After analyzing how real financial systems operate behind the scenes. I have realized that the future of blockchain adoption won't be decided by hype cycles but by architecture choices most users never see. When I took another deep look at Dusk Foundation. I approached it differently than before. Instead of asking whether it could attract users quickly. I asked whether it could survive contact with regulators, auditors and institutional risk committees. In my assessment that question is far more important for long term relevance and it’s exactly where Dusk quietly stands apart.

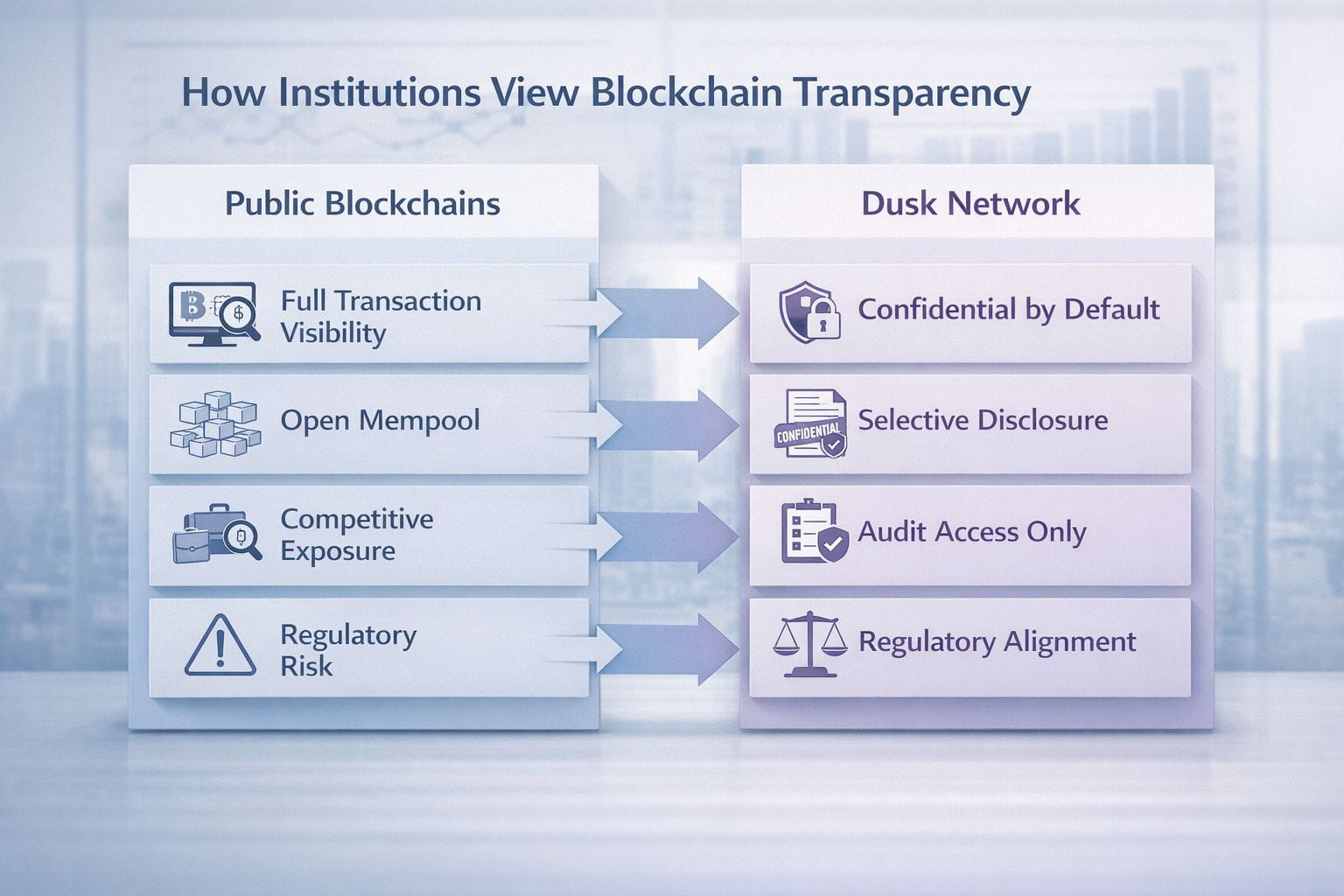

My research into institutional blockchain adoption shows a consistent theme. Banks, asset managers and issuers don't reject public blockchains because they dislike decentralization. They reject them because transparency without context becomes a liability. According to a 2024 report by the Bank for International Settlements over 65 percent of financial institutions testing tokenized assets identified data confidentiality as a non negotiable requirement for production systems.

