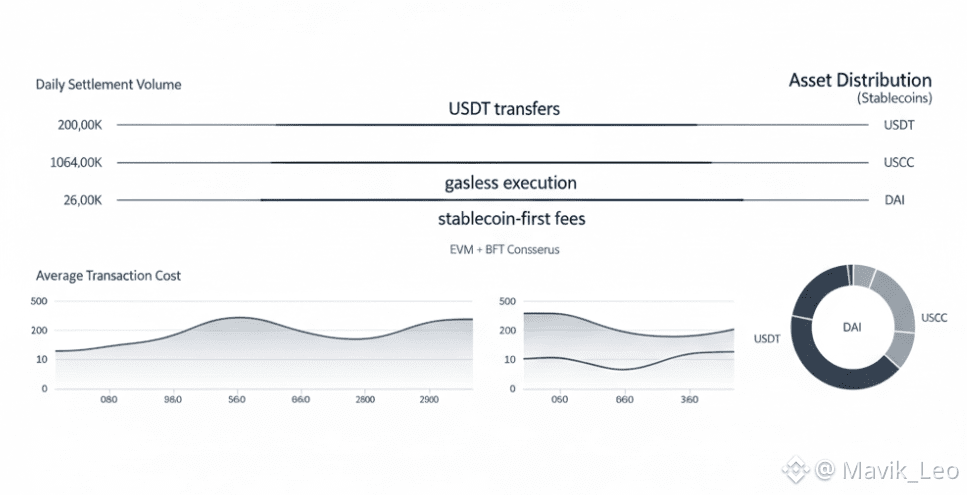

The same thinking shows up in stablecoin-first fees. Paying network costs in the same unit your books are already denominated in sounds trivial until you notice how rare it is at the base layer. For institutions, merchants, or anyone managing real balances, this isn’t a UX nicety. It’s operational sanity. Forcing users to hold a second asset just to keep transactions flowing isn’t decentralization it’s friction. And friction, when it accumulates quietly, is how adoption dies without drama.

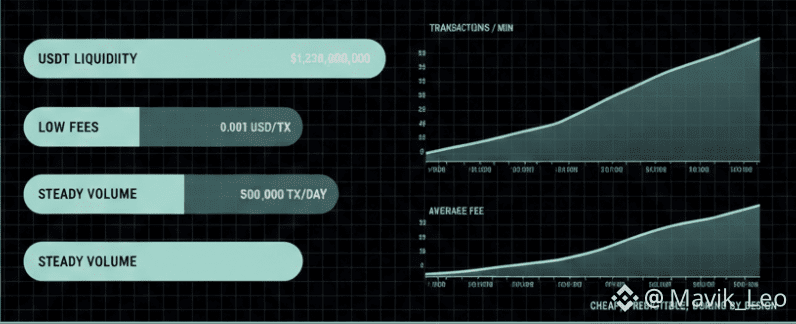

What stands out when you look at Plasma’s on-chain behavior is how uneventful it feels and that’s meant as praise. Stable value dominates. Fees are low. Activity looks less like speculation and more like parking and movement. This isn’t a chain optimized to extract excitement from users. It looks like a place value sits because it’s predictable to move. That’s what working payment infrastructure looks like once the novelty wears off.

That calm surface hides the hardest question Plasma faces. If transactions are cheap and often subsidized, what ultimately funds security? The native token has roles in staking, governance, and non-sponsored activity, but the familiar story—higher fees automatically benefiting the token—doesn’t map cleanly here. Plasma seems to be betting on scale, on volume, and on becoming a default settlement layer rather than a high-margin toll road. It’s a quieter bet, and a riskier one, because it depends on patience more than hype.

