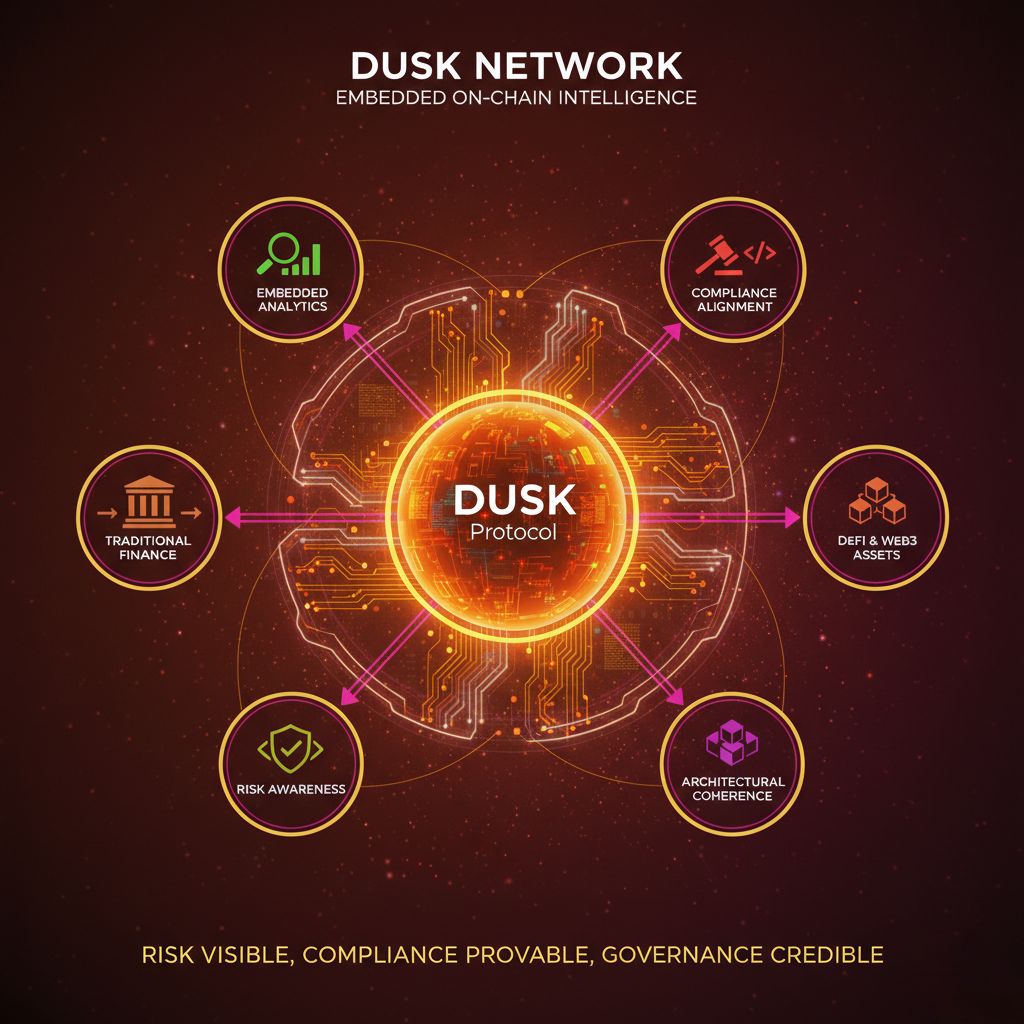

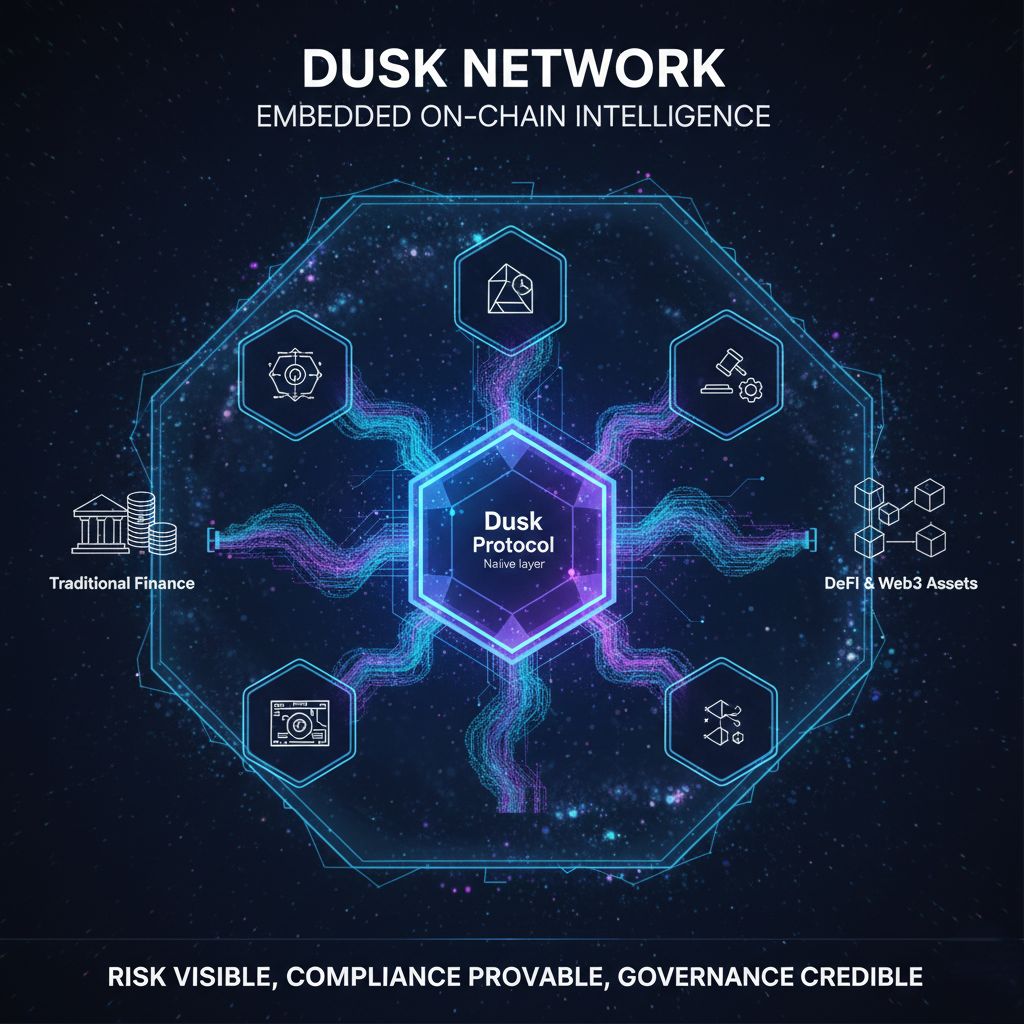

Founded in 2018, Dusk was conceived around a structural insight that most blockchain systems still struggle to address. Financial markets do not fail primarily because of insufficient throughput or composability. They fail when information is asymmetric, when risk is opaque, and when compliance and oversight are layered on after execution rather than enforced at the point of settlement. Dusk approaches blockchain design from this institutional reality, embedding analytics, transparency, and regulatory awareness directly into the base layer rather than treating them as external services.

At the core of Dusk’s architecture is the idea that data intelligence must be native to the protocol. In traditional finance, analytics are inseparable from market infrastructure. Order books, clearing systems, and custodians all produce structured, auditable data in real time. Dusk mirrors this principle on chain by ensuring that transaction validity, compliance conditions, and state transitions are continuously provable at the protocol level. Rather than exposing raw transactional data, the network produces cryptographic attestations that confirm correctness, rule adherence, and solvency constraints. This approach preserves confidentiality while still enabling precise analytical insight into system health and behavior.

Real time data intelligence on Dusk is not built around dashboards or off chain monitoring tools. It is enforced through deterministic execution and verifiable state transitions. Every transaction carries with it embedded proof that predefined conditions have been met, whether those conditions relate to balance integrity, permissioning, or regulatory constraints. This transforms analytics from a retrospective activity into a live component of execution. Risk is assessed before settlement finality rather than after exposure has already occurred, aligning more closely with how regulated markets operate.

Transparency on Dusk is deliberately selective rather than absolute. Public blockchains typically equate transparency with full disclosure, an approach that conflicts with the confidentiality requirements of institutional finance. Dusk instead adopts a model where transparency is expressed through verifiability. Regulators, auditors, and authorized entities can confirm that rules are being followed without accessing sensitive commercial data. This distinction is critical for institutions that must demonstrate compliance without compromising client privacy or trading strategies. It also enables a more nuanced form of oversight that scales with regulatory complexity.

