Most blockchains try to impress you early. Fast TPS claims, flashy dashboards, aggressive marketing. Dusk does none of that — and that’s precisely why it deserves attention. When you strip away hype, what’s left is architecture designed for environments where mistakes are expensive and regulation is unavoidable.

Dusk isn’t optimizing for retail excitement. It’s optimizing for financial correctness.

That distinction changes everything.

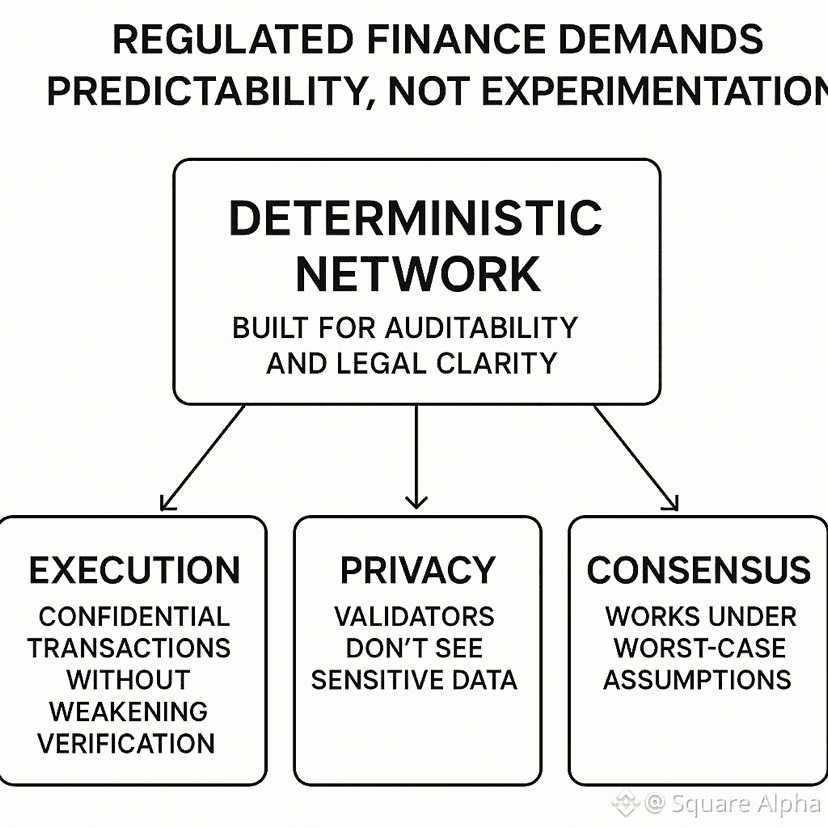

Regulated Finance Demands Predictability, Not Experimentation

Traditional finance doesn’t care about novelty. It cares about determinism, auditability, and legal clarity. Dusk’s Layer 1 is built around those constraints rather than fighting them.

The network separates execution, privacy, and consensus in a way that allows confidential transactions to exist without weakening verification. Validators don’t need to see sensitive data to confirm correctness. That’s not just privacy — that’s operational discipline.

This design choice explains why Dusk development appears slower than hype-driven chains. Every component must work under worst-case assumptions: audits, regulators, institutions, and real capital flows.

DuskEVM Is a Strategic Unlock, Not a Feature Upgrade

EVM compatibility is often marketed as a checkbox. On Dusk, it’s a structural unlock.

With DuskEVM settling directly on the Layer 1, developers can deploy Solidity contracts while inheriting compliance-aware privacy at the base layer. This matters because institutions do not want fragmented stacks or experimental tooling. They want familiarity with constraints baked in.

This turns Dusk from a “specialized chain” into a compliant execution environment. Not louder — broader.

