Crypto spent years calling tokenization the future, yet ironically treated tokenized assets like souvenirs. A token is minted, it trades for a while, the narrative cools off, and the industry moves on. In regulated markets, issuance isn’t the story the lifecycle is. Bonds, equities, funds, and structured notes are not defined by their minting event. They are defined by what happens between issuance and redemption: compliance, transfers, settlement, reporting, corporate actions, payouts, and termination. That entire chain of obligations is the product.

Crypto spent years calling tokenization the future, yet ironically treated tokenized assets like souvenirs. A token is minted, it trades for a while, the narrative cools off, and the industry moves on. In regulated markets, issuance isn’t the story the lifecycle is. Bonds, equities, funds, and structured notes are not defined by their minting event. They are defined by what happens between issuance and redemption: compliance, transfers, settlement, reporting, corporate actions, payouts, and termination. That entire chain of obligations is the product.

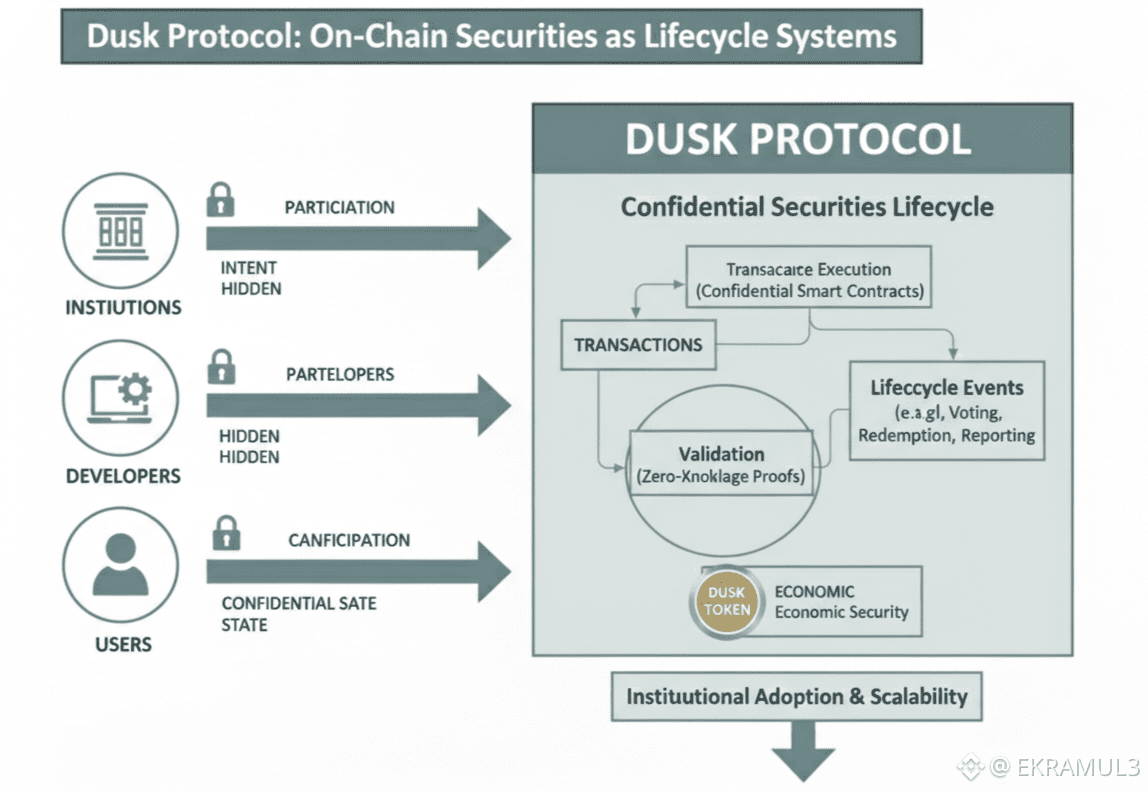

Dusk is one of the first blockchains that treats tokenization with that level of seriousness. It does not stop at minting. It does not assume trading equals adoption. It frames tokenized securities as lifecycle instruments that need compliance, confidentiality, settlement guarantees, and event-driven mechanics. This shift matters because lifecycle is where traditional financial infrastructure makes its money and where most crypto tokenization attempts silently fail.

Take bonds as the simplest example. A bond is not just issued and forgotten. It distributes coupons. It changes hands. It undergoes regulatory checks. It may be called early. It eventually matures. In every step, counterparties must comply with eligibility rules, transfer restrictions, reporting obligations, and jurisdictional controls. On a transparent public ledger, those workflows leak sensitive market data: positions, flows, portfolio strategies, client structures, and hedging intentions. On a privacy-max chain, regulators get cut out. Dusk introduces a third path: lifecycle-compliant confidentiality.

By enabling selective disclosure and privacy-preserving execution, Dusk allows regulatory rules and corporate actions to be executed on-chain without turning the cap table into public surveillance data. Coupon payments can be processed confidentially. Transfers can respect jurisdictional restrictions. Corporate events can be delivered without forcing issuers to reveal investor lists to competitors. Regulators and auditors get access when law requires it the market does not.

This lifecycle perspective becomes even more important when you consider redemption and servicing. Most tokenization in crypto fails at redemption either assets can’t be redeemed, or redemption requires off-chain negotiation that voids the point of tokenization. Dusk introduces deterministic settlement models that can service the entire lifecycle, including the terminal state of redemption or maturity settlement. This is the difference between tokenization as a feature and tokenization as financial infrastructure.

The lifecycle also requires data. Traditional markets run on corporate event data, reference data, valuations, ratings, disclosures, and regulatory filings. Tokenization without data integration becomes a dead asset. This is why Dusk’s work with regulated venues, European pilot regimes, and interoperability/data providers matters more than DeFi TVL. It signals that the chain is being wired into the institutional workflows that make lifecycle securities operable, not just tradable.

Stablecoins and tokenized cash instruments also enter the lifecycle story at a critical point. It is impossible to settle tokenized securities at scale without compliant cash legs. Delivery-versus-payment isn’t a meme. It is the rule. Dusk’s settlement rail can handle both legs under the same compliance and confidentiality framework, which removes the need for external custodial settlement layers that destroy composability.

Issuance-only tokenization is a demo. Lifecycle tokenization is a market. The industry is now entering the phase where that distinction determines what survives. In regulated environments, lifecycle-complete systems will win, because issuers don’t care how easy it is to mint. They care how cleanly they can manage compliance, payout flows, reporting, and closure without leaking competitive intelligence or blocking regulators from doing their jobs.

Dusk’s insight is that on-chain securities don’t become useful when they mint they become useful when they can complete their lifecycle. And until a chain can handle that full path, tokenization won’t scale beyond PR announcements and pilot programs. Dusk is building for the moment tokenization becomes infrastructure rather than demo theater.