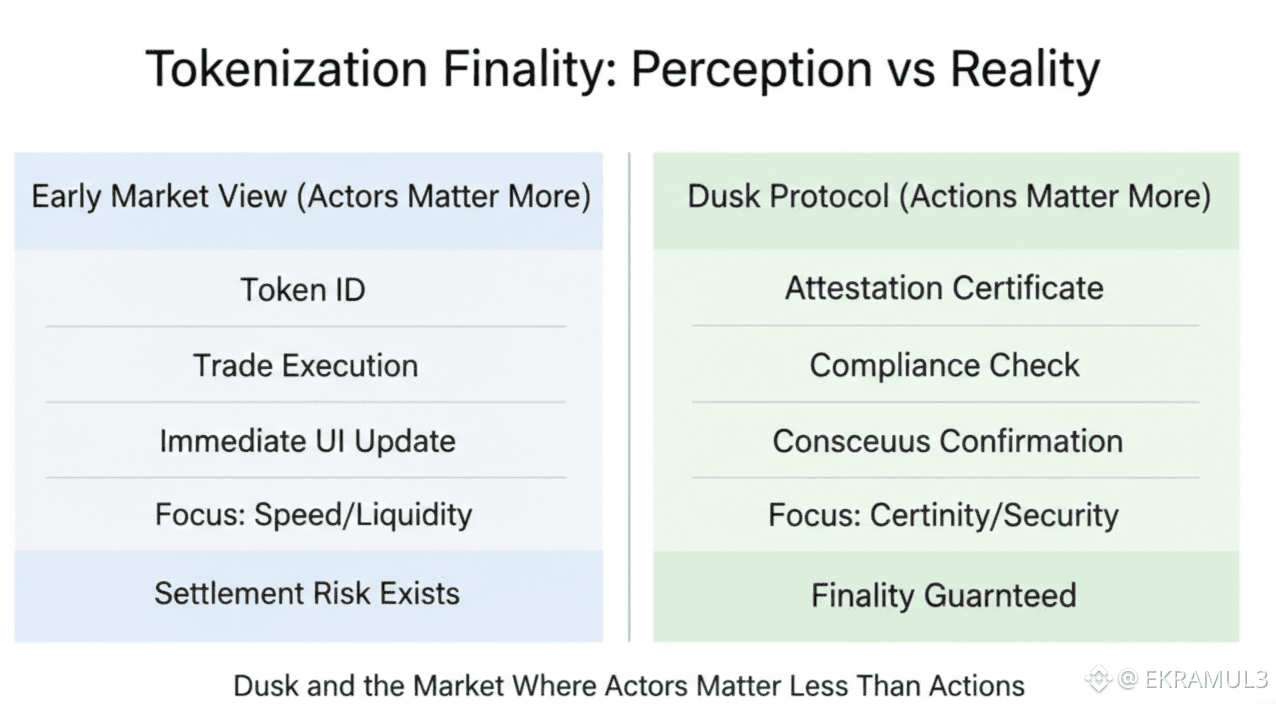

There’s a fundamental tension in financial market infrastructure that crypto has never resolved: markets need information to function, but they do not need identity to function. Price discovery is driven by actions, not by attribution. Yet compliance and regulation rely on attribution, not on market exposure. Dusk is one of the first networks built with the assumption that both of these constraints can coexist without breaking each other.

There’s a fundamental tension in financial market infrastructure that crypto has never resolved: markets need information to function, but they do not need identity to function. Price discovery is driven by actions, not by attribution. Yet compliance and regulation rely on attribution, not on market exposure. Dusk is one of the first networks built with the assumption that both of these constraints can coexist without breaking each other.

In most public blockchains, the system leaks the wrong information. It exposes identities and flows to the entire participant base while regulators remain dependent on off-chain surveillance and analytics for attribution. This satisfies neither side. Markets lose confidentiality and competitive behavior collapses into traceable strategies, while regulators have to reconstruct compliance through inference rather than through protocol guarantees. Dusk flips the model: confidentiality for the market, controlled attribution for compliance, and cryptographic correctness for settlement assurance.

