$ETH #bullish #WEFDavos2026 #TrumpCancelsEUTariffThreat #ethreum

Despite Ether’s latest recovery to $3,000, data suggests that ETH price may see a deeper correction to $1,850 if key support levels don’t hold.

Ether

ETH$2,931

has made modest gains over the last 24 hours, briefly reclaiming the $3,000 psychological level. However, decreased ETH demand, evidenced by heavy outflows from spot Ethereum exchange-traded funds (ETFs), and a weakening technical structure could see Ether drop to levels below $2,000 over the coming weeks.

Key takeaways:

Decreasing Ethereum demand and negative spot Ether ETF flows signal aggressive distribution.

Ether’s bear flag pattern targets $1,850 ETH price if key support is lost.

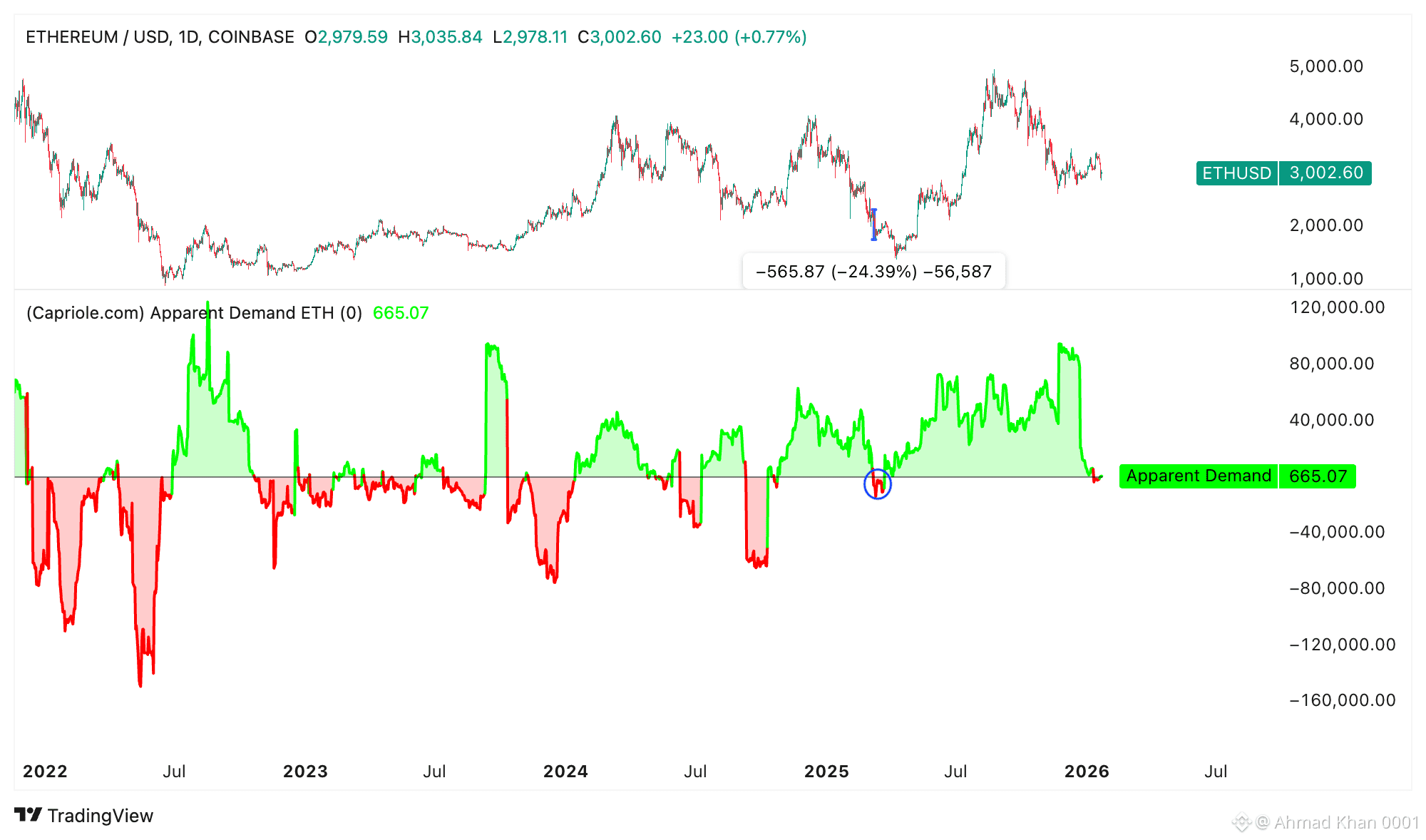

Ether’s apparent demand drops to 10-month lows

One Ethereum demand metric has dropped sharply since mid-December to levels last seen in March 2025.

Capriole Investment’s Ethereum Apparent Demand for Ether dropped significantly to -3,562 ETH on Jan. 16 from over 92,000 ETH on Dec. 13. This metric had improved slightly to 665 ETH at the time of writing on Thursday.

Related: ETH funding rate turns negative, but will Ether bulls take the bait?

Decreasing ETH demand amid price drawdown signals aggressive distribution as the price tests key support levels, particularly the $3,000 psychological level this week.