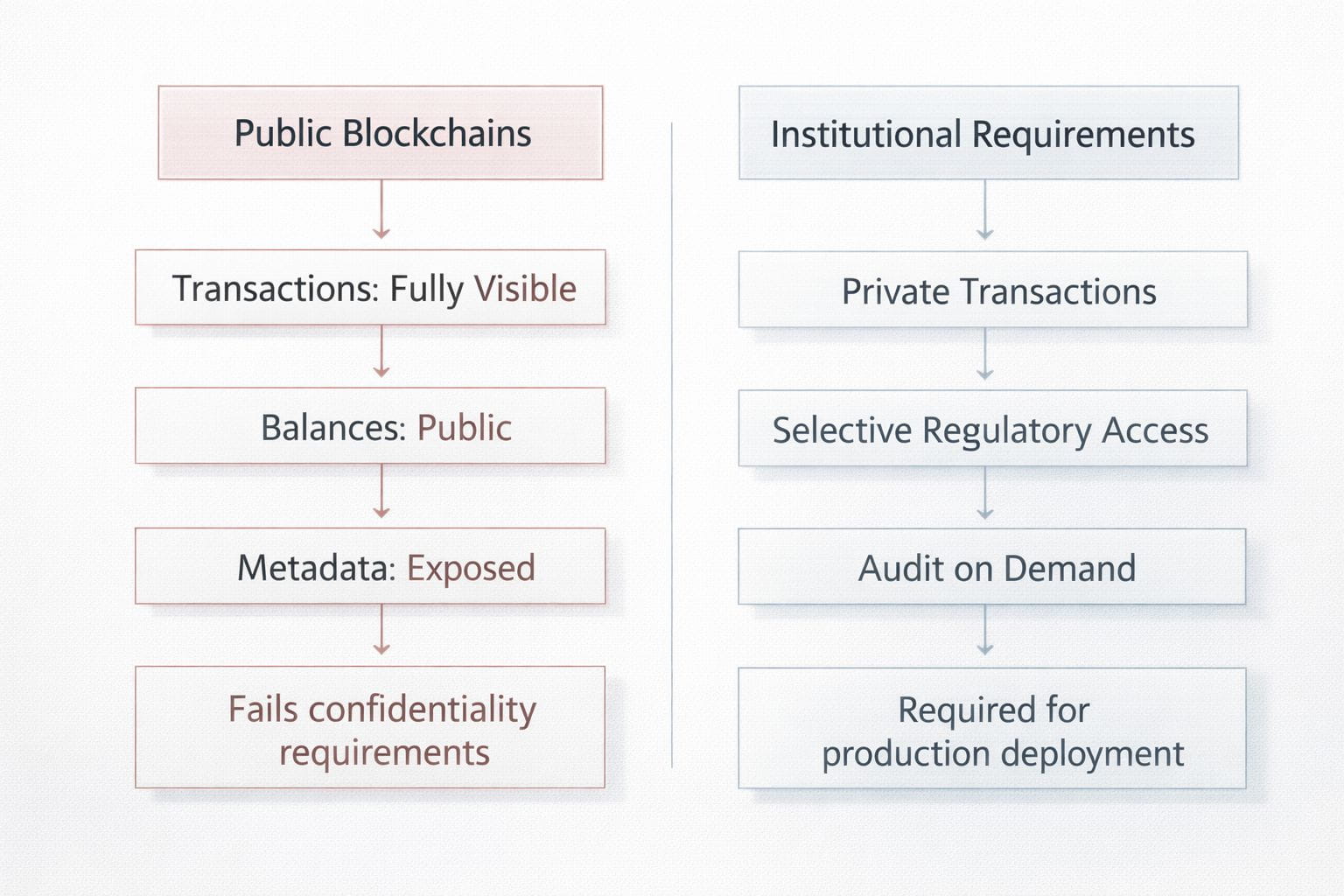

After analyzing dozens of Layer 1. I have come to realize that the most valuable infrastructure in crypto is often the one you barely see working. When I revisited Dusk Foundation with fresh eyes. I was not looking for hype signals or short term catalysts. I was looking for architectural intent. In my assessment Dusk is one of the few blockchains that was designed with an honest understanding of how regulated finance actually operates not how crypto Twitter wishes it would. My research into recent institutional blockchain pilots shows a clear pattern. Adoption does not fail because of lack of throughput or composability. It fails because sensitive financial data cannot live on fully transparent ledgers. According to a 2024 BIS report over 60 percent of banks testing tokenized assets cited confidentiality as the primary blocker to production deployment. That statistic alone reframes how we should evaluate projects like Dusk.

Dusk is a Layer 1 but it does not behave like one in the usual sense. Instead of competing for users. It competes for trust frameworks. Privacy on Dusk is not an add on it is the default state with auditability embedded where it legally matters.

Think of compliance as the foundation not just an add on.

