🚨 Yield Alert: Lista DAO is crushing BNBFi in Jan 2026 with locked 2.74% Fixed Rate Loans & ultra-low USD1 borrowing (~1.98% on PT-USDe) – collateralize BNB/slISBNB/BTCB.

Borrow predictably without rate swings, stack 20%+ APY on Binance Earn or RWA Treasuries, and compound with 36.75% veLISTA rewards!

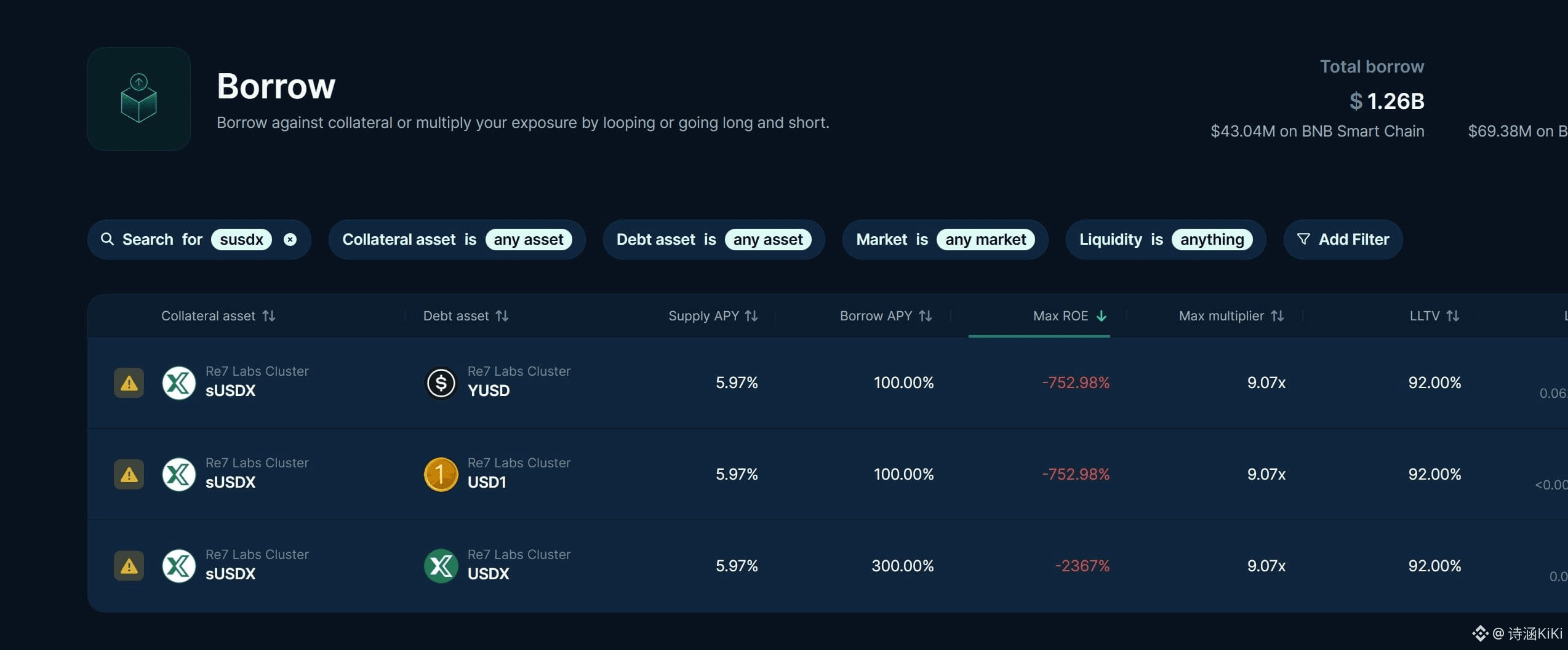

This isn't basic lending; it's a full-stack yield optimizer turning idle assets into multi-layered earners while keeping risks dialed down.

Lista DAO's powerhouse edge? Its hybrid LSDFi + CDP model delivers unmatched capital efficiency: slisBNB liquid-stakes BNB for 5-8% APY while fully collateralized – borrow without unstaking. @ListaDAO #USD1理财最佳策略ListaDAO $LISTA

Layer staking rewards atop arb plays. PT-USDe integration locks Ethena yields (10%+ base) at sub-2% borrow costs, solvBTC/BTCB add BTC-native stability/upside.

Fixed-Term Lending (7/14/30 days) eliminates volatility for pro strategies – hedge, arb, or structure with certainty, far superior to variable-rate chaos.