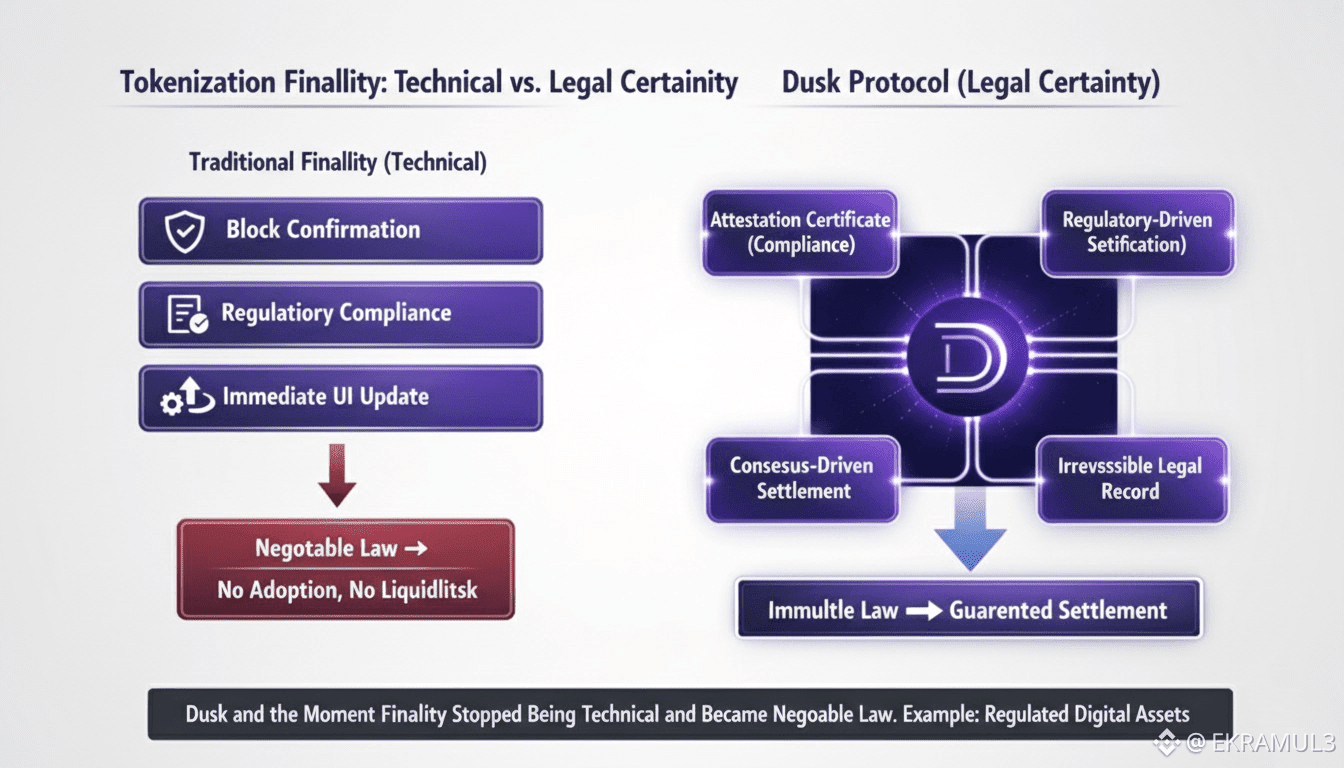

For more than a decade, crypto has treated “finality” as a computer science feature. Blocks finalize. Probabilities converge. Fork risks decay. Exchanges wait a set number of confirmations, not because of compliance, but because of engineering risk mitigation. In that world, finality has always been a technical parameter. But the moment regulated assets entered the conversation, that framing snapped. Settlement isn’t just about halting reorgs anymore. It’s about answering a legal question: At what exact point is a transaction not only final to validators, but final to regulators, clearing venues, custodians, and courts? That pivot is what makes Dusk fundamentally different from general-purpose blockchains.