I took another look at how Dusk's protocol works especially how it uses zero knowledge proofs to keep transactions private. Here is a way to picture it is regular blockchains are like glass buildings you can see everything happening inside. Dusk feels more like a private office. Only the right people get to check what is going on but even then they don't get to listen in on every conversation. That difference is not just technical. It's actually a big deal. When I dug into the EU's tokenization rules. I found that laws like MiCA don't ask for public transparency on every transaction. What they want is transparency for regulators so they can audit things when they need to. Dusk is built for that. The EU's 2023 DLT Pilot Regime puts a spotlight on selective disclosure and that is basically Dusk's whole approach. Deloitte's 2024 global blockchain survey found that 52 percent of institutional respondents care more about privacy preserving compliance than scalability when picking blockchain infrastructure. That flips the retail narrative entirely. Dusk is not falling behind. It just plays by different rules. On one side you have got public blockchains. Then you have got modular privacy solutions and finally privacy compliant chains like Dusk. Stack them up by how much data they show by default how well they line up with regulations and how tricky they are to run. You will start to see the real differences. Now imagine a second table. This one matches up financial tools stuff like tokenized bonds or private funds with the level of privacy each one needs. That is where Dusk really starts to stand out.

So how does Dusk stack up against other Layer 1s or scaling solutions?