Dusk was founded in 2018 long before regulation became a dominant narrative in crypto. That timing matters. It suggests intent rather than reaction. The protocol was not retrofitted for compliance. It was shaped around it.

Why confidentiality is becoming non optional?

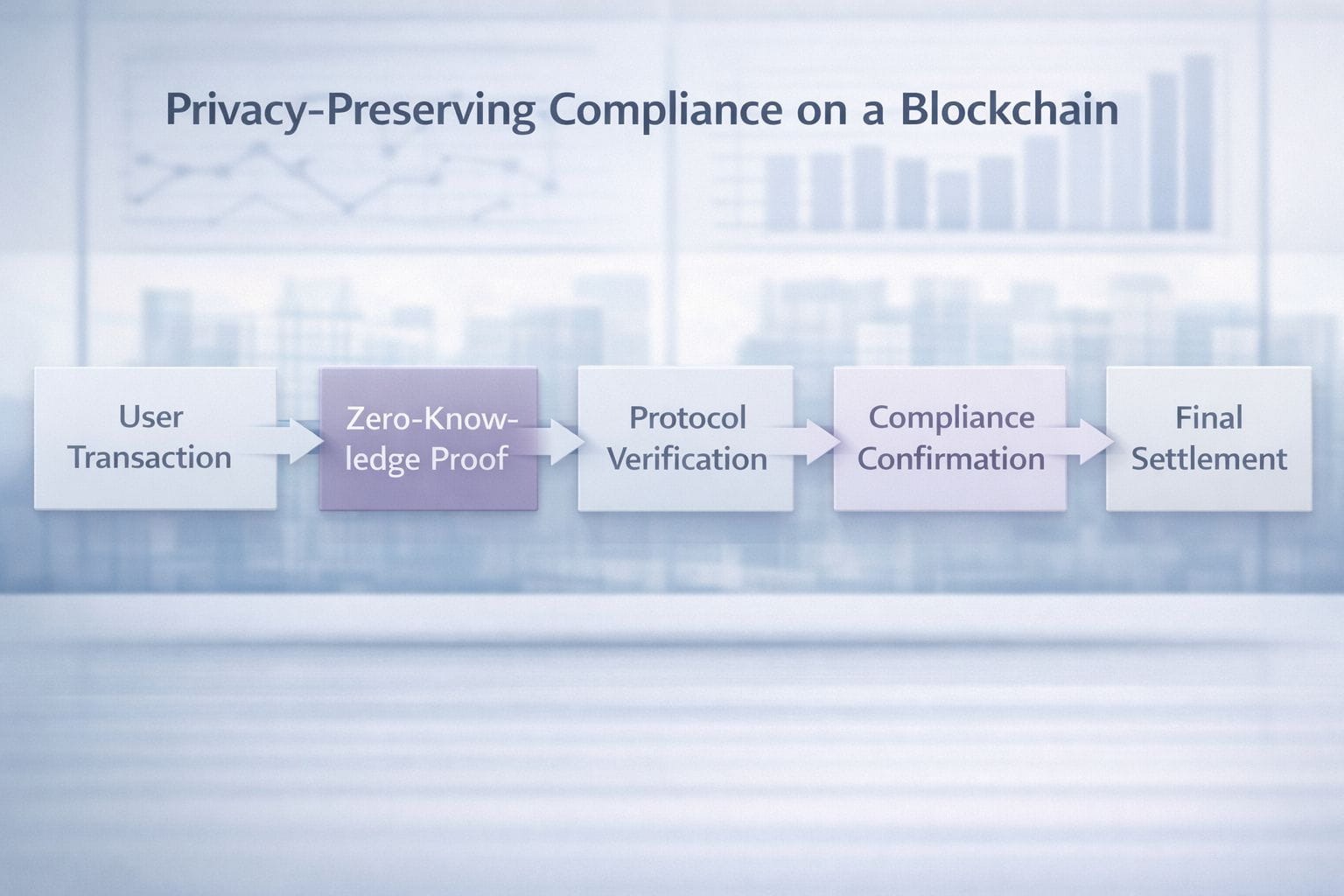

In my experience retail crypto often misunderstands privacy. People hear "secrecy" or "anonymity" and start to worry but institutional privacy is not about hiding everything. It's about letting the right people see what they need to see while keeping sensitive stuff out of the public eye. I took a closer look at how Dusk handles this using zero knowledge proofs to walk that fine line. Here is an easy way to think about it. Think of proving you paid your taxes without showing your entire bank statement. The authority gets assurance but your private financial history stays private. That is the logic Dusk applies at the protocol level.

This design follows the direction regulators are heading. The European Commissions DLT Pilot Regime which came out in 2023 backs selective transparency over putting everything out in the open. I have seen the same trend in MiCA guidance during my own research. Compliance is about auditability not public voyeurism. There is also a strong economic case. Deloitte's 2024 Global Blockchain Survey reported that 54 percent of institutional respondents ranked privacy preserving compliance as more important than transaction throughput. That statistic alone explains why many high speed chains struggle to onboard regulated assets despite impressive benchmarks.

A helpful chart visual here would show how transaction data visibility differs across public blockchains privacy add ons and Dusk's native model. Another visual could illustrate how zero knowledge proofs enable verification without disclosure across the transaction lifecycle.

How Dusk fits among Layer 1 and scaling solutions?

When I compare Dusk to other Layer 1. I avoid the usual speed versus cost debate. Ethereum, for example excels at openness and composability. Solana focuses on performance and efficiency. Both are powerful but neither was designed with regulatory confidentiality as a base layer assumption. Some scaling solutions attempt to bridge this gap using privacy rollups or application level encryption. My research suggests this approach increases complexity rather than reducing it. A PwC report