Global markets have swung sharply this week as geopolitical flashpoints drove risk repricing, as Trump’s Greenland tariff brinkmanship at Davos and the abrupt retreat after a ‘framework’ deal. CMC Research views the current macro risks as below:

Cross-asset pricing over the course of this week signals a renewed shift toward defensive positioning, consistent with a macro shock rather than idiosyncratic asset moves. VIX, gold, and rates are doing more of the work than equities.

The move is not disorderly, but it is coordinated: markets are repricing policy risk, geopolitical uncertainty, and duration sensitivity simultaneously.

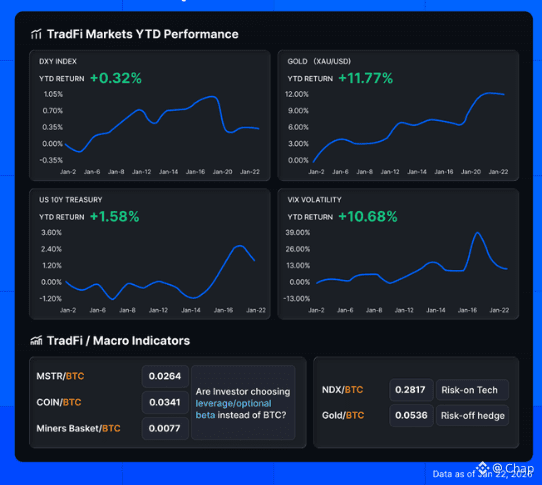

Rates and Volatility Lead the Signal

Gold (+11.77% YTD) and VIX (+10.68% YTD), underscoring demand for protection rather than growth exposure.

US 10Y yields (+1.58% YTD) point to renewed focus on rates and term premium, not a flight to bonds. This is consistent with policy uncertainty rather than recession hedging.

DXY is effectively flat (+0.32% YTD), suggesting this is not a classic USD-led risk-off. Instead, stress is emerging from rates and geopolitical channels rather than FX funding stress.

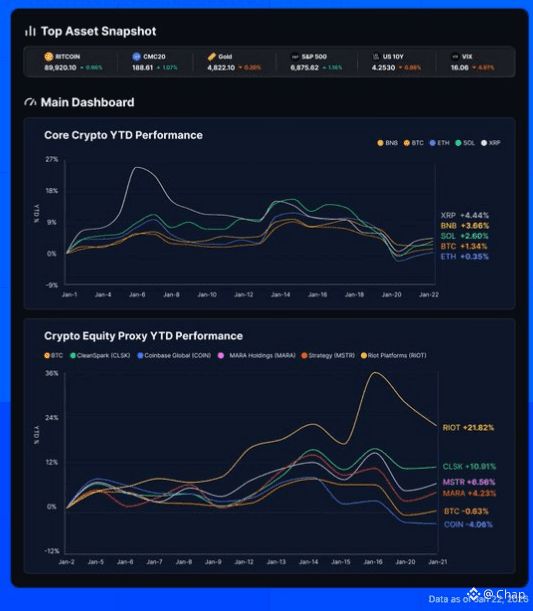

Crypto: High-Beta Macro, Not a Hedge

Core crypto assets show muted and uneven YTD performance:

BTC ~ flat to slightly negative

ETH marginally positive

SOL/XRP outperform but remain volatile

This dispersion reflects beta selection, not broad crypto inflows.

Bitcoin is trading less like a hedge and more like a high-beta macro asset, responding directly to: Rates volatility, Geopolitical headlines, and Cross-asset risk sentiment

The underperformance of BTC relative to gold and volatility reinforces that crypto remains reactive rather than defensive in the current regime.

Japan as a Global Volatility Catalyst

The repricing in Japanese government bond yields has reintroduced Japan as a global transmission mechanism for volatility.

Higher JGB yields force global investors to reassess the cross-border duration exposure, their Yen-funded strategies, and its relative attractiveness of global fixed income

In a market already sensitive to policy error, Japan’s move is amplifying global risk premia rather than remaining a local event.

Geopolitics Re-enters the Pricing Model

Renewed US–Europe tariff rhetoric and broader geopolitical uncertainty are raising the probability of tighter financial conditions at the margin.

Markets are discounting not just headline risk, but the possibility that rhetoric hardens into policy, weighing on confidence, trade expectations, and forward growth assumptions.

Bottom Line

Markets are repricing policy risk, rates volatility, and geopolitics, not growth collapse.

Japan has re-emerged as a credible global volatility trigger.

Bitcoin is not being treated as a safe haven; it is trading squarely inside the macro risk complex.

Until clearer policy direction emerges on rates, trade, and geopolitics: crypto and risk assets are likely to remain headline-driven and non-directional, with volatility outperforming conviction.