Walrus Protocol represents a distinct architectural direction within digital asset infrastructure, one that treats data intelligence, transparency, and governance not as auxiliary tooling but as core protocol primitives. Designed and deployed on the high-performance Sui blockchain, Walrus addresses a structural weakness that has persisted across much of the crypto market: the separation between economic activity and verifiable, real-time analytical visibility. In Walrus, storage, incentives, compliance awareness, and governance are inseparable from on-chain observability, creating an infrastructure model that is materially different from most tokens that merely circulate value.

At the architectural level, Walrus embeds analytics directly into how data is stored, priced, validated, and governed. Every storage commitment is expressed as an on-chain object whose lifecycle is fully transparent, auditable, and time-bounded. Storage contracts are not opaque off-chain agreements but cryptographically verifiable commitments that can be inspected, analyzed, and monitored in real time. This enables continuous assessment of storage availability, redundancy levels, node performance, and economic exposure without reliance on trusted intermediaries or delayed reporting. For institutions, this represents a shift from probabilistic trust to deterministic verification.

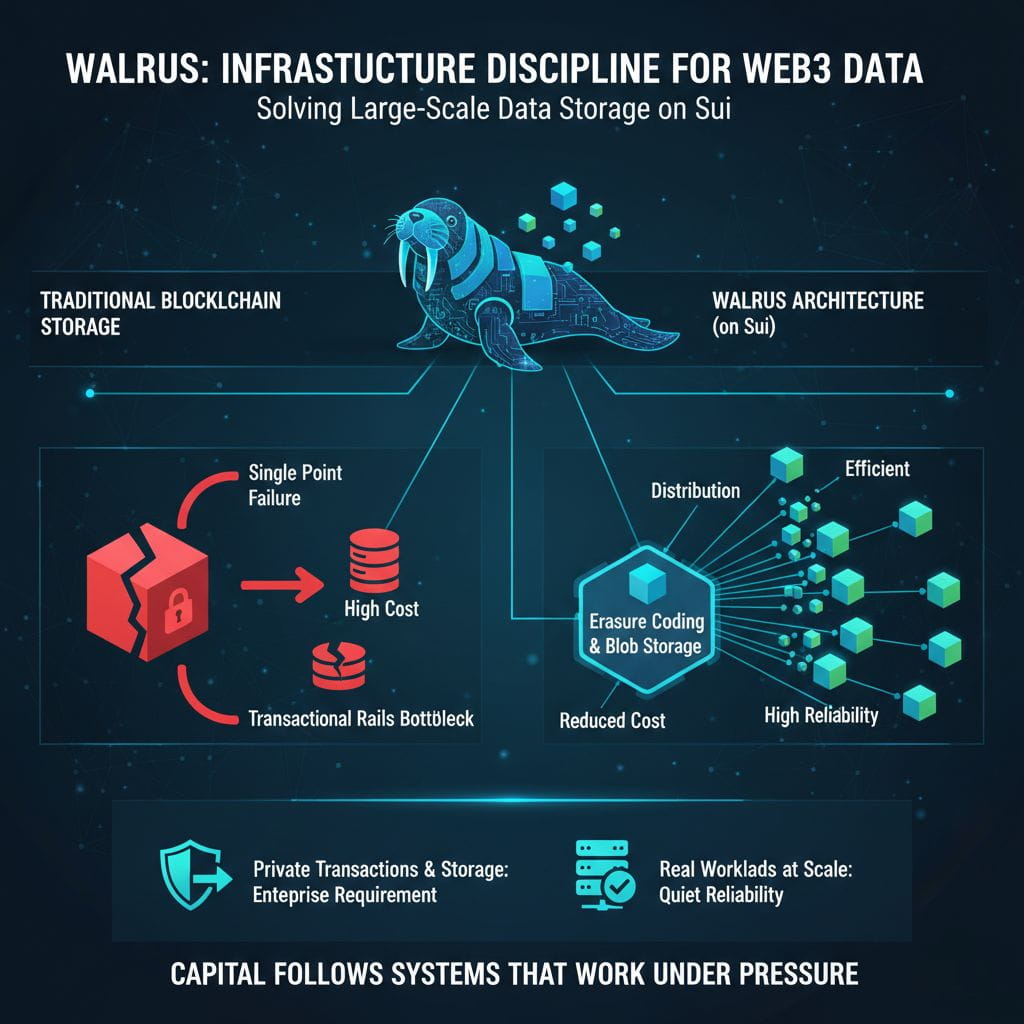

The protocol’s use of erasure coding is not only a cost-efficiency mechanism but also a risk-management construct. By distributing encoded fragments across independent nodes, Walrus reduces correlated failure risk while enabling measurable resilience thresholds. These thresholds are observable on-chain, allowing participants to quantify availability guarantees rather than assume them. In contrast to many decentralized storage systems where redundancy is static and largely unmeasured in practice, Walrus exposes redundancy and fault tolerance as live, inspectable parameters. This design allows capital allocators and regulators alike to reason about operational risk using data rather than assurances.

Economic intelligence is similarly native to the system. WAL is not a speculative token loosely associated with a network, but the accounting unit through which storage demand, supply, and security incentives are continuously reconciled. Storage pricing mechanisms are structured to remain stable in real-world terms, while on-chain flows of WAL reveal demand patterns, subsidy utilization, and long-term sustainability. Because these flows are transparent, analysts can model whether network incentives are consumption-driven or inflation-dependent, a distinction that is often obscured in competing protocols.

