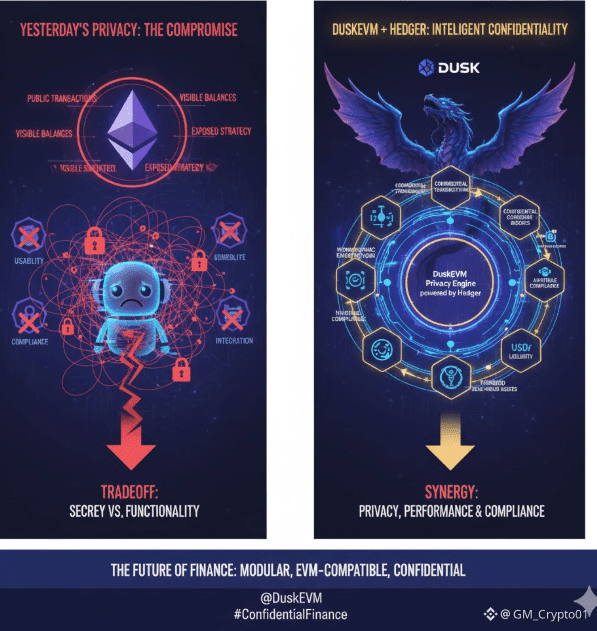

For years, privacy in crypto has been overlooked. Early blockchain systems were built for transparency, and while that transparency created trust, it also created real risks. Every transaction, every balance, every transfer could be seen by anyone. Traders and institutions had to reveal strategies, positions, and holdings, leaving them exposed. Early privacy solutions tried to fix this but often came with trade-offs: they were slow, difficult to integrate, or incompatible with the tools developers already relied on. Hedger, the new privacy engine for DuskEVM, approaches the problem differently. Privacy is not an add-on. It is built into the system from the ground up, while still being fast, easy to use, and compliant with regulations.

Privacy in finance is not a luxury. For enterprises and regulated markets, it is essential. It protects strategies, builds trust, and allows organizations to operate securely. Most blockchains today ignore this. Platforms like Ethereum expose nearly everything, and this level of openness can be dangerous for anyone handling large amounts of capital or sensitive positions. Hedger solves this by keeping transactions confidential while staying fully compatible with the tools and workflows developers already use.

Hedger was designed for the account-based model of the EVM, which makes it different from older privacy systems. Account-based blockchains are the backbone of DeFi and smart contracts, and Hedger fits seamlessly into that world. Developers can deploy contracts, manage assets, and integrate privacy without having to relearn everything. Privacy becomes natural, not a complication.

The real impact is easiest to see in trading. Public order books reveal strategies, leaving large trades vulnerable to manipulation. Hedger enables confidential order books, allowing trades to happen without exposing intent. Asset ownership and balances remain fully encrypted, while regulators can still audit when necessary. Privacy and oversight coexist.

Hedger also changes how liquidity and capital work. Enterprises can use USDf and DuskEVM to access liquidity without selling assets. A company can collateralize digital and tokenized real-world assets to unlock capital while keeping ownership intact. Capital becomes productive without exposure. Yield emerges from intelligent infrastructure rather than frantic trading.

Speed and usability are crucial. Hedger allows proofs to be generated in-browser in seconds, so users can transact quickly, developers can integrate seamlessly, and regulators can verify without slowing the system down. Privacy no longer comes at the cost of efficiency.

Hedger and DuskEVM represent a new kind of on-chain finance. Institutions can integrate tokenized real-world assets, digital securities, and conventional instruments into a single framework that balances privacy, compliance, and usability. Liquidity flows naturally, capital remains secure, and real-world finance can operate confidently on-chain.

This is a turning point for crypto. Many platforms chase hype, trends, or token incentives. Hedger focuses on readiness, reliability, and real-world utility. It shows that blockchain can serve enterprise needs, regulated markets, and strategic capital. Privacy is no longer optional. It is the standard.

Hedger is more than a privacy engine. It is a vision for blockchain finance where confidentiality, compliance, and usability form the foundation. Liquidity moves freely, capital works without compromise, and privacy is a principle, not a feature. DuskEVM and Hedger prove that blockchain can be secure, practical, and intelligent. This is how real finance meets crypto, and it is only the beginning.