In most blockchains, transparency is treated as an unquestionable virtue. Every transaction, every balance, every strategic move is broadcast to the world. For retail users this might feel empowering, but for institutions it is often a dealbreaker. Financial markets are built on confidentiality, selective disclosure, and compliance with strict regulatory frameworks. Dusk Network was created precisely at this intersection, not to fight regulation or hide from it, but to redesign blockchain infrastructure so that privacy and compliance can finally coexist.

Founded in 2018, Dusk Network has steadily evolved from a research-driven privacy experiment into a fully fledged Layer 1 blockchain designed for regulated finance. Its core idea is simple but radical: blockchains should not force a choice between transparency and legality. Instead, they should allow financial actors to transact privately while still being auditable by regulators and authorized parties. This philosophy shapes everything Dusk has built, from its cryptography to its execution environment and identity systems.

At the heart of the network is a modular architecture tailored for financial use cases rather than generic decentralization. The base layer handles settlement, consensus, and data availability through a native proof-of-stake mechanism designed to provide fast finality and predictable execution, both essential for institutional settlement. On top of this sits an EVM-compatible execution environment, allowing developers to deploy Solidity smart contracts without abandoning the tools and workflows they already know. What makes this environment different is not the syntax, but the guarantees beneath it: smart contracts can interact with private balances, confidential assets, and permissioned participants without leaking sensitive information onto a public ledger.

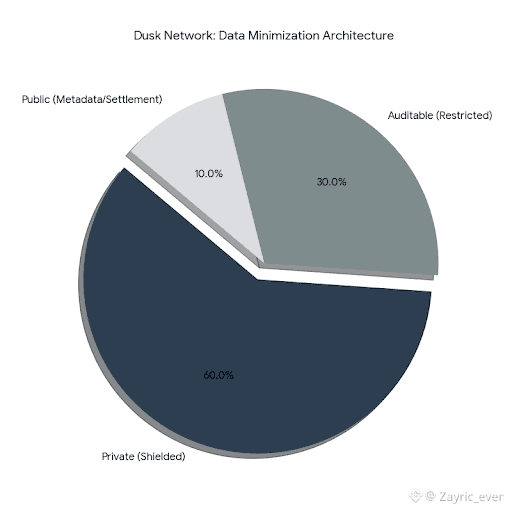

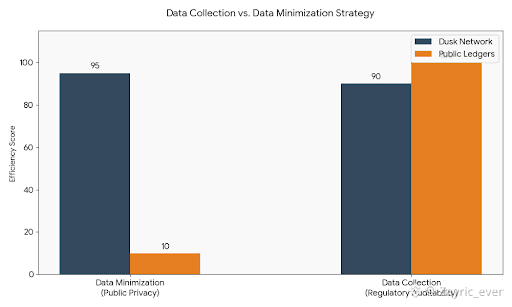

Privacy on Dusk is not an all-or-nothing choice. Transactions can be fully public, fully shielded, or selectively private depending on the needs of the user and the regulatory context. Zero-knowledge proofs enable what Dusk often describes as “auditable privacy.” Data remains hidden from the public, but can be revealed cryptographically to regulators, auditors, or counterparties when required. This approach directly addresses legal frameworks such as GDPR, MiFID II, MiFIR, and MiCA, where unrestricted transparency can be just as non-compliant as complete opacity.

Identity and access control are equally central to the design. Rather than bolting KYC and AML checks onto applications as an afterthought, Dusk integrates identity primitives at the protocol level. Institutions can define who is allowed to participate in specific transactional flows, while users retain self-sovereign control over their credentials. This makes it possible to build decentralized applications that behave more like regulated financial venues, without reverting to centralized custody or opaque intermediaries.

January 2026 marked a major milestone with the launch of Dusk’s mainnet, bringing private smart contracts and compliant transaction flows live. This was not a sudden debut, but the result of years of phased development, testing, and iteration. The EVM testnet that preceded mainnet allowed developers to experiment with deploying contracts in a privacy-aware environment, laying the groundwork for broader ecosystem growth. Alongside this, cross-chain interoperability has been a key focus, with bridges designed to move DUSK and tokenized assets between Dusk and other EVM-compatible networks while preserving privacy through zero-knowledge proofs.

Dusk’s ambitions extend well beyond technical elegance. The network is explicitly positioned as infrastructure for real-world assets and institutional finance. One of the most notable signals of this direction is its collaboration with NPEX, a fully regulated Dutch stock exchange. Through this integration, hundreds of millions of euros worth of securities are being prepared for tokenization and on-chain settlement, not as experimental DeFi instruments, but as legally compliant financial products. This is complemented by initiatives such as Dusk Trade, envisioned as a gateway where KYC-verified investors can access tokenized funds and assets within a compliant framework.

Interoperability and data integrity are further strengthened through integration with Chainlink. By adopting Chainlink’s cross-chain interoperability protocols and data services, Dusk connects its regulated environment to the broader blockchain ecosystem without compromising on security or compliance. This allows tokenized assets and regulated instruments to interact with liquidity and applications beyond a single chain, while still enforcing the rules that institutions require.

The DUSK token plays a central role in this ecosystem. It is used to pay transaction fees, secure the network through staking, participate in governance, and act as collateral within tokenized financial structures. As cross-chain standards mature, DUSK is designed to move across networks, extending its utility beyond the confines of its native chain while remaining anchored in Dusk’s regulated environment.

From an adoption perspective, Dusk’s progress reflects a broader shift in the market. As regulators increase scrutiny and institutions look for compliant pathways into blockchain technology, platforms built purely around radical transparency or absolute privacy are finding their limits. Dusk’s hybrid model, where confidentiality is preserved without sacrificing oversight, resonates strongly with this emerging demand. Early 2026 has seen growing institutional interest, increased wallet activity, and renewed market attention driven by the network’s real-world asset focus and strategic partnerships.

None of this comes without challenges. Regulatory certification processes are slow and often unpredictable, and the very institutions Dusk aims to serve tend to move cautiously. Cross-chain bridges and complex cryptographic systems introduce additional security considerations that must be managed with care. Yet these challenges are not unique to Dusk; they are inherent to any attempt to bridge traditional finance and decentralized systems in a credible way.

What ultimately sets Dusk Network apart is not a single feature, partnership, or technical breakthrough, but its coherence of vision. From consensus to identity, from privacy to interoperability, every component is designed around the realities of regulated finance rather than ideological purity. In a landscape crowded with blockchains promising speed, cheap fees, or radical decentralization, Dusk is carving out a quieter but potentially more enduring path: building the infrastructure where institutions can finally operate on-chain without broadcasting their intent, violating compliance, or surrendering control.

As blockchain technology matures, the question is no longer whether institutions will come on-chain, but which networks are prepared to meet them where they are. Dusk Network is betting that the future of finance will not be loud and transparent, but discreet, programmable, and accountable.