The more time I spent studying Dusk, the clearer one uncomfortable realization became. Most blockchains talk about compliance as something that can be layered on later, a wrapper you add once institutions arrive. Dusk flips that logic. It assumes regulation is inevitable and designs the base layer around that assumption from day one. That single design choice quietly reshapes everything about how the network behaves, what it enables, and who it is actually for. Dusk is not trying to persuade regulators to tolerate crypto. It is trying to give regulated finance a blockchain that behaves like infrastructure, not a rebellion.

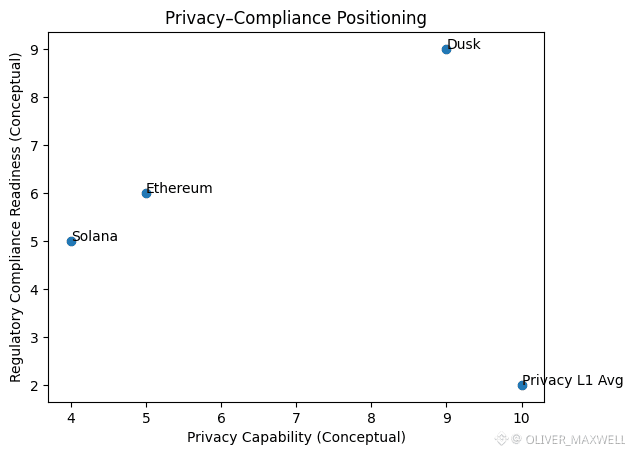

At a technical level, Dusk’s layer 1 architecture immediately separates itself from Ethereum, Solana, and even other privacy-focused chains by refusing to optimize for general-purpose composability at all costs. Ethereum maximizes openness and permissionless interoperability, then relies on external tooling for privacy and compliance. Solana maximizes throughput and latency, treating regulatory considerations as downstream concerns. Privacy-first chains often maximize anonymity, even when that choice makes regulated use nearly impossible. Dusk’s design constraint is different. It optimizes for transaction privacy that can still be selectively disclosed, audited, and proven to authorities when required. That means sacrificing some of the raw flexibility and cultural neutrality of general-purpose chains in exchange for predictability and control. This is not a weakness. It is a deliberate narrowing of scope to serve a market others structurally avoid.

What makes this interesting is how deeply privacy and compliance are interwoven in Dusk’s protocol design. Instead of treating privacy as absolute secrecy, Dusk treats it as controlled confidentiality. Transactions can remain hidden from the public while still allowing verifiable proofs of correctness, ownership, and compliance conditions. This is fundamentally different from privacy coins that obscure everything by default and then struggle to interact with regulated entities. In Dusk’s model, privacy does not eliminate oversight. It reshapes it. Regulators do not need full transparency into every transaction. They need assurance that rules are enforced. Dusk’s architecture internalizes that distinction and encodes it directly into how financial logic executes on-chain.

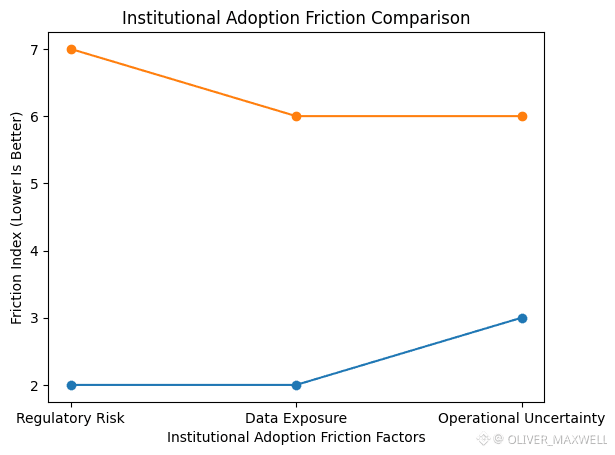

This becomes more powerful when combined with Dusk’s modular approach. Rather than forcing every application to inherit the same execution assumptions, Dusk allows financial primitives to be composed with explicit compliance logic. Modules can define how assets behave, how transfers are validated, and how disclosure rules operate under different jurisdictions. From an institutional perspective, this matters more than raw decentralization purity. Banks and asset managers do not want a one-size-fits-all chain. They want infrastructure that can be configured to mirror existing legal and operational constraints without rewriting the entire system. Dusk’s modularity reduces the translation cost between traditional finance and on-chain execution, which is often the real blocker to adoption.