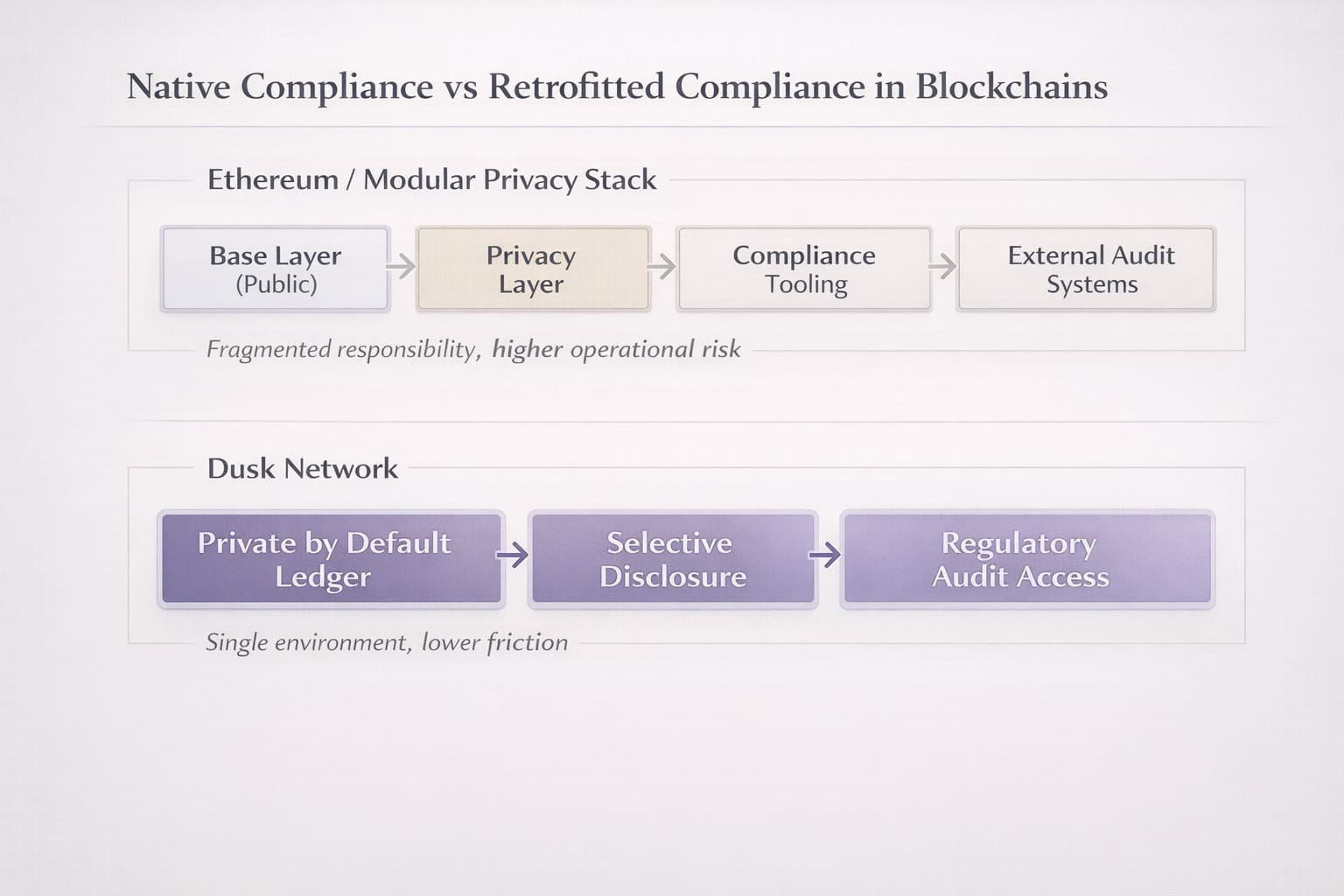

Honestly it only makes sense to compare Dusk to Ethereum or Solana if we are crystal clear on what each is aiming for. Ethereum's all about openness and building blocks anyone can use perfect for permissionless DeFi Solana chases speed and low fees which pulls in apps that need to move fast. Dusk? It's in a different league, focused on privacy and compliance from the ground up. Neither was built with regulatory confidentiality as a base-layer assumption. Some scaling solutions attempt to solve this with privacy rollups or application specific layers. From what I have seen, this way of thinking actually piles more responsibility on developers and makes legal and audit work harder. PwC's 2024 report on blockchain governance backs this up saying that when compliance is fragmented institutions face more operational challenge not less.

Dusk's advantage is simplicity from an institutional standpoint. Confidentiality, settlement finality and audit access exist in a single environment. That may limit composability today but it dramatically lowers friction for regulated deployments. In long term infrastructure plays reduced friction often beats optional flexibility. A useful chart visual here would illustrate the data exposure paths on Ethereum with privacy add ons versus Dusk's native flow. Another visual could show how many compliance layers institutions must integrate on different chains to reach production readiness. That lack of visible progress can frustrate retail markets. There is also the risk that larger networks successfully integrate comparable privacy compliance frameworks, compressing Dusk's differentiation over time. However, my research suggests that retrofitting regulation is significantly harder than designing for it. Infrastructure built for compliance tends to age better than infrastructure forced into it.

My Closing perspective

After reviewing Dusk Foundation from multiple angles. My conclusion is not about immediate upside. It's about inevitability. Regulation is not a temporary phase in crypto. It is the environment we are moving into. Dusk does not promise a world without oversight. It offers a way to operate within oversight without sacrificing decentralization. That balance is rare and it is expensive to design correctly. In markets what is boring today often becomes essential tomorrow and when that shift happens the most important advantage is not visibility. It's readiness.