For most of its history, Bitcoin lived outside the regulatory imagination of central banks. It was treated as a speculative curiosity, disconnected from the plumbing of traditional finance. That separation is now breaking down.

The U.S. Federal Reserve is considering whether Bitcoin price shocks should be included in its 2026 bank stress testing framework. If adopted, this would mark a structural shift in how regulators view digital assets. Bitcoin would no longer be a fringe variable. It would become an explicit macro-financial risk factor.

That change matters far more than it may seem at first glance.

Why the Fed Is Even Thinking About Bitcoin

Stress tests exist to answer one question: can large banks survive extreme but plausible shocks without collapsing or needing bailouts?

Traditionally, those shocks include deep recessions, stock market crashes, housing downturns, and credit defaults. Crypto never appeared because banks had little direct exposure.

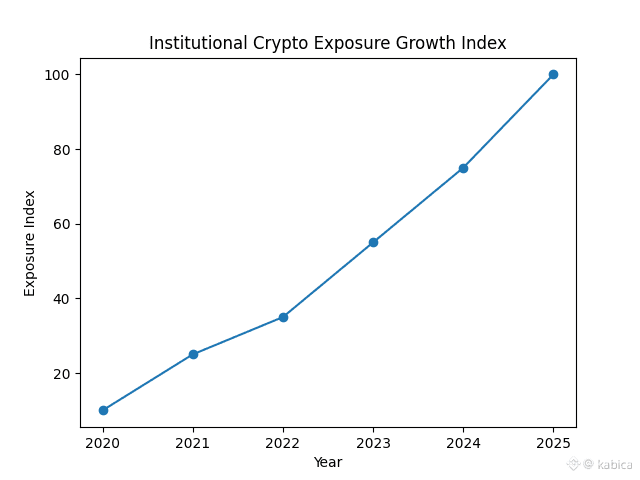

That is no longer true.

Banks today are involved with Bitcoin and crypto through multiple channels: • Custody services for ETFs and institutions

• Prime brokerage for crypto trading firms

• Lending against crypto collateral

• Market making and derivatives exposure

• Client balance sheet exposure via structured products

Even if a bank does not “own Bitcoin,” it can still face second-order losses when Bitcoin collapses and counterparties fail.

From a regulatory perspective, ignoring a volatile asset class that is now intertwined with institutional finance is becoming increasingly hard to justify.

What “Bitcoin Price Shocks” Actually Means

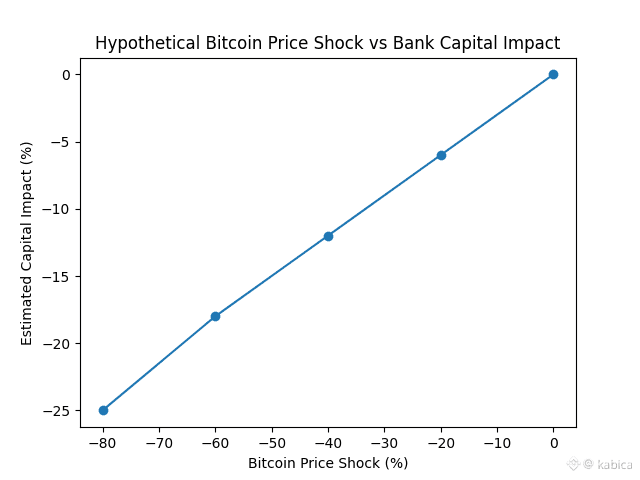

If Bitcoin is added to the 2026 stress tests, the Fed would likely model extreme downside scenarios such as: • 50% to 80% BTC drawdowns

• Rapid liquidity evaporation in crypto markets

• Counterparty failures among crypto-exposed firms

• Margin call cascades and collateral impairment

Banks would then be required to show how those shocks flow through: • Trading losses

• Counterparty defaults

• Capital ratios

• Liquidity buffers

If losses breach regulatory thresholds, banks could be forced to: • Hold more capital

• Reduce crypto exposure

• Exit certain crypto-linked activities

That would not be a symbolic change. It would be a balance sheet change.

Why This Is a Quiet Validation of Bitcoin’s Importance

Ironically, including Bitcoin in stress tests is not bearish from a long-term perspective. It is the opposite.

It means Bitcoin is now large and connected enough to matter to systemic risk models.

Central banks do not model irrelevant assets.

Once Bitcoin becomes a formal stress variable: • Regulators implicitly acknowledge it as a permanent part of the financial system

• Institutional exposure becomes more standardized and transparent

• Risk management around crypto becomes more professionalized

That pushes Bitcoin further out of the “speculative toy” category and deeper into the “macro asset” category.

The Capital Risk Angle for Banks

For banks, this development is not comfortable.

Bitcoin’s historical drawdowns are brutal. 70% collapses are not rare. They are normal.

If a bank’s crypto exposure meaningfully dents its capital ratio under a modeled BTC crash, regulators will respond conservatively. That means: • Higher capital requirements

• Tighter exposure limits

• Higher internal risk weightings

In plain terms: crypto becomes more expensive for banks to touch.

That could slow short-term institutional expansion into crypto. But it also filters out weak players and reckless leverage. What remains is a more durable financial layer around Bitcoin.

The Bigger Signal Investors Should Notice

The real story is not about the stress tests themselves.

It is about what they imply.

Bitcoin is quietly graduating from a speculative outsider into a modeled component of systemic finance.

That transition follows a familiar path:

1. Early retail speculation

2. Institutional trading and custody

3. Derivatives and ETFs

4. Regulatory modeling

5. Balance sheet integration

Bitcoin is now entering stage four.

That does not mean price will go straight up. It means Bitcoin’s future volatility will increasingly collide with traditional finance infrastructure. And that collision is exactly what forces deeper integration.

Final Take

If the Fed includes Bitcoin price shocks in its 2026 stress tests, it will be one of the clearest signals yet that Bitcoin has crossed a structural threshold.

Banks will complain. Capital rules will tighten. Exposure growth may slow temporarily.

But the long-term consequence is unavoidable.

Bitcoin is becoming too big, too liquid, and too interconnected to ignore.