For more than a decade, crypto has treated “finality” as a computer science feature. Blocks finalize. Probabilities converge. Fork risks decay. Exchanges wait a set number of confirmations, not because of compliance, but because of engineering risk mitigation. In that world, finality has always been a technical parameter. But the moment regulated assets entered the conversation, that framing snapped. Settlement isn’t just about halting reorgs anymore. It’s about answering a legal question: At what exact point is a transaction not only final to validators, but final to regulators, clearing venues, custodians, and courts? That pivot is what makes Dusk fundamentally different from general-purpose blockchains.

Dusk was one of the first chains to notice that finality behaves differently once the underlying asset has a legal claim attached to it. A tokenized bond does not behave like a meme token. A tokenized share in a regulated MTF cannot rely on probabilistic finality or soft finality assumptions. The value being transferred is not just bytes. It is rights coupon entitlements, voting privileges, redemption guarantees, or obligations backed by law. Those rights cannot settle until both the network and the regulator agree that settlement is finished. That dual acknowledgement transforms finality into a negotiation between consensus and jurisprudence.

This is why Dusk’s deterministic finality model matters. When Dusk finalizes a settlement instruction, it reaches absolute, non-probabilistic finality, meaning it cannot be reverted by longer-chain attacks or validator reorg behavior. In crypto, this is often dismissed as “nice to have.” In regulated markets, it is non-negotiable. Institutions cannot operate in environments where trades that settle today could be unwound tomorrow because network conditions changed. Once the orchestra of legal actors enters the room, rollback ceases to be a technical nuisance it becomes a regulatory impossibility.

But even deterministic finality is only half the story. The other half lives in a space the crypto world rarely discusses: legal finality, the moment when the asset transfer is recognized by the legal system as binding. In TradFi settlement infrastructure, this separation has existed for decades. A clearing house may process the trade and update its internal ledger at time T, but legal transfer may only become effective at time T+1 after compliance checks, clearing validation, and regulatory windows. Dusk’s design respects that split rather than pretending it doesn’t exist. In doing so, it positions blockchain settlement inside the reality of how regulated markets already function.

This is also where selective disclosure and compliant privacy become essential. In a regulated settlement flow, there are events that must remain confidential to protect market structure (internal flows, portfolio adjustments, liquidity provisioning) and events that must remain visible or provable to satisfy oversight. Dusk’s architecture allows one to travel without compromising the other. If settlement finality is to become legally binding, regulators cannot be blind. But if settlement is to become institutionally usable, the public cannot be omniscient. Few chains understand that privacy is not a moral debate it is a market structure requirement.

The bigger point is that Dusk is not trying to “make crypto more like TradFi.” It’s doing something more novel: it is isolating the pieces of traditional settlement infrastructure that are structurally necessary, and discarding the parts that exist only due to outdated intermediaries. Clearing houses, registrars, custodians, and compliance departments do not exist because finance enjoys bloat. They exist because real-world settlement is not just about validators reaching consensus. It is about risk, attribution, eligibility, disclosure, and legal transfer. When Dusk embeds these constraints into a layer-1 environment, it isn’t recreating bureaucracy it is compressing it into software.

This leads to a fascinating strategic question: what happens when finality becomes a jurisdictional primitive instead of just a consensus primitive? If tokenized securities and regulated RWAs migrate to chains like Dusk, finality may no longer be defined by block intervals but by regulatory timeframes. The settlement lifecycle could extend beyond the block and into clearance windows where privacy, auditability, and legal review coexist. This is the kind of nuance the industry has avoided for years because it’s complicated, slow, and not conducive to hype cycles. Dusk is betting that institutional infrastructure requires exactly that kind of depth.

The irony is that crypto always talked about “institutional adoption” as if institutions would bend to crypto’s architecture. Instead, the opposite is happening. The moment capital markets step on-chain, they force chains to adopt constraints that traditional finance lived with for decades: privacy, finality, compliance, selective disclosure, and legal certainty. Dusk didn’t wait for that conversation to happen. It built for it. And now that regulators are finally acknowledging tokenized settlement as a credible direction, Dusk’s framing feels less like a niche experiment and more like an infrastructure thesis that was simply early.

If Dusk succeeds, people won’t describe it as a privacy chain or a DeFi chain. They’ll describe it as the first settlement infrastructure where finality stopped being a consensus gimmick and became the bridge between code and law. That shift from technical finality → to legal finality → to compliant settlement is the real unlock for tokenized finance. And it’s the day finality started arguing back.