After analyzing where real capital is slowly moving. I have realized that the next phase of crypto won't be loud, fast or speculative. It will be careful, regulated and designed for trust which is exactly where Dusk fits. When I revisited Dusk Foundation with fresh eyes. I stopped looking at it like a typical Layer 1 and started viewing it like financial infrastructure. In my assessment that mindset change explains why Dusk often feels under discussed despite being structurally aligned with where the industry is heading. Not every blockchain is meant to attract millions of retail wallets but some are meant to handle billions in regulated value. My research into Dusk's origins shows that being founded in 2018 was not just a timestamp. it was a signal. This was a period when most projects were chasing speed or permissionless experimentation. Dusk instead focused on privacy, compliance and auditability at the protocol level which only recently became mainstream concerns as regulation accelerated. What stood out to me immediately is that Dusk does not treat regulation as an external layer. It treats it as an assumption. That single design philosophy changes everything from how smart contracts behave to how institutions can safely interact with the chain.

Why financial institutions think differently than retail crypto?

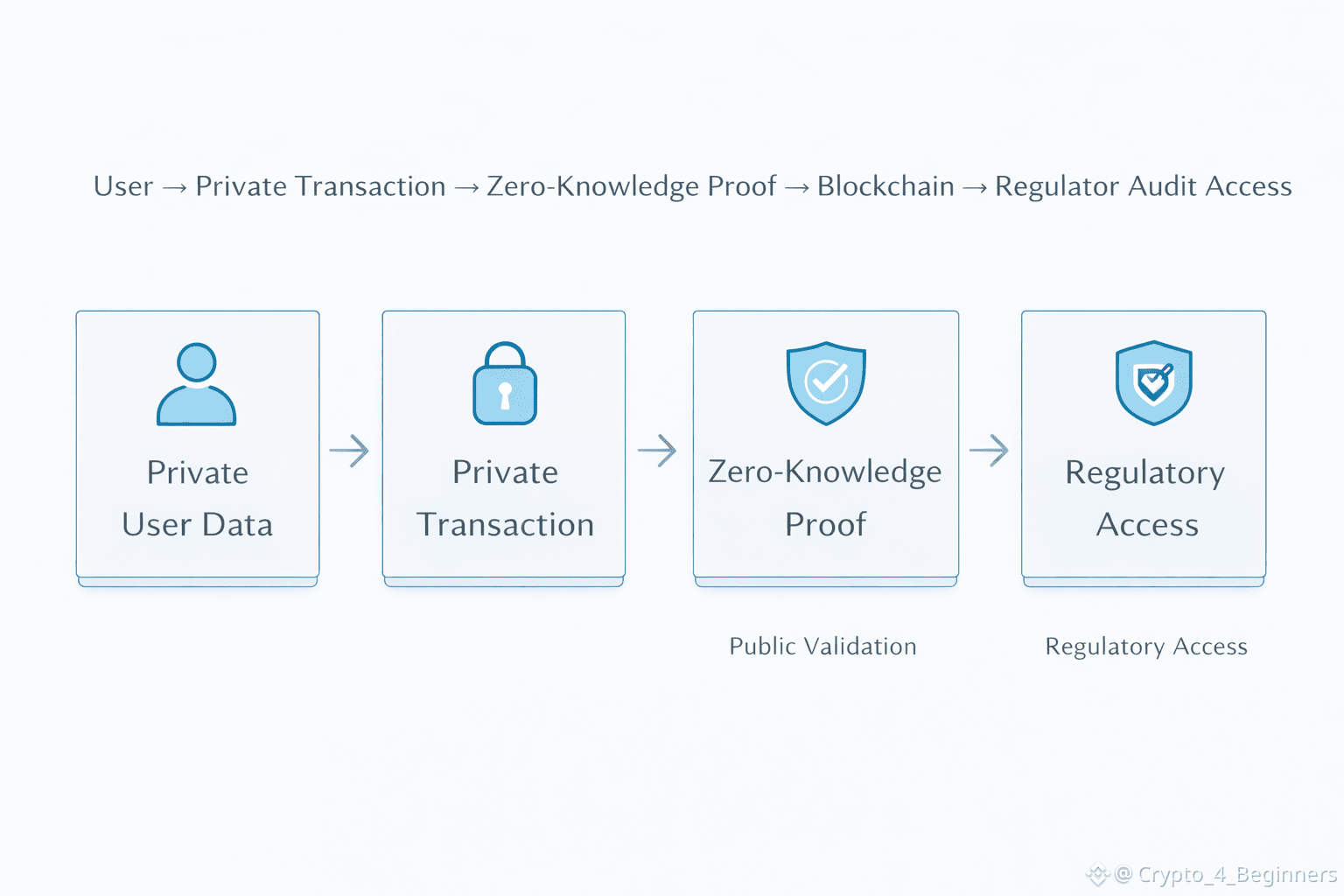

I analyzed several public reports while forming this view, and the data paints a consistent picture. According to the World Economic Forums 2024 report on tokenized assets over 70 percent of institutions exploring blockchain adoption cited regulatory clarity as more important than transaction speed. This is a completely different priority set than retail markets which often chase throughput and fees. From my experience watching institutional pilots fail the issue is rarely technical capability. It's governance and data exposure. Public blockchains expose too much by default forcing institutions to choose between transparency and confidentiality. In traditional finance those two are not opposites. They coexist. Zero knowledge tech can sound complicated but Dusk actually makes it pretty easy to grasp. Think of it like this is you want to prove you own a house but you don't want to share the address or how much you paid for it. You can still prove it's yours just without giving away all the details. That is basically what Dusk does it keeps your transactions private but anyone can still check that they are real. This setup fits right in with what regulators want. The European Central Banks 2023 report on DLT settlement talks about the need for selective disclosure if you want to do finance on-chain. I have seen the same thing in MiCA the focus is on giving auditors access not making everything public. That is exactly the kind of privacy Dusk is built for.