Staking within Walrus further reinforces analytical clarity. Delegated stake determines which storage nodes participate and how much data responsibility they assume. Performance is measurable, underperformance is attributable, and future slashing mechanisms are designed to be rule-based rather than discretionary. This creates a governance environment where accountability is enforced algorithmically and where oversight does not rely on informal coordination or off-chain arbitration. For institutions accustomed to supervisory clarity, this represents a closer analogue to regulated infrastructure than to experimental crypto networks.

Governance itself is deliberately constrained by data-driven design. Voting power is tied to staked exposure, but rapid stake reallocation incurs penalties, reducing the feasibility of short-term governance manipulation. Protocol parameters, including storage economics and penalty regimes, are adjusted through transparent proposals whose impacts can be modeled in advance using on-chain historical data. This allows governance to function as a risk-managed process rather than a popularity contest, aligning more closely with institutional decision frameworks.

Compliance alignment, while not framed as regulation-by-design, emerges organically from Walrus’s transparency model. The protocol does not anonymize economic behavior in ways that prevent oversight. Instead, it allows privacy at the data layer through encryption while preserving visibility at the economic and operational layers. This separation is critical for institutions that must reconcile confidentiality with auditability. Walrus enables encrypted data storage without obscuring who is responsible for storing data, how long obligations last, or how compensation flows, a balance that most decentralized storage systems fail to achieve.

What ultimately differentiates Walrus from the broader coin market is that value accrual is inseparable from measurable utility and observable system health. Many digital assets rely on narratives of future adoption while offering limited insight into whether their networks are meaningfully used or economically coherent. Walrus, by contrast, exposes its internal state continuously. Storage utilization, node concentration, incentive sustainability, and governance participation are all visible on-chain, enabling external parties to form independent assessments of systemic integrity.

This design has implications beyond storage. By treating data as a programmable, auditable asset, Walrus creates a foundation for regulated use cases such as institutional data custody, compliant decentralized publishing, and verifiable AI dataset management. In each case, analytics are not layered on after deployment but emerge naturally from the protocol’s structure. The result is an infrastructure that does not ask institutions to suspend analytical rigor, but instead invites it.

In a market crowded with tokens whose differentiation rests on branding or speculative velocity, Walrus stands apart by embedding transparency, risk awareness, and governance discipline into its base layer. Its architecture assumes scrutiny rather than evading it. For banks, regulators, and long-horizon capital allocators, this assumption is not a liability but a prerequisite.