Price Action & Trend

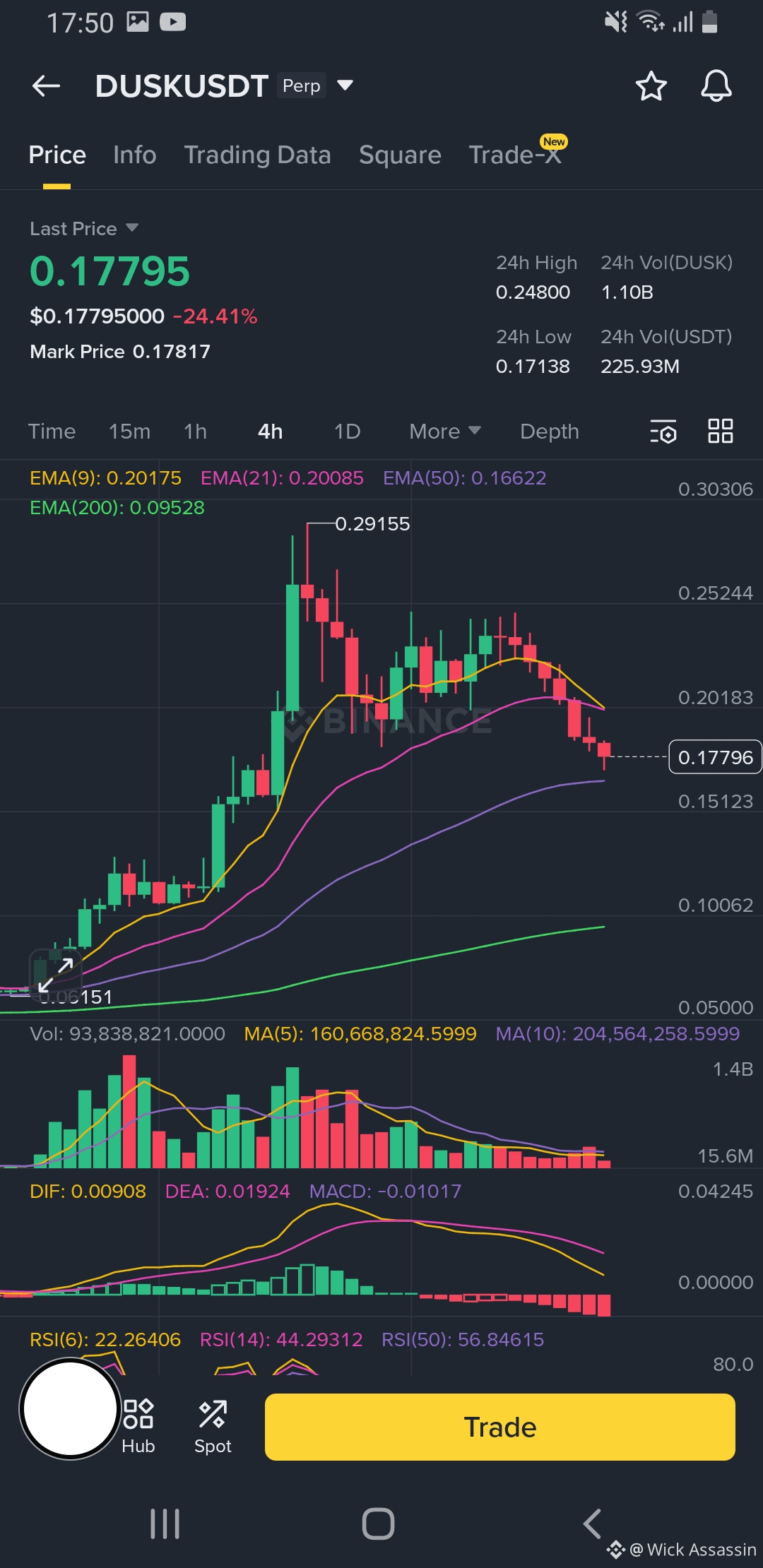

The "Dump" After the "Pump": The asset recently peaked around 0.29155 and is currently trading at 0.17795, marking a sharp 24.41% drop in the last 24 hours.

Bearish Structure: On the 4h chart, DUSK has broken through previous local supports and is printing lower highs and lower lows.

Moving Averages: * The price has sliced through the EMA(9) and EMA(21), which are both now acting as overhead resistance around the 0.20 level.

A bearish cross has occurred: the EMA(9) has crossed below the EMA(21), confirming a short-term trend reversal to the downside.

The EMA(50) (0.166) is the next major dynamic support level the price is gravity-bound toward.

2. Technical Indicators

MACD: This is looking very bearish. The DIF line has crossed below the DEA line, and the histogram is expanding into the negative (red) zone. This suggests that downward momentum is currently strong and hasn't bottomed out yet.

RSI (Relative Strength Index):

RSI(6) is at 22.26: This is deep in the oversold territory (below 30). While this doesn't guarantee a reversal, it suggests the selling pressure is "overextended," and we might see a temporary relief bounce or consolidation soon.

RSI(14) is at 44.29: This indicates there is still room for more downside before the medium-term trend is considered fully exhausted.

3. Support and Resistance Levels

Immediate Resistance: 0.200 - 0.202. If the price bounces, it will likely struggle to break back above these EMAs without significant new volume.

Immediate Support: 0.166 (EMA 50). This is a crucial level; if this fails, the next major support zone is much lower, near 0.150.

Major Support: 0.095 (EMA 200). This is the long-term trend line. As long as DUSK stays above this, the macro-bullish case (from months ago) remains intact, but the short-term pain is significant.

Summary & "The Bottom Line"

For Bears: The move is already quite extended. Shorting here carries the risk of a sharp "dead cat bounce" due to the oversold RSI.

Disclaimer: This analysis is for informational purposes only and is not financial advice. Crypto markets, especially perpetuals, carry extremely high risk.