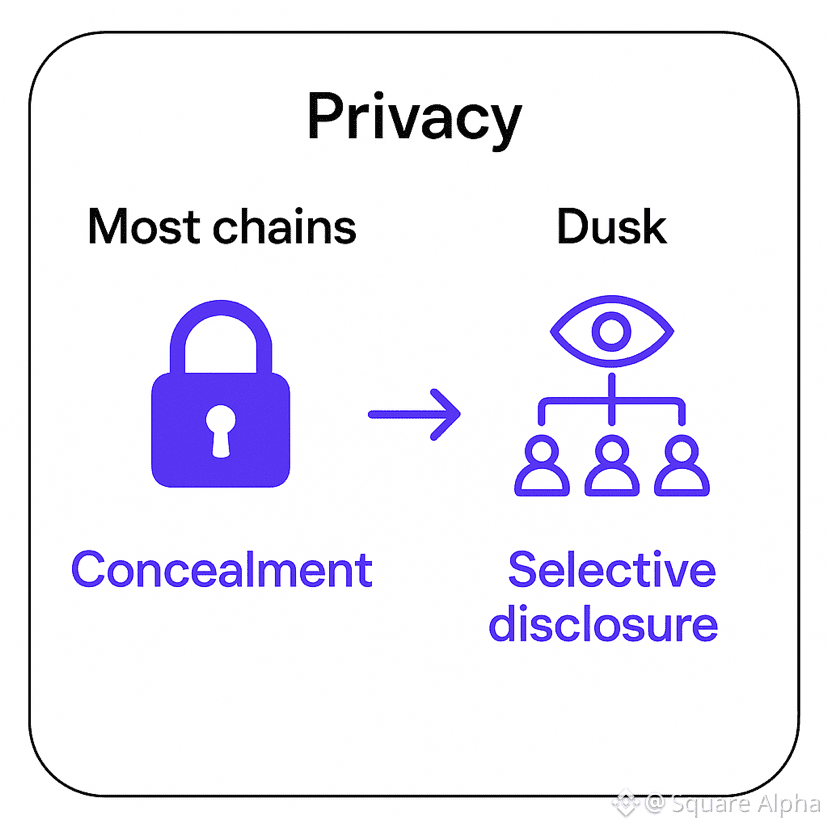

Hedger Changes the Meaning of Privacy

Most chains treat privacy as concealment. Dusk treats it as selective disclosure.

Hedger enables confidential computation using zero-knowledge proofs and homomorphic encryption, allowing transaction correctness to be proven without revealing inputs. That distinction is subtle, but critical.

In regulated finance, privacy isn’t about hiding activity. It’s about controlling who can see what — and when. Hedger’s live Alpha shows that Dusk understands this at the protocol level, not as an afterthought.

That’s why Hedger is more than a privacy tool. It’s a compliance primitive.

DuskTrade Is Where Theory Meets Accountability

Tokenized RWAs are easy to talk about. They’re hard to execute.

DuskTrade, launching in 2026 with NPEX, introduces regulated securities directly onto Dusk’s settlement layer. €300M+ in tokenized assets isn’t marketing — it’s liability, reporting, custody, and enforcement.

This is where many blockchain projects fail. They underestimate the operational weight of real assets. Dusk embraces it.

The January waitlist opening signals readiness, not speculation. Onboarding precedes volume. That’s how real markets form.

What This Means for DUSK

$DUSK is not designed for narrative velocity. It’s designed for system participation.

Its role spans:

Network security via staking

Transaction execution across Layer 1 and DuskEVM

Settlement activity tied to RWA flows

As infrastructure activates, usage becomes structural. That’s a different demand curve than speculative trading. Slower — but harder to disrupt.

This is not a token that benefits from hype spikes. It benefits from sustained operation.

Why Dusk Scores High When Framed Correctly

CreatorPad systems don’t reward excitement. They reward:

Execution clarity

Infrastructure relevance

Real timelines

Functional integration

Dusk checks those boxes when discussed through architecture and delivery — not price or promises.

That’s why technical, execution-focused articles outperform narrative fluff.

Final Thought

Dusk doesn’t look exciting at first glance. No viral hooks. No exaggerated claims. Just infrastructure built for environments where failure is unacceptable.

That’s not a weakness. It’s a filter.

If regulated finance moves on-chain — and evidence suggests it will — networks like Dusk won’t need to pivot. They’ll already be where the flow is heading.