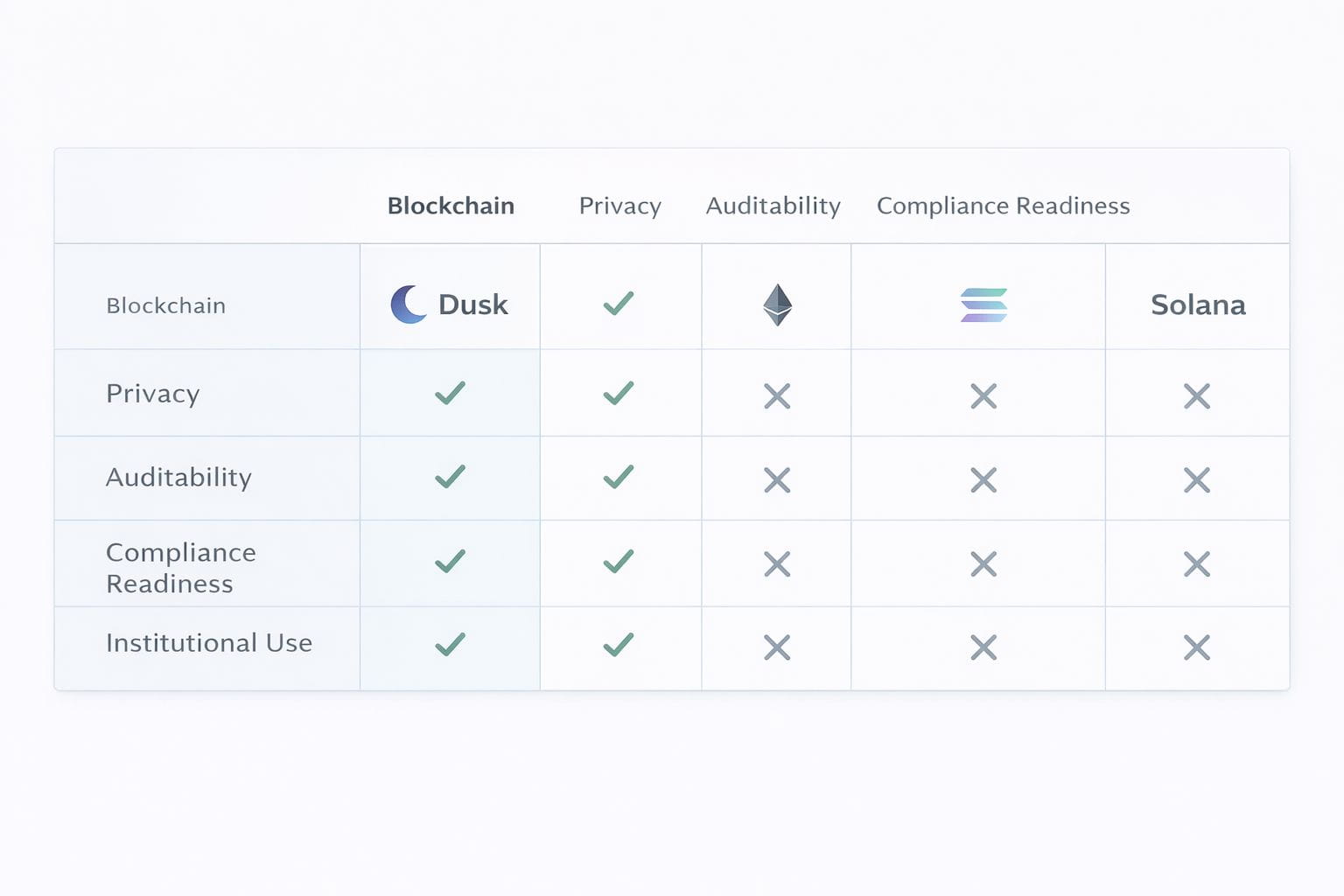

Honestly a chart here would make things clearer. You could show how much info is visible on a regular public blockchain versus a privacy focused one like Dusk. Another chart could walk through how a transaction moves from being created to getting audited on Dusk compared to the typical DeFi process. Here is how I see it is Stacking Dusk up against Ethereum or Solana just by looking at things like speed or capacity does not really tell the whole story. Ethereum's got composability locked down like nobody else. Solana? It's crazy fast but neither was architected specifically for regulated financial instruments at the base layer. But here is where some projects trip up. They try to bolt on compliance after the fact, using permissioned subnets or app level encryption. From what I have seen that just ends up splitting the network. PwC pointed this out in their 2024 digital assets report is when you pile compliance on in layers you ramp up operational challenge and make it tougher for institutions to get on board. It all gets way more complicated than it needs to be. Dusk bakes compliance right into its protocol so developers working on regulated DeFi or tokenized assets don't have to keep building compliance from scratch. For institutions this kind of consistency cuts down on legal headaches and technical guesswork.