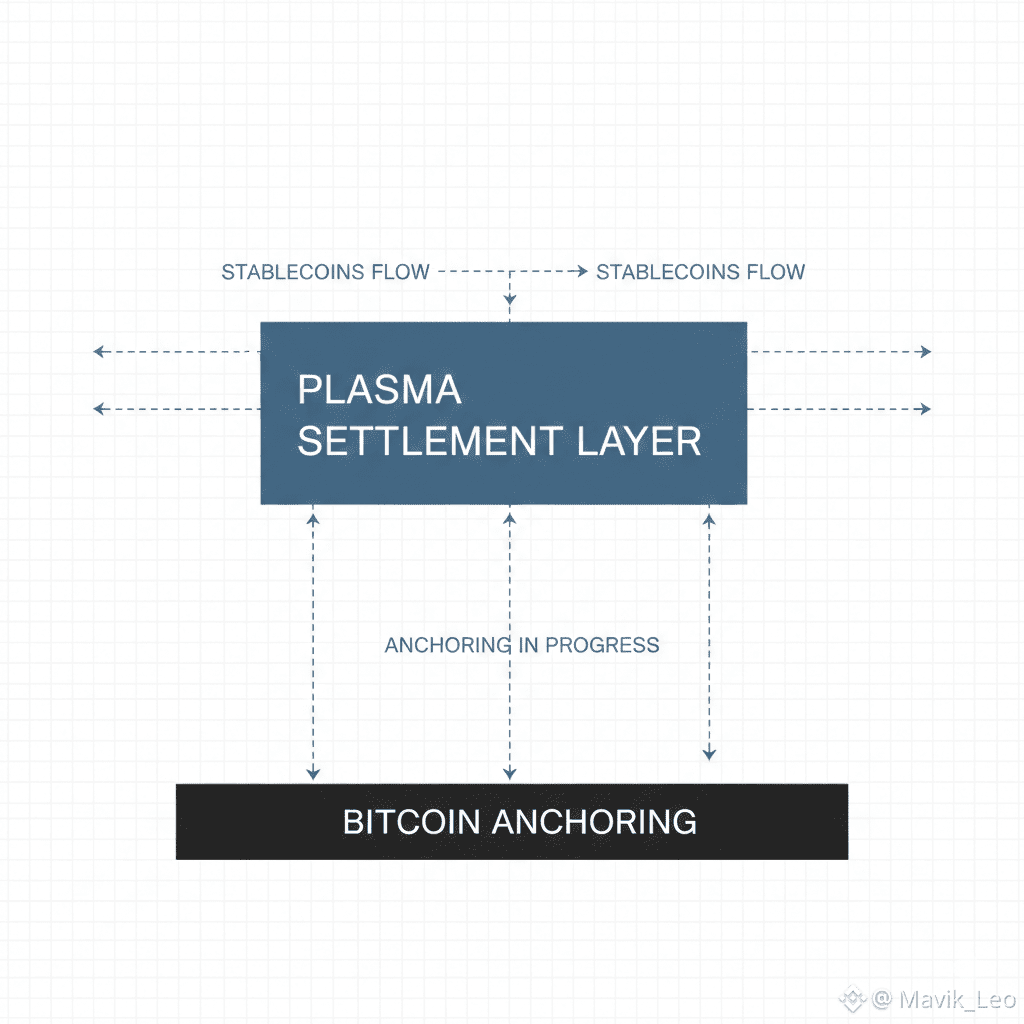

The idea of anchoring parts of the system to Bitcoin fits neatly into this philosophy. It signals a desire not to be the final authority. At the same time, it’s honest to admit that this remains a direction rather than a finished state. Bridges are difficult. Credibility only matters once mechanisms are live, decentralized, and boringly reliable. Plasma doesn’t seem to confuse intention with completion, which is already a form of discipline.

What makes Plasma compelling isn’t that it promises transformation. It’s that it seems comfortable being ignored. It’s focused on removing small, persistent irritations that users have normalized for years and seeing what happens when those frictions disappear. If it works, the result won’t feel revolutionary. It will feel inevitable.

And maybe that’s the real test. The best payment systems don’t announce themselves as breakthroughs. They fade into habit. If Plasma ever reaches that point, it won’t be because of a headline feature or a loud roadmap update. It will be because people keep using it quietly, repeatedly to move stable value without ever thinking about the chain underneath.