Where this architecture starts to feel uniquely well suited is in real-world asset tokenization. Most tokenization efforts fail not because of technology, but because they cannot reconcile ownership privacy with regulatory reporting. Dusk’s model allows ownership and transaction details to remain confidential while still producing verifiable proofs for auditors, regulators, and counterparties. That opens doors for tokenized equities, debt instruments, and structured products where public transparency is neither desired nor legally acceptable. In these contexts, Dusk is not competing with Ethereum-based DeFi. It is competing with internal bank ledgers and centralized settlement systems. That is a very different battlefield, and one where Dusk’s constraints suddenly look like advantages.

Institutional hesitation toward blockchains usually centers on three issues: regulatory risk, data exposure, and operational uncertainty. Dusk addresses all three directly. Regulatory logic is embedded, not improvised. Data privacy is default, not optional. Execution rules are explicit, not emergent. This does not guarantee adoption, but it does remove many of the reasons institutions dismiss blockchains outright. From my observation, this is where Dusk’s strategy feels quietly pragmatic rather than visionary. It is not promising to revolutionize finance overnight. It is offering a credible migration path that looks boring enough to be trusted.

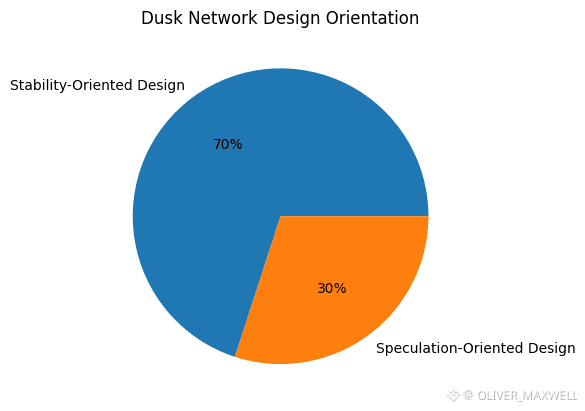

The tokenomics reinforce this conservative posture. Dusk’s staking and validator model prioritizes network integrity and predictable participation over speculative yield games. Validators are incentivized to behave like infrastructure operators rather than opportunistic actors chasing short-term rewards. Governance participation, while not as noisy as larger ecosystems, reflects a community oriented around protocol stability rather than rapid experimentation. Network activity metrics do not show explosive growth, but they do show consistency, which is often more meaningful for regulated systems. In institutional contexts, stability is a feature, not a lack of ambition.

Regulatory trends globally are moving toward privacy-preserving compliance rather than blanket transparency or outright bans. Jurisdictions are increasingly comfortable with cryptographic proofs that enforce rules without exposing sensitive data. Dusk’s early alignment with this direction positions it ahead of chains that will need painful architectural retrofits as regulations harden. The risk, of course, is timing. Infrastructure built for institutions matures slowly. Adoption will not come from retail hype cycles. It will come from pilot programs, quiet integrations, and gradual trust-building.

Looking forward, Dusk’s opportunity lies in becoming invisible infrastructure. If it succeeds, users may not even know they are interacting with Dusk. They will know only that their assets are private, compliant, and settled with certainty. The existential threat is not competition from faster chains, but irrelevance if institutions choose to build permissioned systems instead. Dusk’s bet is that open, verifiable, but compliant infrastructure will be more attractive than closed alternatives over time.

My personal takeaway is simple. Dusk is not trying to win the narrative war of crypto. It is trying to win the operational trust of finance. That makes it less exciting in the short term and far more interesting in the long term. If regulated on-chain finance ever scales beyond experimentation, it will not be built on ideology. It will be built on systems like Dusk that accept constraints and turn them into design principles.