The Infrastructure for Action-Visible, Identity-Silent Markets

Modern financial markets are structured so that actions broadcast to the market, but actors remain shielded. Order books match bids and asks without disclosing who is buying, who is selling, or how inventories sit across counterparties. Attribution enters the conversation only when a trade needs to settle or when regulators investigate. This is not an ideological choice; it’s a structural design to prevent front-running, information leakage, and strategic visibility.

On Dusk, this principle becomes programmable. Transaction validity, eligibility, sufficiency of balances, and compliance checks are proven through zero-knowledge and confidential execution. Markets see that an action occurred not who initiated it or what exposure sits behind it. Identity becomes a compliance-layer artifact, not a market-layer artifact.

Selective Attribution as a Compliance Primitive

The crypto industry spent years debating whether privacy and regulation are antagonists. Dusk treats them as orthogonal layers. Compliance needs to confirm who when required but issuance, matching, settlement, and secondary trading do not require identity exposure for markets to function.

This is the essence of selective attribution:

Regulators see identity when needed

Markets only see actions

Auditors see proofs

Competitors see nothing

The protocol sees correctness

This separation enables a financial environment where risk management, price discovery, and liquidity behavior can operate without violating confidentiality, while compliance can operate without reconstructing transactions through forensic blockchain analytics.

Dusk’s Execution Model: Intent Proven, Actor Abstracted

Crypto networks typically require identity to prove intent: public addresses sign transactions, and those addresses become the identity. Dusk alters this by proving eligibility and correctness without exposing attribution. The network cares that:

The sender is allowed to participate

The asset can legally transfer

The balances are sufficient

The compliance checks succeeded

The settlement can finalize

The actor behind the transaction becomes a cryptographic property, not a market exposure surface.

This makes Dusk structurally closer to how regulated venues operate: identity is handled at the perimeter, but execution is anonymous to the market.

Settlement Without Identity Leakage

Settlement is where attribution traditionally reenters the workflow. Broker-dealers, custodians, clearing venues, and regulators need to know who holds what after the fact. Dusk’s approach is to allow post-trade attribution where legally required without leaking pre-trade signals or mid-trade strategies.

This aligns with real institutional risk profiles:

Market microstructure hates identity leakage

Compliance hates blind systems

Regulators hate unprovable systems

Dusk is designed so none of those groups need to lose.

A New Model for Tokenized RWAs

The moment tokenized RWAs (bonds, funds, treasuries, commercial paper, invoice pools, equity) move onto public rails, information leakage becomes a market threat. Knowing who owns what and who is moving size is a competitive disadvantage for issuers and buyers.

Dusk’s model means RWAs can behave like traditional instruments:

Confidential positions

Permissioned eligibility

Compliant transfers

Auditable lifecycle

Final settlement guarantees

This is one of the few architectures that matches the realities of MiCA, DLT Pilot Regime, and European securities regulation.

Where Actors Matter Less, Liquidity Behaves Better

Liquidity deepens when anonymity is structural and compliance is bounded. Markets function more efficiently when trade execution and settlement flows are shielded from strategic observation. Dusk’s selective privacy model ensures that liquidity does not become a surveillance surface.

If identity exposure is economically costly, liquidity providers disappear. If compliance is absent, institutions disappear. Dusk is built for the equilibrium where neither has to leave.

Why This Matters in 2026

The tokenization discourse has matured significantly. Institutions have stopped asking, “Can we tokenize assets?” and now ask, “Can we tokenize without exposing ourselves?” This is a regulatory and microstructure question, not a blockchain question.

Dusk’s answer is structural:

Actions drive markets. Attribution drives compliance. A mature blockchain can support both without conflating them.

That is the financial environment where actors matter less, actions matter more, and compliance does not require full visibility into market strategy.