🚨 JAPAN COULD SHAKE GLOBAL MARKETS WITHIN 48 HOURS$BNB

The Bank of Japan is set to hike rates again today, pushing Japanese government bond yields to historic highs.

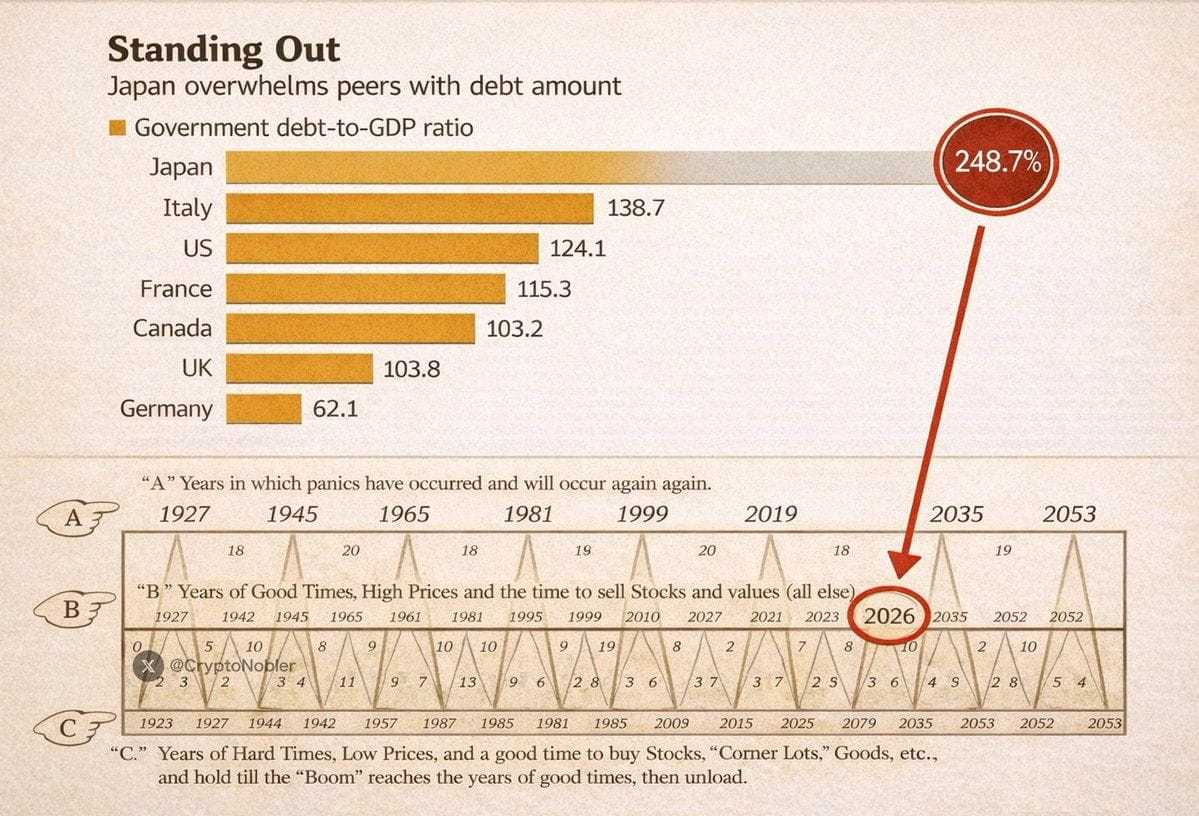

Japan is carrying nearly 0 TRILLION in debt—and it keeps growing.

This is a dangerous mix.

For decades, Japan survived on near-zero interest rates.

That era is over.

Now the math turns unforgiving.

Rising yields mean: → Debt-servicing costs surge

→ Interest eats into government revenue

→ Fiscal flexibility vanishes

No modern economy exits this cleanly: → Default

→ Restructuring

→ Or inflation

And Japan won’t crack alone.

Japan holds trillions in overseas assets: → Over $1T in U.S. Treasuries

→ Hundreds of billions in global stocks and bonds

Those positions made sense when Japanese yields were near zero.

After today’s hike, domestic bonds finally offer real returns.

Once currency hedging is applied, U.S. Treasuries can actually lose money for Japanese investors.

This isn’t fear. It’s math.

Capital comes home.

Even a few hundred billion dollars repatriating isn’t orderly—it creates a global liquidity vacuum.

Then comes the real catalyst: the yen carry trade.

Over $1 TRILLION borrowed cheaply in yen and poured into: → Stocks

→ Crypto

→ Emerging markets

As rates rise and the yen strengthens: → Trades unwind

→ Margin calls trigger

→ Forced selling begins

→ Correlations go to one

Everything sells—at the same time.

Meanwhile: → U.S.–Japan yield spreads are narrowing

→ Japan has less reason to keep money overseas

→ U.S. borrowing costs climb

And the BoJ may not be done.

Another hike? → Yen spikes

→ Carry trades implode harder

→ Risk assets feel it instantly

Japan can’t simply print anymore.

Inflation is already elevated.

Print more → Yen weakens → Import costs surge → Domestic pressure explodes

They’re trapped between debt and currency—and the walls are closing in.

For 30 years, Japanese yields were the invisible anchor holding global rates down.

Every portfolio since the 1990s depended on it—whether they knew it or not.

That anchor just snapped.

→ Bonds fall

→ Stocks fall harder

→ Crypto falls hardest

This is how “everything’s fine” turns into everything breaking at once.

We’re entering a market no living trader has experienced.

I’ve been calling major tops and bottoms for over a decade.

I warned before Japan shook markets in 2025.

After today’s rate hike—I’m warning again.

Follow and turn on notifications before it’s too late.