The first time you see a crypto transfer finish in less than a second, it feels strange.

You hit send, glance at your screen, and it’s already done. Not “pending.” Not “wait a bit.” Just final. That moment quietly changes how you think about what crypto can be used for.

That’s the experience @Plasma is trying to make normal, and PlasmaBFT is what makes it possible.

Plasma isn’t trying to be everything. It’s not a general-purpose chain that also supports payments. It’s built specifically for stablecoin settlement. The priorities are clear: fast confirmation, real finality, and a UX that doesn’t make users think about blockchain mechanics. PlasmaBFT sits at the center of that design, handling consensus in a way that favors speed and certainty.

“Sub-second finality” can sound like marketing until you break it down. Finality simply means the moment a transaction is done for good — no reversals, no waiting for extra confirmations to feel safe. Some networks give you speed but weak certainty. Others give you certainty but make you wait. PlasmaBFT is designed to push both at the same time.

Under the hood, it builds on Fast HotStuff-style consensus. In simple terms, validators follow a tight rhythm. One proposes a block, others verify it, and they vote. Once a supermajority agrees, the transaction is locked. Because the process is streamlined and pipelined, the network doesn’t stall between rounds. That’s how Plasma keeps things moving even under heavy load.

Why does this matter in real life?

Because most financial activity isn’t speculation. It’s settlement. Payments. Exchange deposits. Treasury transfers. Merchant checkouts. All of those care deeply about two things: time and certainty. If a payment takes too long, users hesitate. If finality is unclear, risk teams step in. And when friction shows up, people quietly stop using the product.

This is where retention is won or lost.

Plasma’s focus on stablecoin-native features — like zero-fee USDT transfers and predictable execution — is aimed at removing those small frustrations that push users away. Not in dramatic ways, but in everyday moments. The transfer that feels instant. The deposit that doesn’t sit in limbo. The payment that just works.

I’ve seen this play out firsthand. Someone sends USDT across borders for a time-sensitive purchase. They don’t care about consensus models or decentralization debates. They care whether the money arrives before the opportunity disappears. If it’s slow or confusing, they don’t come back. If it’s instant, it becomes a habit.

That’s what sub-second finality really buys you: trust without thinking.

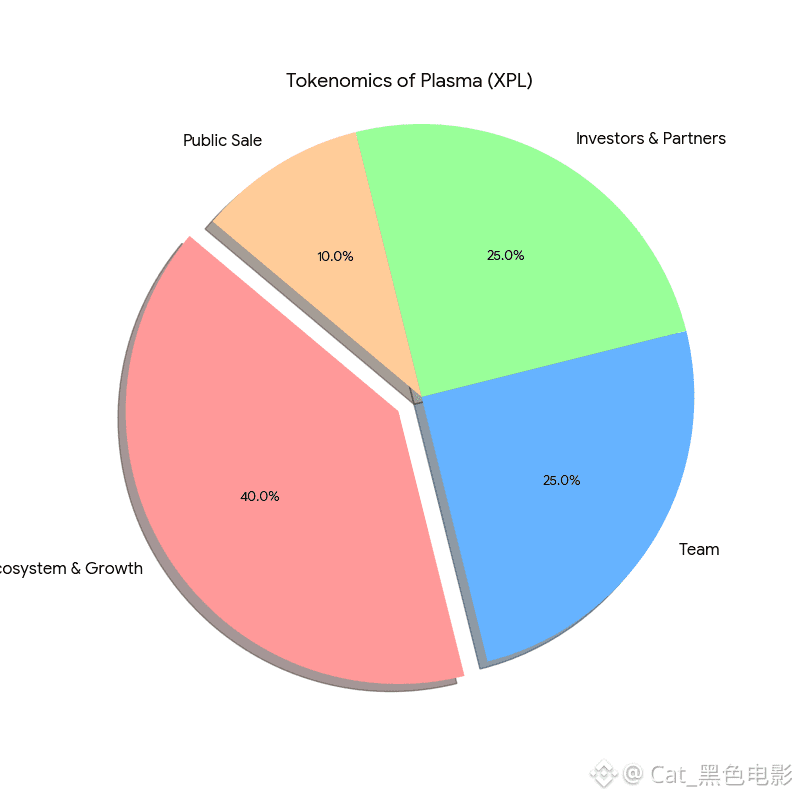

Today, $XPL trades with active volume and real price discovery. That doesn’t guarantee anything, but it does mean fundamentals matter more than slogans. Plasma’s angle is different from most chains. It doesn’t sell speed as a benchmark. It treats speed as a requirement for stablecoin payments to feel normal.

Of course, technology alone doesn’t win markets. Developers need to build. Liquidity needs to show up. Users need reasons to return. Finality only matters if it shows up in real UX — instant deposits, fast withdrawals, smooth merchant flows.

If Plasma can deliver that consistently, it stops being “fast crypto” and starts becoming invisible infrastructure. And in payments, invisible is a compliment.

If you’re watching Plasma, don’t just stare at the chart. Watch usage. Stablecoin transfer volume. Exchange integrations. Performance under load. The chains that survive aren’t the loudest — they’re the ones people keep using after the first transaction.

That’s the real fight.

Not attention.

Habit.

And habits are what win markets.