Risk awareness is embedded into Dusk through its consensus and execution design. The network’s settlement logic emphasizes deterministic finality and provable correctness, reducing ambiguity around transaction completion and counterparty exposure. By enforcing strict validation rules at the base layer, Dusk minimizes classes of operational risk that often emerge from loosely governed smart contract environments. This is particularly relevant for tokenized real world assets and regulated financial instruments, where settlement risk and legal finality are not abstract concerns but binding obligations.

Compliance alignment on Dusk is not dependent on external enforcement or discretionary governance. The protocol is structured so that compliance conditions can be expressed directly in on chain logic and verified through zero knowledge proofs. This allows financial applications to encode jurisdictional requirements, eligibility rules, and reporting constraints directly into their execution environment. As a result, compliance becomes a property of the transaction itself rather than an after the fact reconciliation process. For regulators, this creates a system where oversight is continuous and cryptographically enforced rather than episodic and manual.

Governance within the Dusk ecosystem is informed by the same analytical foundations. Protocol level decisions are grounded in measurable network behavior, including validator performance, settlement integrity, and system utilization. Because the underlying data is verifiable and tamper resistant, governance discussions can rely on objective signals rather than speculative narratives. This is particularly important in institutional contexts, where governance credibility depends on transparency of process and accountability of outcomes.

From an institutional perspective, the significance of Dusk lies not in any single feature but in its architectural coherence. Analytics, risk management, compliance, and oversight are not external layers competing for data access. They are native properties of the protocol, enforced through cryptography and consensus. This reduces operational complexity and aligns incentives across participants, from developers and validators to regulators and end users.

As financial markets continue to explore on chain settlement and asset issuance, the limitations of transparency without context and decentralization without accountability are becoming increasingly apparent. Dusk represents a deliberate response to these constraints. By treating analytics as foundational infrastructure rather than optional tooling, it offers a model for how blockchain systems can evolve beyond experimental markets and toward environments capable of supporting regulated capital at scale. The long term relevance of such systems will depend not on narrative momentum, but on their ability to make risk visible, compliance provable, and governance credible within the protocol itself.