from 2024 on digital asset infrastructure points out that when compliance gets fragmented. It just adds more risk and bumps up audit costs for institutions. Dusk's method keeps things easier for governance. They build confidentiality settlement finality and audit access right into the protocol. This reduces the number of external systems institutions must trust. Simplicity usually beats flexibility, especially when you are dealing with regulated capital. Imagine a quick chart lined up with Dusk, Ethereum and a few modular privacy tools. You would see the differences right away stuff like how much data they expose by default what kind of compliance work they require and whether big institutions can actually use them. Then take another table and match up use cases like tokenized bonds private equity or regulated DeFi with what each system needs under the hood. Suddenly it's obvious where Dusk really fits. What I notice most? Dusk is not trying to do it all. It focuses on being correct for a specific high stakes use case. In infrastructure specialization often wins. Even projects built for institutions trade in open markets and price behavior still matters. I analyzed DUSK price data from CoinMarketCap and TradingView across multiple cycles. The structure suggests long accumulation phases rather than speculative spikes. Of course, Institutional adoption moves slowly and often invisibly. This can test patience and suppress short term price discovery. There is also the risk that larger networks successfully integrate similar compliance focused features over time.

However my research suggests that building compliance into a protocol from day one is fundamentally different from bolting it on later. Sure, there is execution challenge. But being first in a growing niche? That is a big deal. Here is where I landed after digging into Dusk Foundation from every angle structure regulation the whole market picture. I'm clear on my conclusion. This is not a project optimized for noise. It's optimized for survival in a regulated future. Crypto is gradually transitioning from experimentation to integration. As that happens the question shifts from what is possible to what is acceptable. Dusk positions itself precisely at that intersection. In markets, value often accrues to those who prepare early for uncomfortable realities. Regulation is one of those realities. Dusk didn’t wait for it. It was built for it.