If you lay out a simple table comparing Dusk, Ethereum and modular compliance tools looking at things like built in privacy auditability and how ready they are for regulations you really start to see what sets Dusk apart. Another table mapping use cases such as tokenized bonds, private funds and compliant lending protocols to required infrastructure features would show where Dusk naturally fits. This is why I see Dusk less as a competitor to general purpose chains and more as a specialist infrastructure layer. There are challenges worth acknowledging. Institutional adoption is slow often opaque and rarely generates immediate hype. There is also the possibility that larger ecosystems successfully integrate native compliance features over time increasing competition. However my research suggests that compliance by design creates a structural moat that is difficult to replicate later. Retrofitting privacy and auditability into existing architectures is not trivial.

A long term view beyond hype cycles

After analyzing Dusk Foundation through the lenses of regulation infrastructure and market behavior my conclusion is that it represents a different kind of bet. This is not a project designed to dominate headlines. It’s designed to remain relevant as crypto matures. The industry is slowly shifting from asking what can be built to asking what can be legally deployed at scale. That transition favors projects that anticipated constraints rather than reacted to them. Dusk appears to be one of those projects. In a market driven by narratives the quiet ones are often ignored until they are unavoidable. Dusk's focus on regulated privacy preserving finance suggests it may become unavoidable sooner than many expect.