When I first examined Plasma XPL, the context was very different. Stablecoins were already large, but their role was still being debated. Were they merely liquidity instruments for crypto markets, or were they evolving into something closer to neutral digital cash? At the time, it was reasonable to frame Plasma as an experiment in specialization. A Layer One designed explicitly for stablecoin settlement felt contrarian in an industry obsessed with general-purpose platforms. That framing no longer holds. The market has answered the question Plasma was built around, and it has done so quietly but decisively.

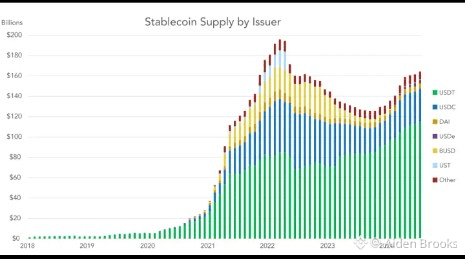

Stablecoins have crossed a threshold. They are no longer a subset of crypto activity. They are one of the most widely used forms of digital money in the world. They move more value daily than many national payment networks. They are used by individuals, businesses, payment processors, and increasingly by institutions that have no interest in ideological debates about decentralization. They care about reliability, neutrality, and cost. This shift changes how Plasma XPL should be evaluated. It is no longer useful to ask whether a stablecoin-focused blockchain is too narrow. The more relevant question is whether general-purpose chains were ever suited for this role in the first place.

What has become clear over time is that stablecoins expose the structural weaknesses of most blockchain architectures. Volatile fee markets, probabilistic finality, dependency on speculative native assets for gas, and congestion driven by unrelated activity all create friction that does not matter much for speculative trading but matters enormously for settlement. These are not abstract concerns. They show up as failed transactions, unpredictable costs, delayed confirmations, and operational complexity. For retail users in high-adoption regions, this friction translates into confusion and risk. For institutions, it translates into non-starter infrastructure.

Plasma XPL was designed with these realities in mind from the beginning. That is no longer a theoretical advantage. It is increasingly a practical one. Plasma’s positioning as a Layer One optimized for stablecoin settlement is not about chasing a niche. It is about accepting a constraint and building within it. In financial infrastructure, constraints are not weaknesses. They are design boundaries that enforce discipline.

One of the most important design decisions Plasma made early on was full EVM compatibility via Reth. With hindsight, this choice looks less like convenience and more like risk management. Payments infrastructure does not benefit from novel execution environments. It benefits from predictability, auditability, and integration with existing tooling. By remaining EVM compatible, Plasma reduces the cognitive and operational cost for developers and institutions. It does not ask participants to relearn or retool. It asks them to operate in a familiar environment with different economic assumptions underneath.

Those economic assumptions are where Plasma meaningfully diverges from most of the ecosystem. The introduction of stablecoin-first gas and gasless USDT transfers addresses a problem that has existed since the first stablecoin was issued. Money that is designed to remain stable should not require exposure to volatility simply to move. For years, users accepted this contradiction because there was no alternative. Plasma removes it. Fees paid in stablecoins align user incentives with network behavior. They make costs transparent. They make accounting simpler. They make forecasting possible. For institutions, this is not an optimization. It is a requirement.

Sub-second finality through PlasmaBFT is another area where the difference between theoretical performance and real-world relevance has become clearer with time. In early crypto discourse, finality was often discussed in terms of speed benchmarks. Today, finality is better understood as a risk parameter. Faster finality reduces settlement risk. It reduces the window for reorgs and reversals. It enables workflows that depend on immediate certainty. This matters in payments, treasury management, and any environment where capital efficiency is critical. Plasma’s focus on finality reflects a settlement mindset rather than a throughput race.

Bitcoin-anchored security is perhaps the most misunderstood aspect of Plasma’s architecture, and also one of the most forward-looking. Anchoring to Bitcoin is not about borrowing hash power or marketing association. It is about anchoring credibility. Bitcoin remains the most neutral, least captured blockchain in existence. Its governance is slow, conservative, and resistant to sudden change. By anchoring to Bitcoin, Plasma signals that its settlement layer is not meant to be easily altered by short-term incentives or governance swings. In a world where payment infrastructure increasingly intersects with politics and regulation, this kind of neutrality is not ideological. It is strategic.

Over time, the incentive structure Plasma creates has become more interesting than its individual features. Networks that rely on congestion and volatile fees benefit from speculation. Plasma benefits from volume and consistency. Its success is tied to usage, not hype. This aligns the network with the needs of users who actually move money rather than those who trade narratives. It also changes the power dynamics within the ecosystem. When speculation subsides, infrastructure that serves real economic activity tends to persist.

This shift becomes clearer when comparing Plasma to its alternatives today rather than in theory. Ethereum remains the dominant settlement layer for many applications, but its fee dynamics and congestion profile make it ill-suited for high-volume, low-margin payments. Solana offers speed, but its fee model and trust assumptions introduce different risks. Layer two solutions reduce costs but add complexity and dependency on base layers that were not designed for settlement as a primary workload. Private or semi-private payment networks sacrifice openness and neutrality. Plasma occupies a space that none of these systems fully address. It is public, neutral, stablecoin-native, and optimized for settlement rather than expression.

The market context has also evolved. Stablecoin regulation, while still uncertain, has moved from hostility to cautious engagement in many jurisdictions. Institutions are no longer asking whether on-chain settlement is possible. They are asking how to do it safely, predictably, and at scale. Retail adoption in emerging markets continues regardless of market cycles. These trends favor infrastructure that is boring, reliable, and specialized. Plasma’s lack of noise increasingly looks like restraint rather than absence.

None of this implies inevitability. Plasma still faces significant execution risk. Adoption by payment providers and institutions is slow by nature. Regulatory environments can shift. Stablecoin issuers themselves represent points of centralization. But these risks exist regardless of Plasma. The question is whether the infrastructure is designed to handle them when they materialize. Plasma’s design suggests that it is.

What has become clearer with time is that the future of blockchain infrastructure is not about maximizing optionality. It is about minimizing friction for specific, economically significant workloads. Stablecoin settlement is one of those workloads. It touches payments, remittances, trade, treasury management, and financial inclusion. It does not need flashy features. It needs reliability.

From a strategic perspective, Plasma XPL represents a maturation of blockchain design philosophy. It accepts that not all value comes from generalization. It recognizes that money infrastructure has different requirements than application platforms. It prioritizes neutrality over novelty and predictability over performance theater.

The deeper pattern here extends beyond Plasma itself. Crypto as an industry is moving from invention to integration. Early systems proved what was possible. The next generation must prove what is sustainable. Infrastructure that survives this transition will not look exciting. It will look obvious in retrospect.

Stablecoins are not a trend. They are becoming a layer of global finance. Building systems around that reality requires discipline, patience, and a willingness to be unglamorous. Plasma XPL was designed with that mindset long before it became fashionable. Whether it ultimately dominates or simply influences future designs, its significance lies in how clearly it articulates the settlement problem and how deliberately it attempts to solve it.

The real test of Plasma will not be market cycles or narrative attention. It will be whether money quietly keeps moving through it when nobody is watching. That is how financial infrastructure proves itself.